This week in macro markets, the spotlight is on the US employment and spending data, known as the Federal Reserve’s preferred inflation indicators. Both sets of data will be announced on February 29, potentially offering a volatile end-of-month period for risk assets. Employment trends boosted market sentiment in January, while the Personal Consumption Expenditures (PCE) Index is a significant factor for Fed policy when it comes to interest rate decisions.

Focus Shifts to Upcoming US Data Releases

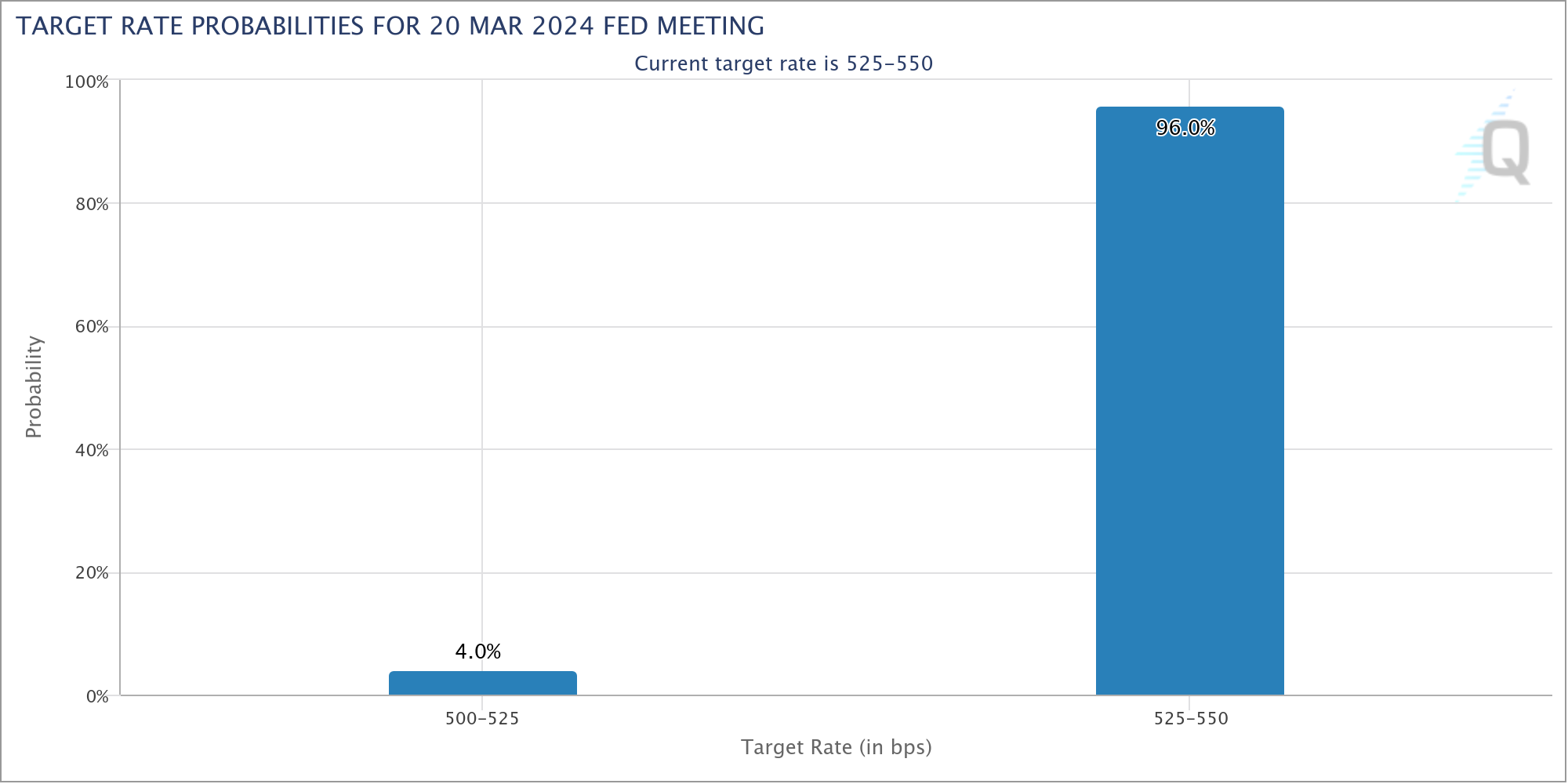

The figures come at a challenging time. Inflation data has recently exceeded expectations, causing markets to significantly reprice the likelihood of the Fed cutting interest rates in its March meeting. According to data from CME Group’s FedWatch tool, the probability of a rate cut in March is only 4%, while it rises to 25% for May.

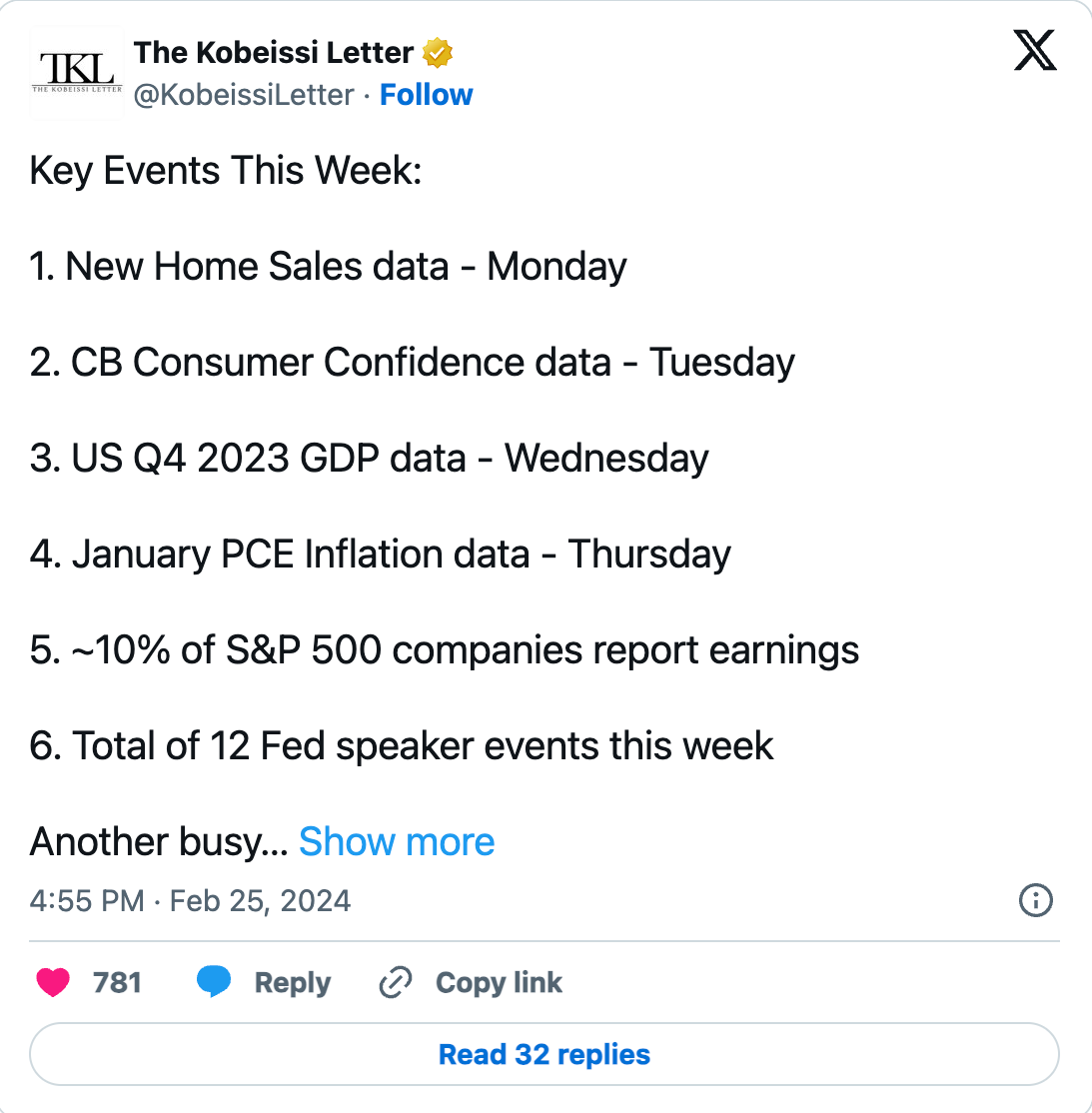

Meanwhile, optimism in US stocks is such that the S&P 500 is nearing its all-time high levels. Trade source The Kobeissi Letter mentioned in a section of an article about the upcoming week:

“Last week was all about Nvidia, this week we return to the Fed. Can the run towards record levels continue?”

Kobeissi did not fail to reference the particularly strong earnings report announced by tech giant Nvidia last week.

Bitcoin Halving Excitement Persists

As Bitcoin price movement slows, network fundamentals are checking their growth this week. Latest forecasts from data source BTC.com suggest that Bitcoin mining difficulty will decrease in the automatic readjustment set for February 29.

Difficulty, like the hash rate, showed a nearly vertical increase for much of the past year, and pullbacks never lasted long before reaching all-time high levels. While the previous two adjustments showed increases of 8.2% and 7.3%, respectively, the new decrease is expected to be around 2%.

A popular theory currently suggests that Bitcoin miners are eager to make the most of the current supply rules before the block subsidy halving in April, which will reduce the reward per newly mined block by 50% to 3.125 Bitcoins.

However, in 2024, a distribution trend contrasting with some large-volume investor classes or whales among miners was observed. According to data from blockchain analytics firm Glassnode, known miner wallets’ Bitcoin balance has decreased by 1.16% since reaching a peak of 1,833,321 Bitcoins on October 23. Nevertheless, research generally indicates that accumulation is outpacing the current new supply:

“Currently, monthly Bitcoin issuance is 27,000, but an expected halving event in April will reduce this issuance to 13,500 BTC per month.”

James Van Straten, a research and data analyst at blockchain data analysis firm CryptoSlate, interestingly noted in an article last week that accumulation across all sectors is outstripping supply by more than four times:

“When we delve deeper into a particular sector behavior, whales holding between 1,000 and 10,000 Bitcoins are accumulating about 236,000 Bitcoins over a 30-day period, thus leading the accumulation race. Meanwhile, super whales with 10,000 or more Bitcoins have distributed about 50,000 Bitcoins in the past month.”

Türkçe

Türkçe Español

Español