Avalanche’s (AVAX) burn rate showed a sharp increase last week, accelerating the rate at which tokens were removed from circulation. According to analysis of Avascan data, about 31,650 AVAX tokens were burned in the last seven days, with more than half of that amount burned on February 24 alone.

Burn Rate Spike in AVAX

The reported increase followed a period of stability where the daily burn rate ranged between 1,000-1,300 tokens. As a result, more than half of all tokens burned in the last 30 days occurred in the past week. Data from the Avalanche explorer indicated that the rise in the burn rate followed a similar increase in network transactions. Current data suggests that Avalanche may be burning all revenue generated from transaction fees.

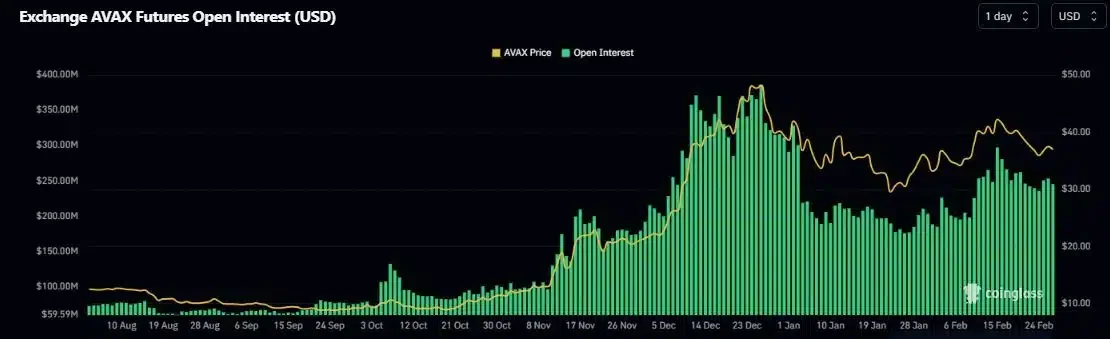

This could mean that the higher the network activity, the higher the fees and, consequently, the higher the amount of AVAX that will be burned. Generally, the burning activity can be interpreted as a bullish event due to the resulting supply constriction. However, last week’s increase failed to create upward pressure on AVAX. According to Coinglass data, open interest (OI) in AVAX futures dropped by 18% in the last 10 days.

Expectations of a Rise in AVAX

During the same period, AVAX’s long/short ratio did not exceed 1, which could indicate a dominance of bearish leveraged investors. Experts suggest that examining AVAX’s daily chart provides interesting insights into its next moves. The Relative Strength Index (RSI) tested the neutral 50 level as resistance and retreated. Successfully surpassing this level could indicate an upcoming bullish trend for AVAX in the following days.

The Moving Average Convergence Divergence (MACD) line was below the signal line, which could indicate a pullback. However, experts believe a bullish crossover seems plausible and could lead to a continued uptrend for AVAX. According to the 21milyon.com website, the ninth-largest cryptocurrency experienced an 8.46% loss over the past week at the time of writing. The price drop in AVAX affected speculative interest in the token.

Türkçe

Türkçe Español

Español