Recently launched spot Bitcoin exchange-traded funds (ETFs) recorded a second trading day with over $2 billion in combined volumes, maintaining their momentum of demand and interest. Bloomberg ETF analyst Eric Balchunas described this in a February 27 post as another busy volume day for the nine ETF funds.

Prominent Analyst Highlights Remarkable Volume

Eric Balchunas noted that BlackRock’s ETF fund achieved a new daily volume record of $1.3 billion, which is more than most large-cap US stocks, and shared the following remarks:

“I don’t know if this is a new normal or some kind of short-term algorithmic or arbitrage-related spike.”

Balchunas observed that BlackRock’s iShares Bitcoin ETF fund (IBIT) saw over 100,000 individual trades on February 27, with the daily average number of trades ranging between 30,000 and 60,000.

While the Fidelity Wise Origin Bitcoin Fund (FBTC) had a daily volume of $578 million, the ARK 21Shares Bitcoin ETF (ARKB) was the third highest in terms of trading volume with $204 million. This marked the second consecutive day that the nine new ETF funds’ daily volumes exceeded $2 billion since their launch on January 11.

Continued Strong Interest in the ETF Space

The trading volumes of the nine funds surpassed $2.4 billion on February 26, exceeding the previous record of $2.2 billion set on their first trading day. According to preliminary data from Farside Investors, these figures do not include the outflows from Grayscale Bitcoin Trust’s GBTC fund volume, which saw $22.4 million on February 26 and $125.6 million on February 27.

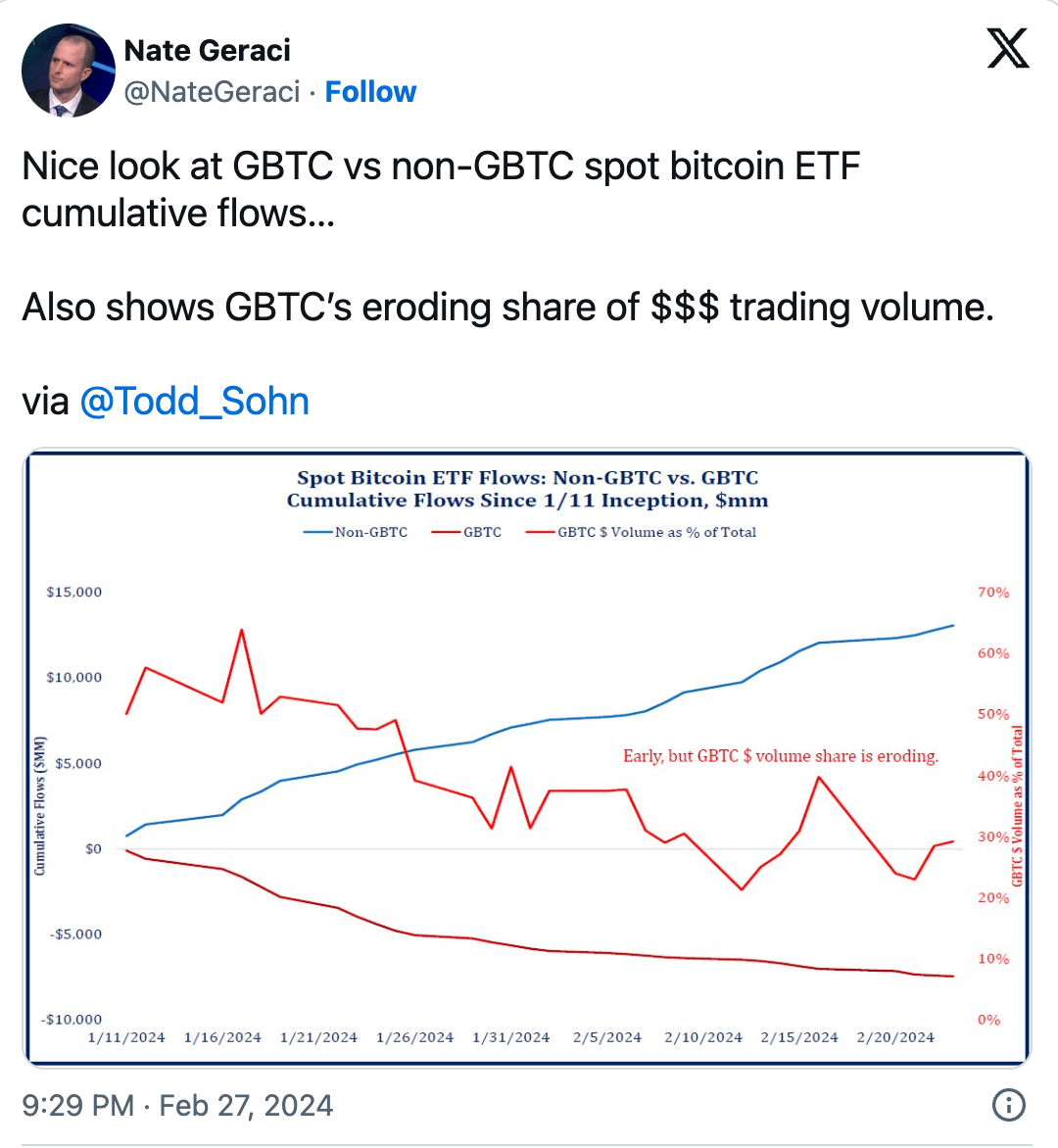

On February 28, Nate Geraci, President of ETF Store, published a chart showing the decreasing share of Grayscale’s ETF volume compared to others. Farside’s preliminary flow data indicates that the ETF fund’s total net inflows on February 27 were $574 million, which is higher than the previous day’s $520 million despite a larger outflow from Grayscale.

While BlackRock’s IBIT saw $520 million in net inflows, Fidelity’s FBTC fund had an inflow of $126 million. Bitwise’s fund was third with an inflow of $18.3 million.

Türkçe

Türkçe Español

Español