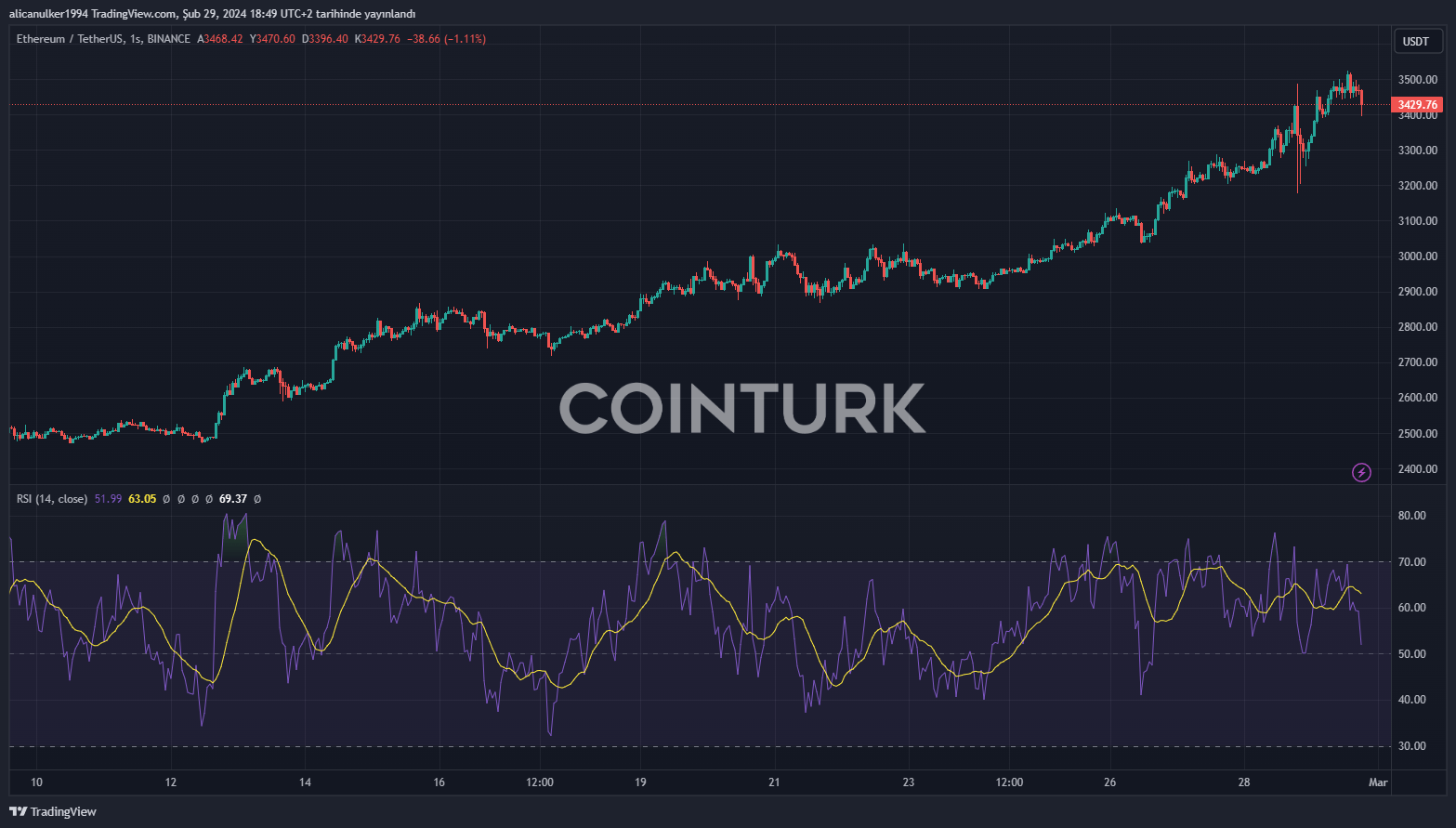

Ethereum had started to find its way back at the end of 2022. As the calendar showed the end of 2022, the price that had hit rock bottom recovered throughout 2023, and as of today, it has returned to the $3,400 level. So, what awaits ETH ETFs in the coming period? Jim Cramer, known for his contrarian predictions in cryptocurrencies, commented on this matter.

Cramer’s Comments on ETH ETFs

In the midst of a 16% increase in Ethereum (ETH) price last week, prominent analyst and TV host Jim Cramer commented that Ethereum ETFs would be the next major event.

In a statement made by Jim Cramer on X (formerly known as Twitter) on February 28, he spoke about the parallelism between the rise of Bitcoin (BTC) and Ethereum’s increase to $3,400, and added:

Considering the success of the Bitcoin ETF, it’s quite clear that an Ethereum ETF will soon flourish.

Coinbase Supports Spot Ethereum ETF

Taking the matter to a new level and declaring its support, the major exchange Coinbase submitted an official petition to the Securities and Exchange Commission (SEC) to start trading the Grayscale Ethereum Trust on the NYSE Arca platform.

Coinbase recently conducted a comprehensive review for a spot Ethereum ETF proposal to the SEC and made a statement defending the Grayscale Ether Trust:

The market depth of ETH, the scarcity of its widespread adoption, and the price correlation between spot markets are indicators of a market resistant to fraud and manipulation.

Alongside this strategic move, major financial institutions like Fidelity and the notable name in spot Bitcoin ETFs, BlackRock, also put significant effort into launching Ethereum ETFs and submitted their applications.

Growing Optimism in Ethereum

According to a statement by Bloomberg, Standard Chartered also made a prediction about Ethereum in recent days. The statement about the prediction was as follows:

Ethereum’s price will rise to $4,000 in May, pending SEC approval.

The optimism surrounding Ethereum ETFs following the Bitcoin ETF has also brightened the sentiments of industry leaders like Grayscale’s Sonneshein, who have expectations for such developments in the sector in 2024.

Additionally, ETF expert James Seyffart, whose name was frequently mentioned during the spot Bitcoin ETF process, reiterated his view that an ETH ETF product would be approved this year.

While all these developments were taking place, the price of Ethereum continued to rise. The ETH price increased by 1.37% in the last 24 hours to $3,429, moving one step closer to its all-time high (ATH).