Bitcoin and cryptocurrency market watchers closely follow whale activities. Particularly, their transfers to exchanges can cause investor anxiety and affect the market. However, if whales withdraw from exchanges, it’s understood that they are accumulating.

Analyst Says Bitcoin Whales Are Building Up Their Holdings

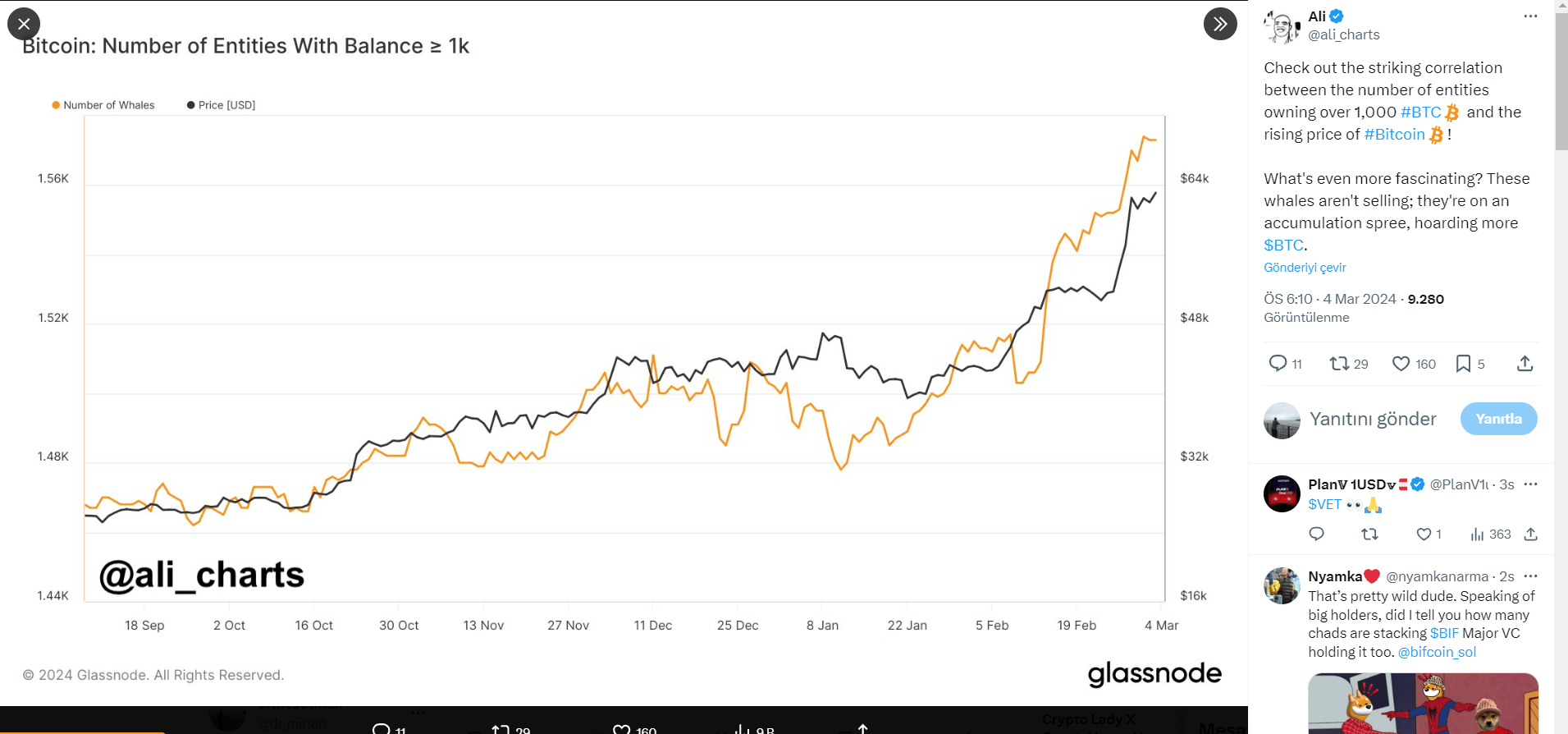

Analyst Ali Martinez, known in the crypto market for his posts on platform X, today focused on whale movements. The analyst points out a correlation, offering significant insights to investors.

According to the analyst, the number of individuals or organizations holding a thousand or more BTC has increased in parallel with Bitcoin‘s rising price. This situation is striking and also fascinating, the analyst notes.

What’s fascinating, according to the analyst, lies within the whales themselves. They are not selling the Bitcoin they have acquired. They are in a frenzy of accumulation and seem to want even more Bitcoin.

As Bitcoin Halving Approaches

As the Bitcoin halving approaches, whales accumulating Bitcoin allows predictions about the future price direction in the crypto market. The fact that whales are not selling their Bitcoin but accumulating more suggests they expect the price to rise.

Today’s Bitcoin price peak of $67,524, the highest in 2024, can be seen as a reflection of the expectation for a price increase. Analyst van de Poppe evaluated this rise today and emphasized that we are at the beginning of the cycle in response to investor questions about whether to enter at these levels.

The flagship cryptocurrency, Bitcoin, if it rises another 3% from today’s level, will surpass its past record of $69,000. Today, Bitcoin has already set an all-time high against the Euro. The only fiat currency against which BTC hasn’t set a record is the dollar. However, a new dollar record could be imminent. We’ll see when Bitcoin will reach and exceed the $69,000 mark.

Türkçe

Türkçe Español

Español