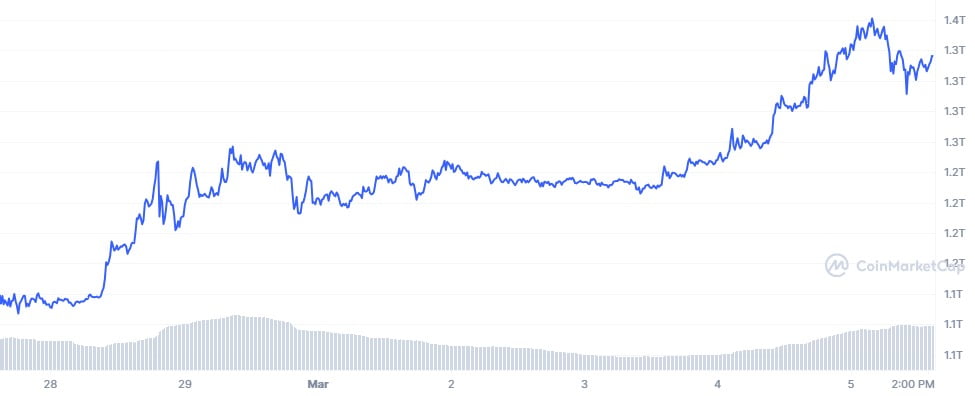

Bitcoin‘s market value reached an all-time high of $1.35 trillion on March 5th. At the time of writing, Bitcoin had decreased by 0.92% in the last 24 hours, trading at $67,576. According to the cryptocurrency price data platform CoinMarketCap, the world’s first cryptocurrency showed an increase of over 17% on the weekly chart.

Intense Interest in Bitcoin Continues

CompaniesMarketCap data indicates that Bitcoin, after briefly surpassing the market value of silver, the world’s second most valuable metal at $1.347 trillion, has become the world’s eighth largest asset. This increase occurred the day after Bitcoin achieved its highest daily close at $68,245 on March 4th, surpassing its previous record close of $67,525 on November 8, 2021, and reinforced analysts’ expectations that Bitcoin’s price could reach $100,000 before the end of 2024.

According to a research report shared with the public by Bitfinex Analysts on March 4th, the recently approved spot Bitcoin exchange-traded funds (ETFs) in the United States were a significant reason behind Bitcoin’s rising price movement. The report stated:

“February witnessed an impressive 44% increase in Bitcoin, reflecting a significant positive momentum since December 2020. The inflow of $7.5 billion into Bitcoin ETFs not only promotes market growth but also indicates a positive outlook and potential for continued capital inflows.”

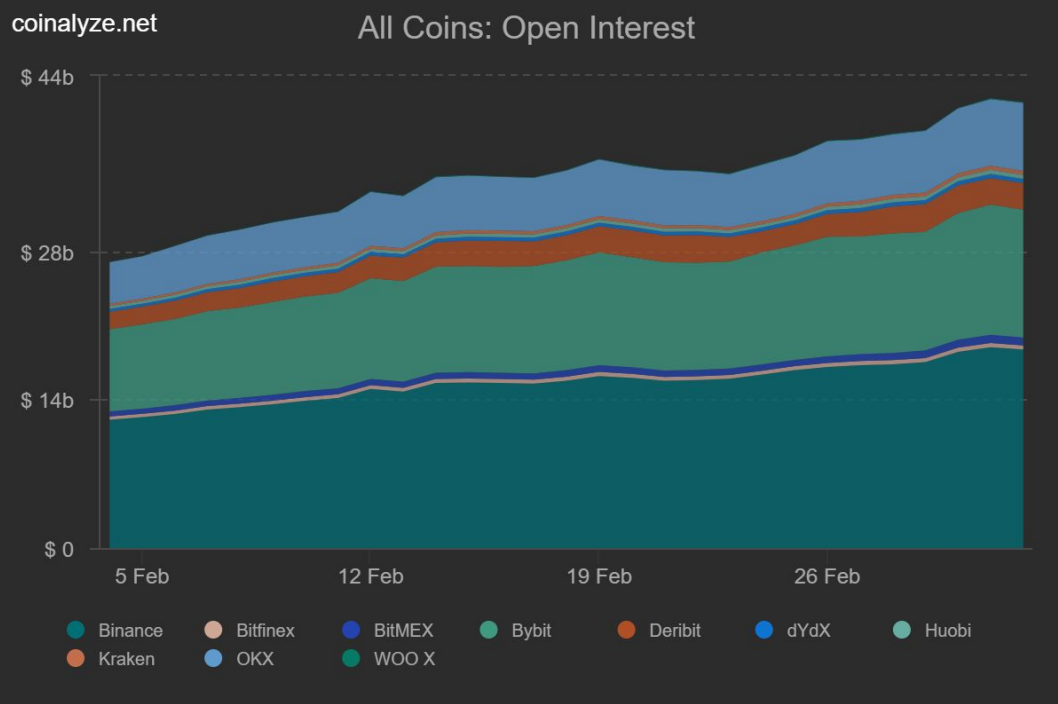

New Record in Futures Market

Bitfinex analysts suggest that the open interest in Bitcoin futures on centralized exchanges has reached record levels, reflecting investors’ confidence in a sustainable rally:

“The recent surge in open interest surpassed levels seen in November 2021 when Bitcoin reached its all-time high of approximately $69,000. On March 1st, the total open positions in Bitcoin futures contracts exceeded $26 billion, surpassing the previous record of $24 billion recorded in the last quarter of 2021.”

The all-time high came a day after the largest corporate Bitcoin holder, MicroStrategy, announced plans to raise $600 million as part of its ongoing Bitcoin purchase strategy. According to a post by Chairman Michael Saylor on March 4th, the funds will be issued in the form of senior convertible notes.