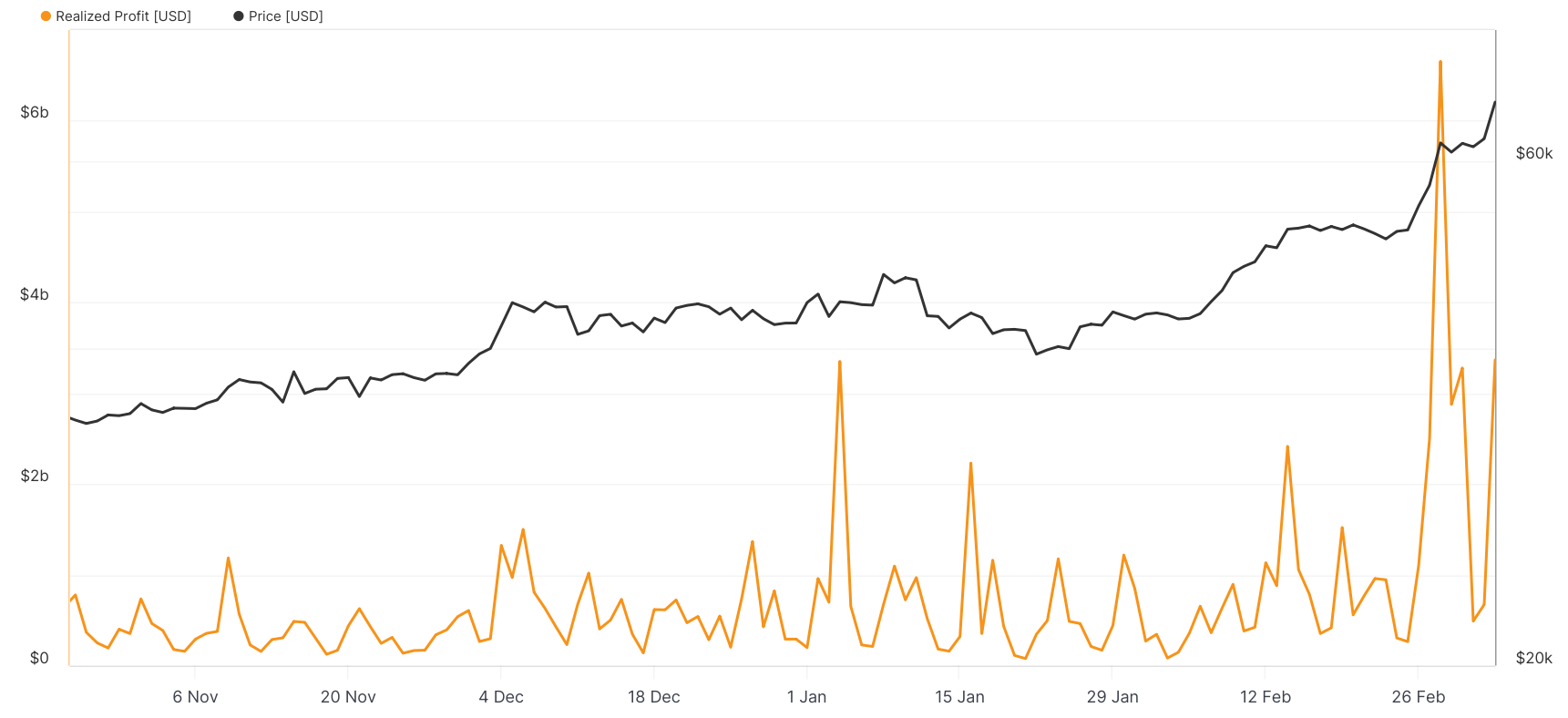

BTC was preparing to write while falling back below $64,000, losing more than $5,000 from its peak. Why did this happen? Bitcoin, reaching its all-time high earlier than expected, has become a victim of profit-taking. Let’s examine the causes of this extreme volatility and what we can expect moving forward.

Why Did Bitcoin Rise?

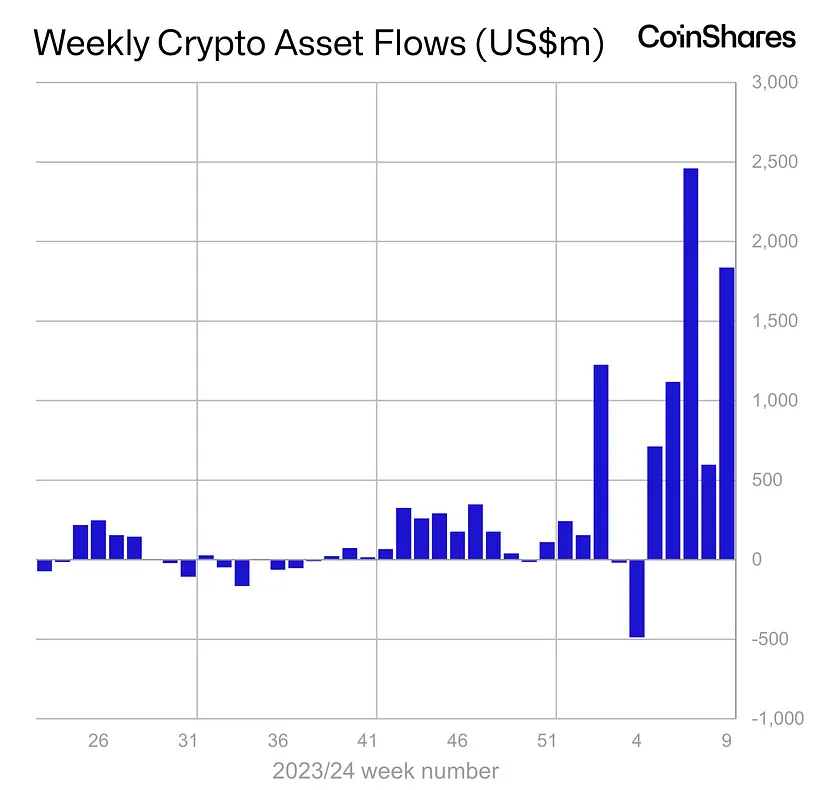

We have reached these days with the excessive demand from institutional investors. The FOMO caught by individual investors familiar with traditional finance through the ETF channel was the real reason for the rise. According to CoinShares data, institutional investors have made purchases worth $7.6 billion in roughly 2 months of this year. Just last week, $1.8 billion flowed into crypto.

Nearly all of the money entering the cryptocurrency markets, which is $7.3 billion, went directly into Bitcoin. The total value of BTC products has surpassed $60 billion. While this indicates strong demand, maintaining the same pace of demand is difficult. Therefore, intermediate corrections are necessary, and as we have been saying for days, we are climbing a peak with the FOMO happening through the ETF channel. Of course, there will be a descent from that peak.

Why Is Bitcoin Falling?

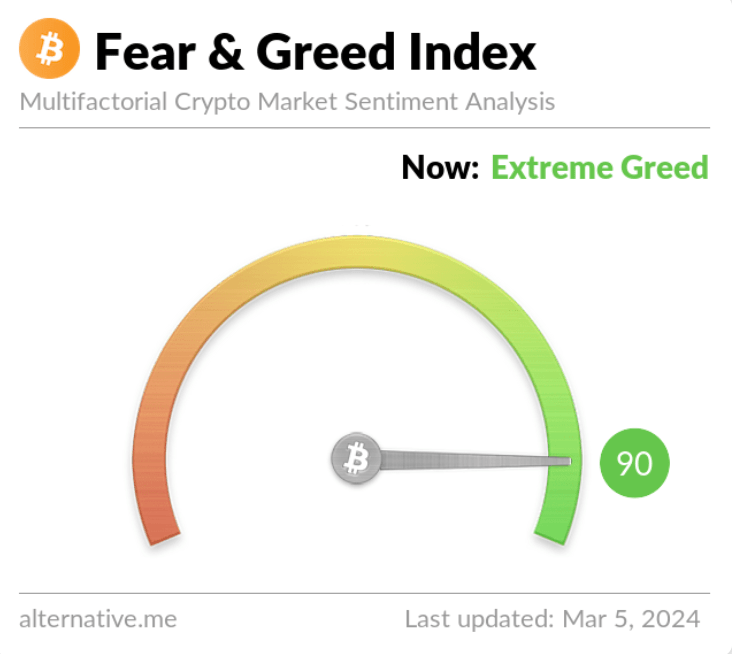

The fear and greed index in cryptocurrencies has exceeded 90 for the first time since February 2021. The needle based on extreme greed already tells us that the balancing process is about to begin. On the other hand, massive long positions accumulated in futures markets are strengthening the appetite for liquidation. Over $700 million in positions were liquidated in the last 24 hours.

Investors focused on larger peaks saw levels close to $69,000 (even surpassing $69,100 in futures pairs) as a reasonable entry point for long positions. However, they are now caught off guard. In short, this correction is not surprising, and considering profitability is close to 99%, it is reasonable.

The real problem will arise if sales deepen with closures below $65,000. If the $58,000 region is also lost, we will see how altcoins, which have increased more than fourfold this year, rush down as if on a descending elevator.

Today, we experienced the second-largest profit realization event of the year 2024 with $3 billion in sales. What happens tomorrow, we will all live and see. However, the US macroeconomic data coming tomorrow and Friday could further undermine optimism related to the interest rate outlook. Investors should not overlook this risk.

Türkçe

Türkçe Español

Español