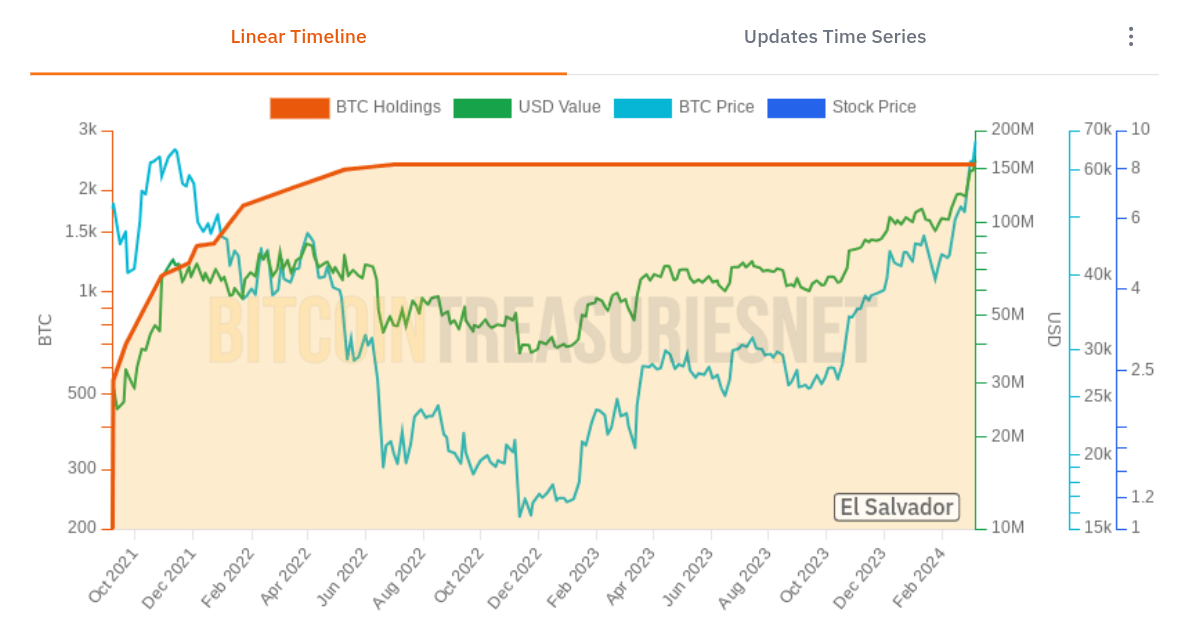

El Salvador government’s held Bitcoin is currently valued at over 150 million dollars. According to the latest data from the data monitoring source BitcoinTreasuries, the cost basis of El Salvador’s Bitcoin assets has increased by 50 million dollars. Bitcoin was first approved as a legal tender in El Salvador in 2022, and since then, the Bitcoins held by the country have reached record valuations following the bear market.

Significant Statements from Nayib Bukele

Since the announcement by El Salvador’s President Nayib Bukele that the government would start buying 1 Bitcoin per day, they have accumulated 2,380 Bitcoins worth approximately 158.5 million dollars. On the date when Bitcoin reached its all-time high on March 5th, this amount was worth 164.7 million dollars, which is a full 53% more than El Salvador’s total cost basis.

Each Bitcoin was purchased at an average price of 44,300 dollars. Bukele, who was re-elected in February, criticized the mainstream media’s approach to the government’s economic policy in his latest comments on platform X and made the following statements:

“Bitcoin’s price was low, and they literally wrote thousands of articles about our so-called losses. Now that the market price of Bitcoin has risen significantly, we would have made a profit of over 40% if we were to sell. Of course, we won’t sell; after all, 1 Bitcoin = 1 Bitcoin. This was true when the market price was low, and it is true now. However, it is very meaningful that the authors of these hit pieces, analysts, experts, and journalists are now completely silent.”

The Bitcoin Journey of El Salvador

Despite the interest shown in Bitcoin, El Salvador continues to follow a solitary process among nation-states by adopting a Bitcoin standard. Although there are rumors that other countries in South America and elsewhere will do the same, no official statement has been made on the matter yet.

Among those most confident in nation-state adoption is Samson Mow, who aims to accelerate hyper-bitcoinization with his company Jan3. Appearing on The Bitcoin Podcast, Mow listed nation-states as one of the key buyers moving forward, in addition to companies and institutional buyers through spot Bitcoin exchange-traded funds, and stated:

“As we continue to rise, you have your price-insensitive buyers, including individual investors who buy much smaller increments.”

Türkçe

Türkçe Español

Español