Recently making headlines with its significant impact on the cryptocurrency market, Binance, the world’s largest exchange by volume, has attracted attention with a new announcement introducing new trading pairs denominated in Japanese Yen (JPY). Starting from 11:00 AM Turkey time on March 12, 2024 (UTC), users will be able to trade leading pairs such as BNB/JPY, BTC/JPY, and ETH/JPY with Japanese yen on the Binance Spot platform.

New Trading Pairs for JPY

Binance’s move aims to expand its user base while offering a broader range of trading options with the Japanese Yen. This initiative appears to be an effort by Binance to further strengthen its already strong position in the market.

On the other hand, Binance also announced the launch of a new zero-fee trading process to celebrate the introduction of JPY spot trading pairs. This zero-fee trading period will be valid from 11:00 AM Turkey time on March 12, 2024 (UTC) until 10:59 AM on April 11 (UTC), during which users can trade all JPY spot pairs without any fees.

According to the announcement, this process will not only cover the newly introduced trading pairs but also future JPY spot trading pairs.

Current State of Bitcoin and Cryptocurrencies

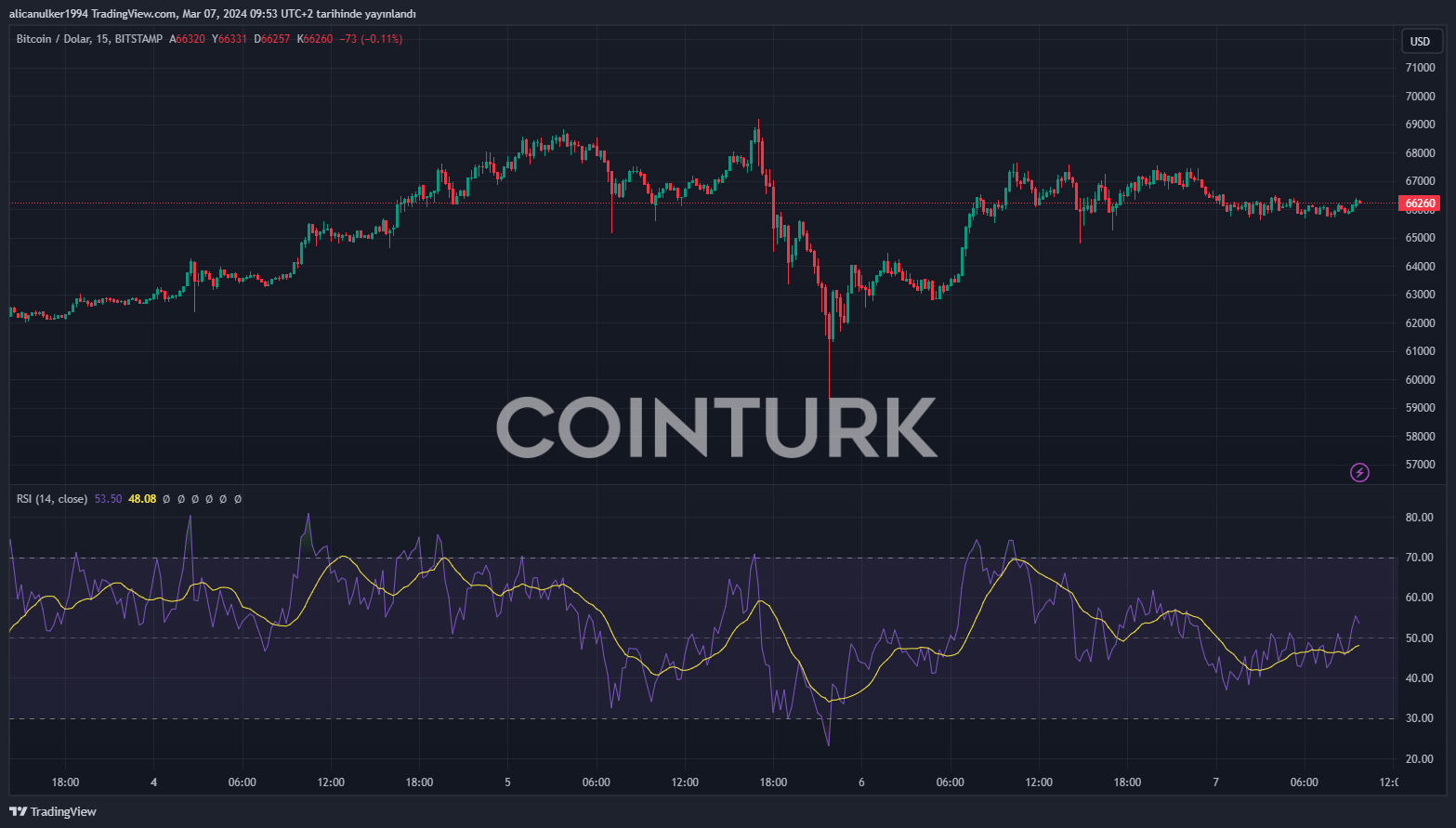

While these developments are taking place, the price of Bitcoin continues to show a stable trend. The price of Bitcoin has seen only a 0.5% increase, trading at $66,270. During this period, Bitcoin’s market capitalization surpassed $1.3 trillion. The trading volume in the last 24 hours has decreased by nearly 40%, amounting to $60 billion. This decline could be interpreted as a shift in interest from Bitcoin to other coins.

There has also been a noticeable decline in interest in meme coins, which were at the peak of popularity last week. Dogecoin (DOGE) price has fallen by more than 8%, retreating to $0.152, while its 24-hour trading volume has decreased by 50%, reaching $3.666 billion.

For Shiba Inu (SHIB), indicators pointed to a 12% decline, and after the drop, the price traded at $0.00003108. Despite the decline, SHIB’s market capitalization fell to $18 billion, yet it maintained its 10th place in the market ranking. The 24-hour trading volume also fell by 55%, down to $5.5 billion.

Türkçe

Türkçe Español

Español