As the cryptocurrency market continues to experience lively days, notable developments are emerging. According to on-chain data, Bitcoin price dynamics point to a seismic shift, with Bitcoin leaving the deep value zone. Charles Edwards, founder of Bitcoin and crypto asset fund Capriole Investments, stated on March 7th that this marks a new chapter for the market.

What’s Happening on the Bitcoin Front?

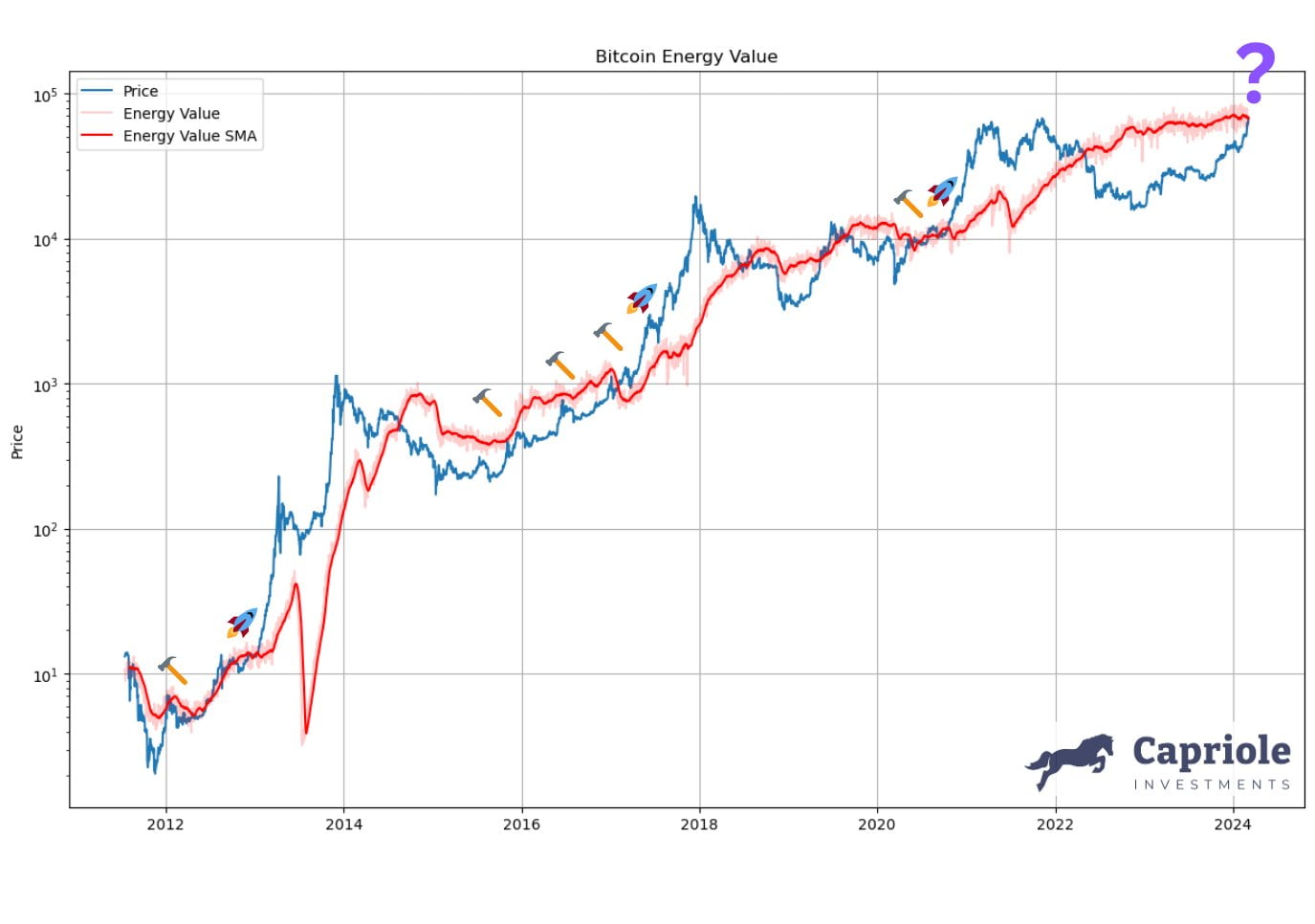

Bitcoin reaching all-time highs represents a significant transformation compared to its price movements a few months ago, but on-chain analyses suggest that the bulls have regained balance. Edwards shows that Bitcoin, priced around $70,000, is fairly valued in terms of the amount of energy miners use to join the network. Capriole’s Bitcoin Energy Price data indicates that this development has occurred for the first time since late 2020. Edwards commented on this data:

“Bitcoin’s real value is assessed solely on the pure energy data transferred to the network. No strange formulas or power laws. Just energy, mapping out Bitcoin’s fair value from the beginning. Bitcoin, currently at the $70,000 level, has fair value for the first time in 2 years.”

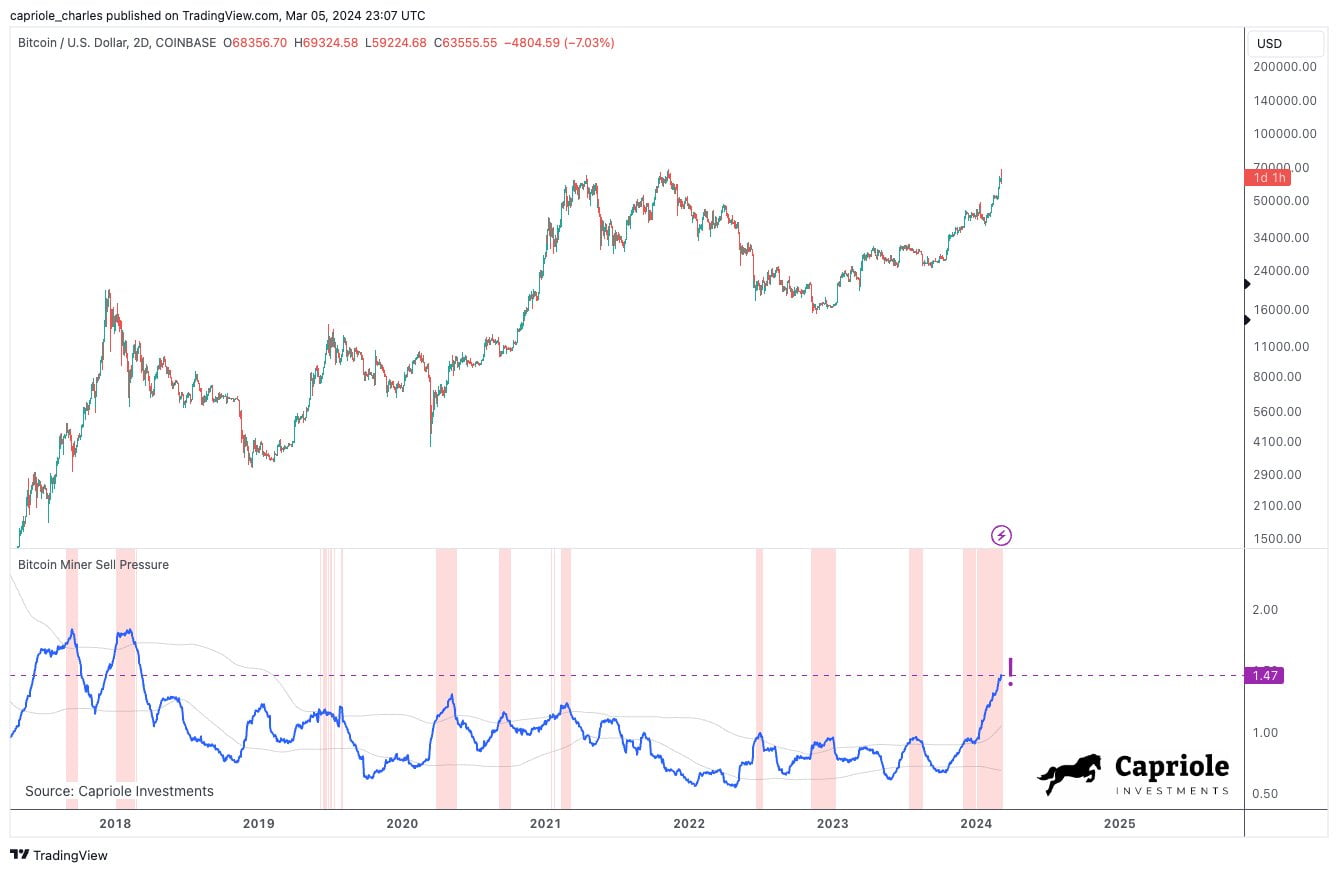

The energy price is currently just one example of a comprehensive list of market indicators pointing to even higher Bitcoin prices. Despite the upcoming block subsidy halving, miners selling significant amounts of Bitcoin are still enjoying solid profit margins. Edwards added:

“Bitcoin has moved beyond its production cost in recent months, and with the Ordinals fee increase, Bitcoin mining is once again very profitable. As you can see, these breakouts often lead to much higher repricing. However, the era of undervalued Bitcoin has ended.”

In this context, Edwards believes that investors waiting for opportunities to buy Bitcoin at affordable prices have missed their chance:

“Bitcoin’s deep value is gone. You had two years to buy undervalued Bitcoin. Instead, an exciting new era has begun. Welcome to the Bitcoin Momentum era.”

Prominent Analyst Makes Striking Statements

Some analysts see all-time high levels as a turning point that will initiate a long-term correction, contrasting with the idea that institutional demand will further invigorate the market. Venturefounder, a contributor to the blockchain data analysis platform CryptoQuant, updated his view on how events might unfold in the coming months, arguing that both Bitcoin and the largest altcoin, Ethereum, need to surpass their current high levels more decisively.

He referred to the upcoming decision on whether spot Ethereum exchange-traded funds will be approved in the United States:

“If Bitcoin and Ethereum cannot achieve a definitive new ATH breakout in March, the halving event in April, which will cut rewards in half, and the approval of an Ethereum ETF, make it more likely that we will see further declines.”