Just moments ago, the price of Bitcoin once again refreshed its all-time high (ATH), soaring to $69,990. Alongside this surge, for the first time in history, futures also surpassed the $70,000 level. The BTC price later retreated below $67,000. Meanwhile, the ETH price in futures also climbed to $4,003. While all this was happening, a piece of news about the market dropped.

THORChain (RUNE) Token Burn

Just recently, an announcement made by the official THORChain account caused a stir in the market during a time of significant price movements. The announcement from THORChain was as follows:

By burning 60 million $RUNE from the Reserve, space for 20 million RUNE (140 million dollars) in collateral loans was created. There is now room for about 2000 #Bitcoin or 36,000 ETH in THORChain loans. No liquidation, no interest.

Generally, burns in crypto projects are known to trigger significant price movements due to the creation of a supply shortage. A noticeable change in the price of RUNE was observed following the burn. How long this price movement will last is already a topic of curiosity.

THORChain (RUNE) Price Outlook

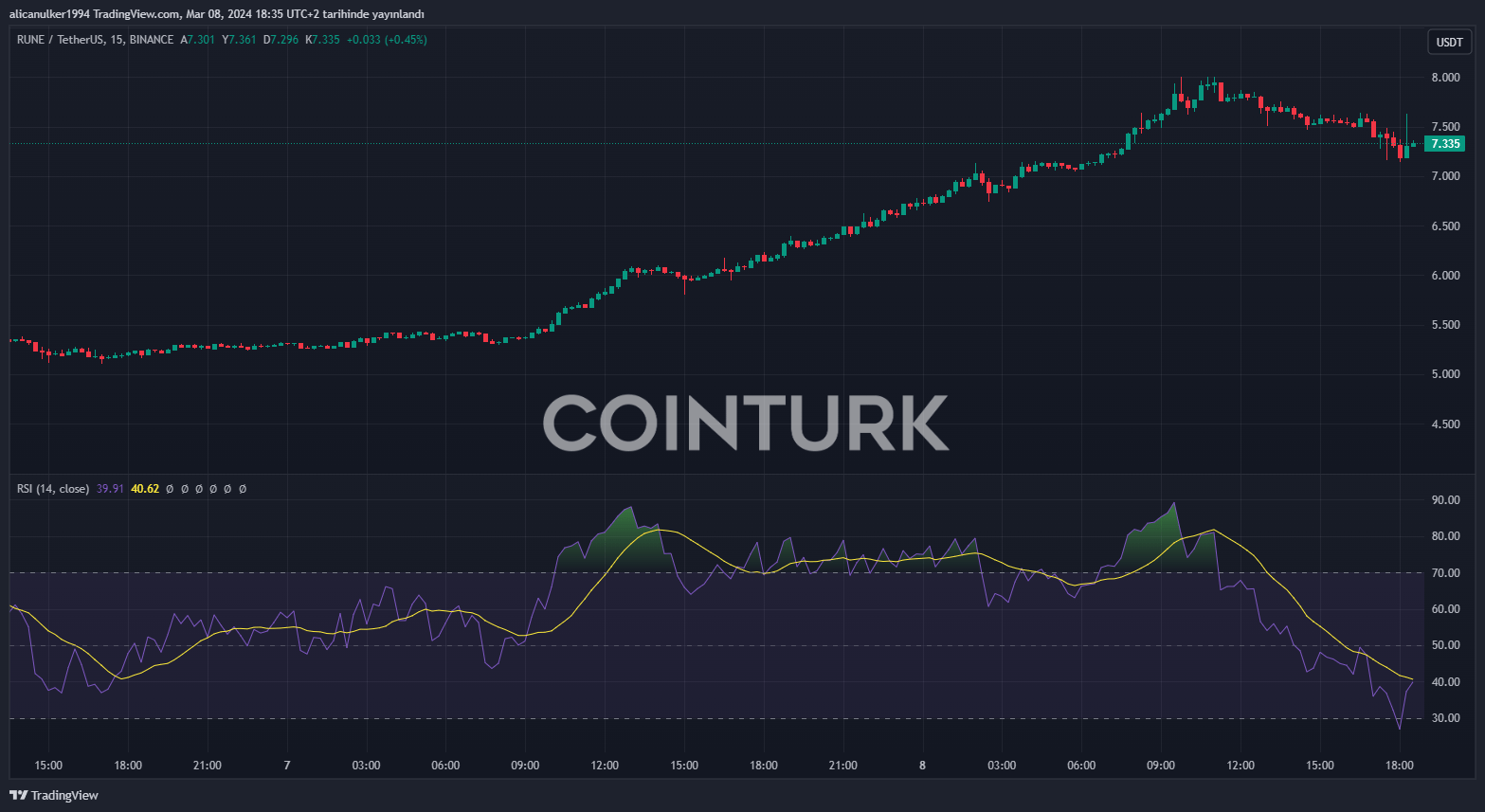

Following the rise in Bitcoin price, the news about RUNE ignited its rockets, and the price experienced a surge of over 20% within minutes. After the initial rise, the price jumped from $7.18 to over $7.5. Subsequently, influenced by a decrease in Bitcoin price, RUNE fell back to around $7.3.

Despite a 28% increase over the past week, RUNE appeared weak compared to many other cryptocurrencies that saw increases of 50-60%. The recent rise in RUNE’s price, which was over 50% in the last 30 days, led to a market cap of $2.49 billion. Following the news, there was a 128% increase in trading volume, leaving the 24-hour volume behind at $1.2 billion.

While all this was happening, the fact that RUNE’s RSI value was only at the level of 40 due to overselling indicates the uncertainty in the market. This could be interpreted as sellers still dominantly controlling the market.

Türkçe

Türkçe Español

Español