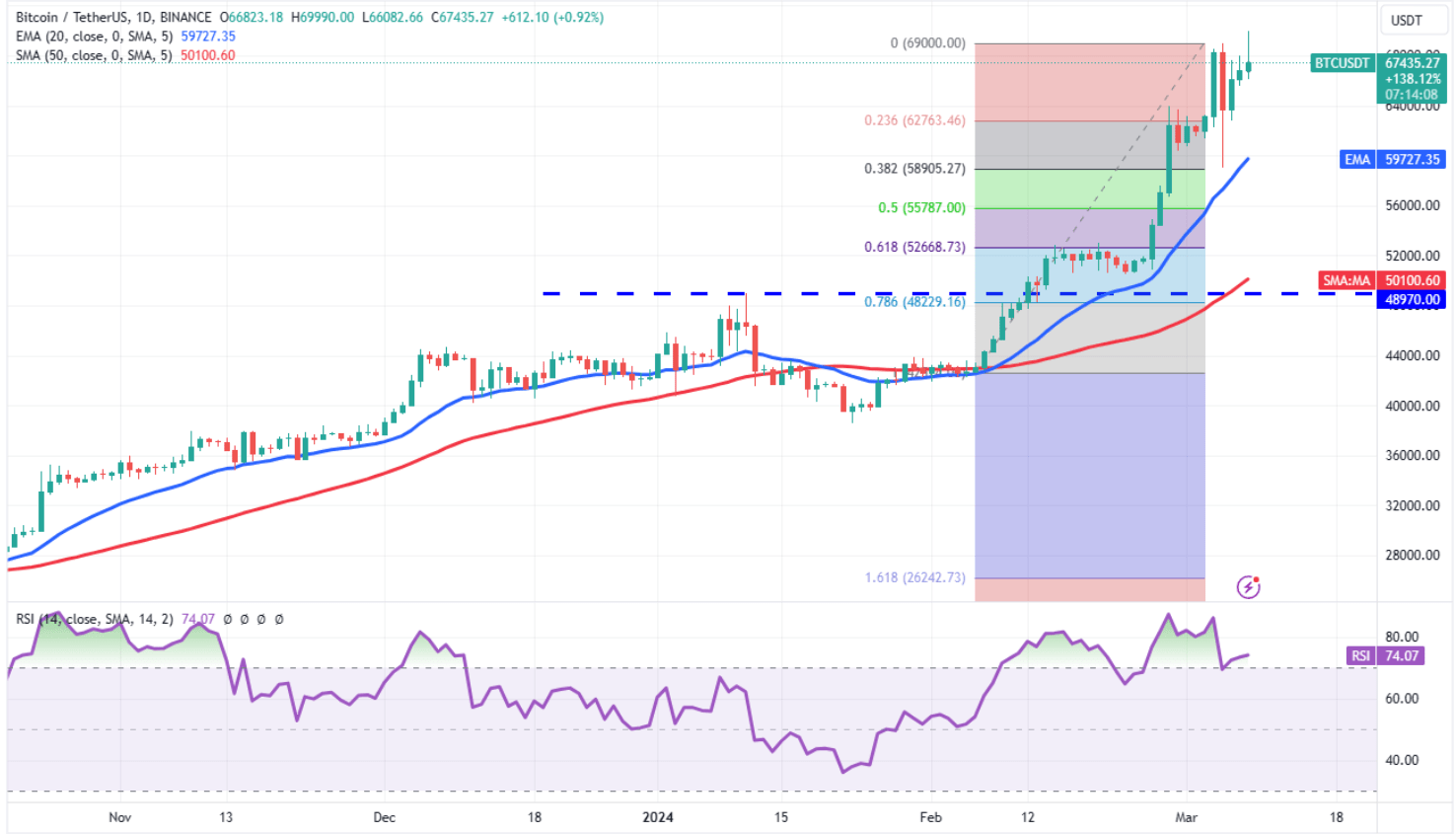

Bitcoin price had become even more normalized around the $68,000 region at the time of writing. The market is now preparing for new highs. BTC has made a new peak above its previous high for the first time, indicating that the bull market rally could accelerate. Corrections up to 30% in the medium term are considered reasonable, but the current outlook is positive.

Bitcoin (BTC)

On March 5, the spot trading volume for BTC reached $46.26 billion, marking the highest level in the last year. This strengthening volume soon led to a new peak. However, according to the Blockchain Center’s altcoin season index, the expected altcoin bull run has not yet arrived. K33 analysts argue that it is about to start. And yes, these rises may still seem quite weak compared to the real altcoin bull run.

Returning to the BTC price, the ATH was reached, and the long upper wick indicates profit-taking. If the Bitcoin (BTC) price can close above $70,000, it could climb to $76,000 and then $80,000.

In a negative scenario, the price could drop quickly and fall to $59,727 with closures below $62,500. Isn’t that interesting? Not long ago, surpassing $58,000 was not considered a reasonable scenario before the year’s end, but now it’s mentioned as a potential support test.

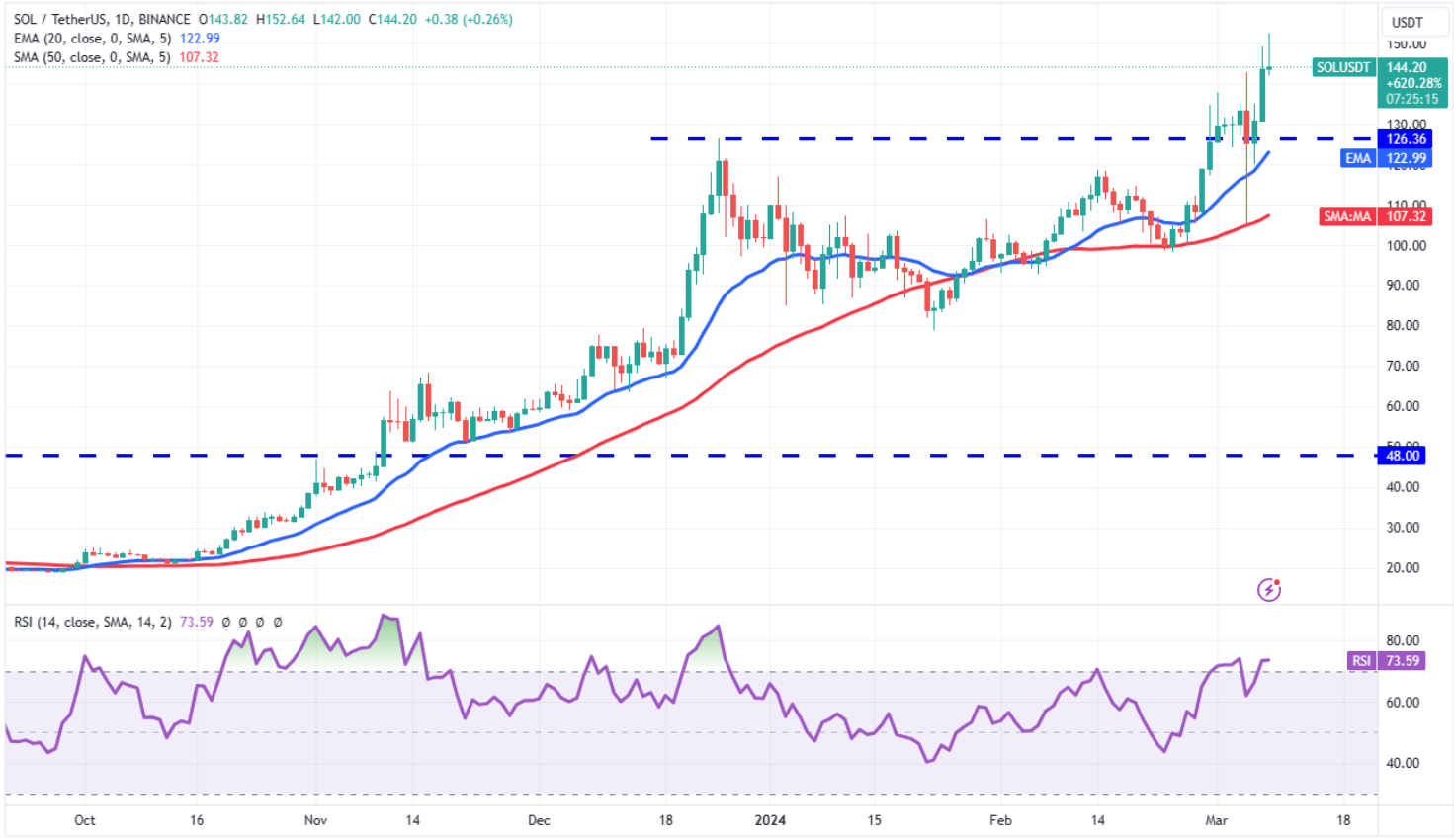

Solana (SOL)

The price holding above $126 finds support from the news we previously reported about Pantera Capital. The company aims to purchase $250 million worth of SOL Coin from FTX, which means a shift of selling pressure from the spot market to OTC, and that’s positive.

Closures above $143 could push SOL Coin’s price to peaks of $158 and $175. However, if significant profit-taking starts with the opening of Asian markets within a few hours, closures below $126 could quickly bring the price down to $107.

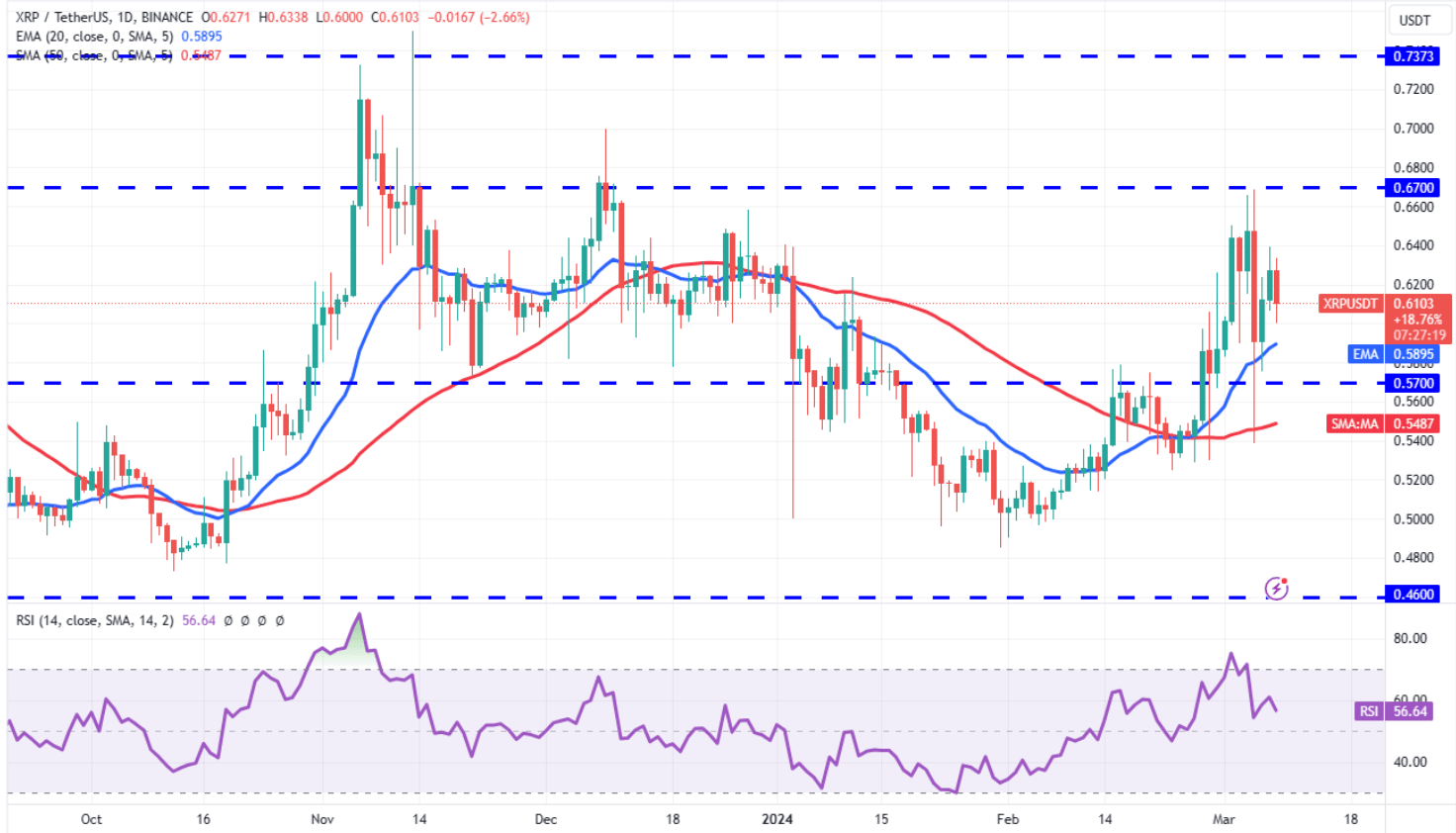

XRP Coin Price Predictions

The price continues to fluctuate between $0.67 and $0.55. Even though Bitcoin has reached an ATH, the $0.67 barrier remains strong for XRP; if breached, the price could rise to $0.74 and $0.93.

Conversely, if the price falls below the 20-day EMA, it could experience a sharp decline to $0.50 due to excessive selling.

Türkçe

Türkçe Español

Español