CMCC Crest Bitcoin analyst and managing partner Willy Woo believes we are at the beginning of the Bitcoin bull market because the $71,000 Bitcoin price is equivalent to the previous bull cycle’s $20,000 mark. Bitcoin crossed the $71,000 threshold on March 11, three days after Ethereum surpassed the $4,000 mark for the first time since 2021.

Prominent Figures Make Noteworthy Predictions

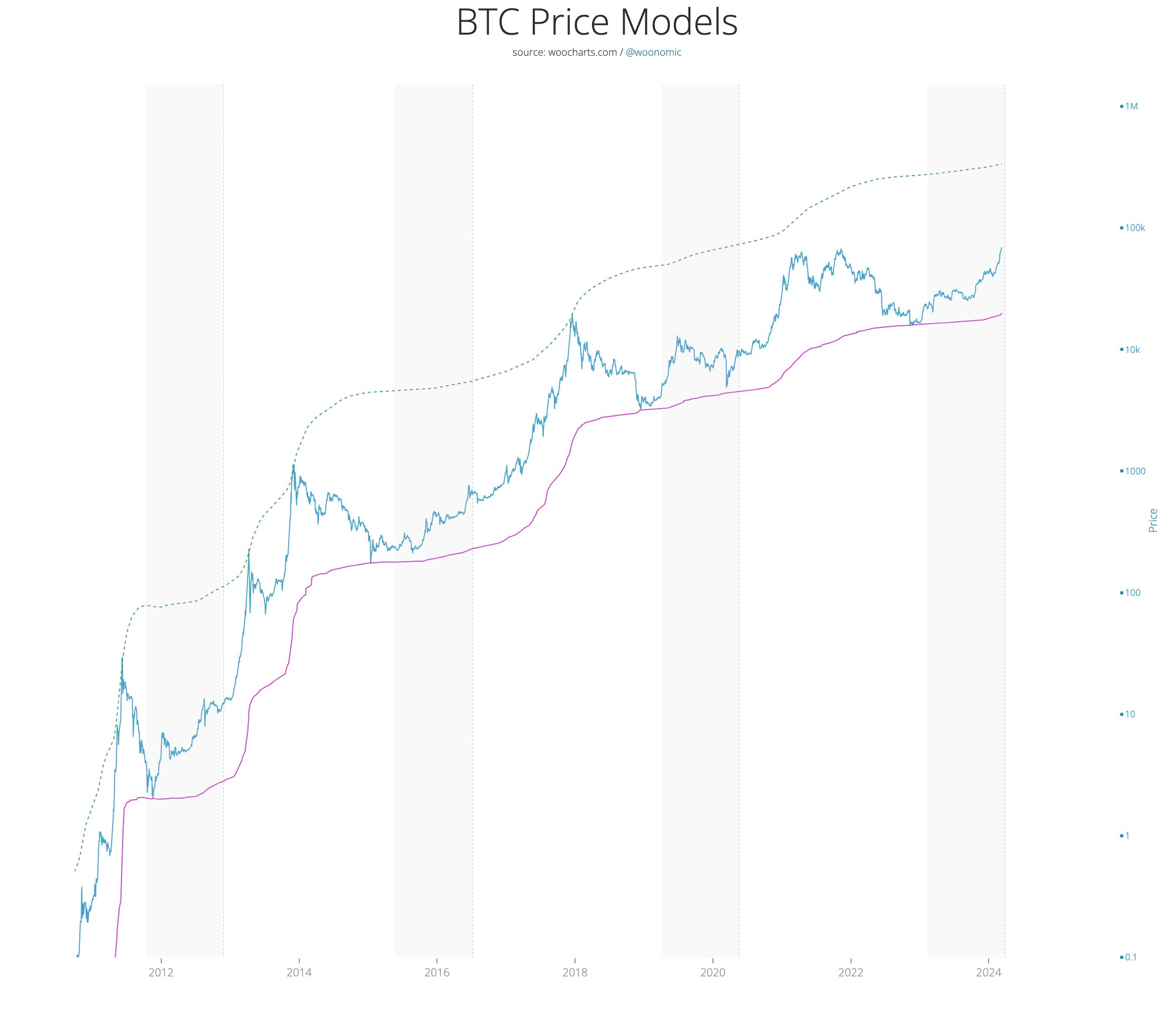

Bitcoin’s rise above $71,000 is just the start of the bull cycle according to a price model based on a combination of various data sets measuring investor behavior, says Woo. In a post dated March 11, Woo wrote:

“Bitcoin at the $71,000 level places us here on the visual of upper and lower boundary models. The current upper boundary is $337,000. This means the bull market is still early, equivalent to the last cycle’s $20,000 level.”

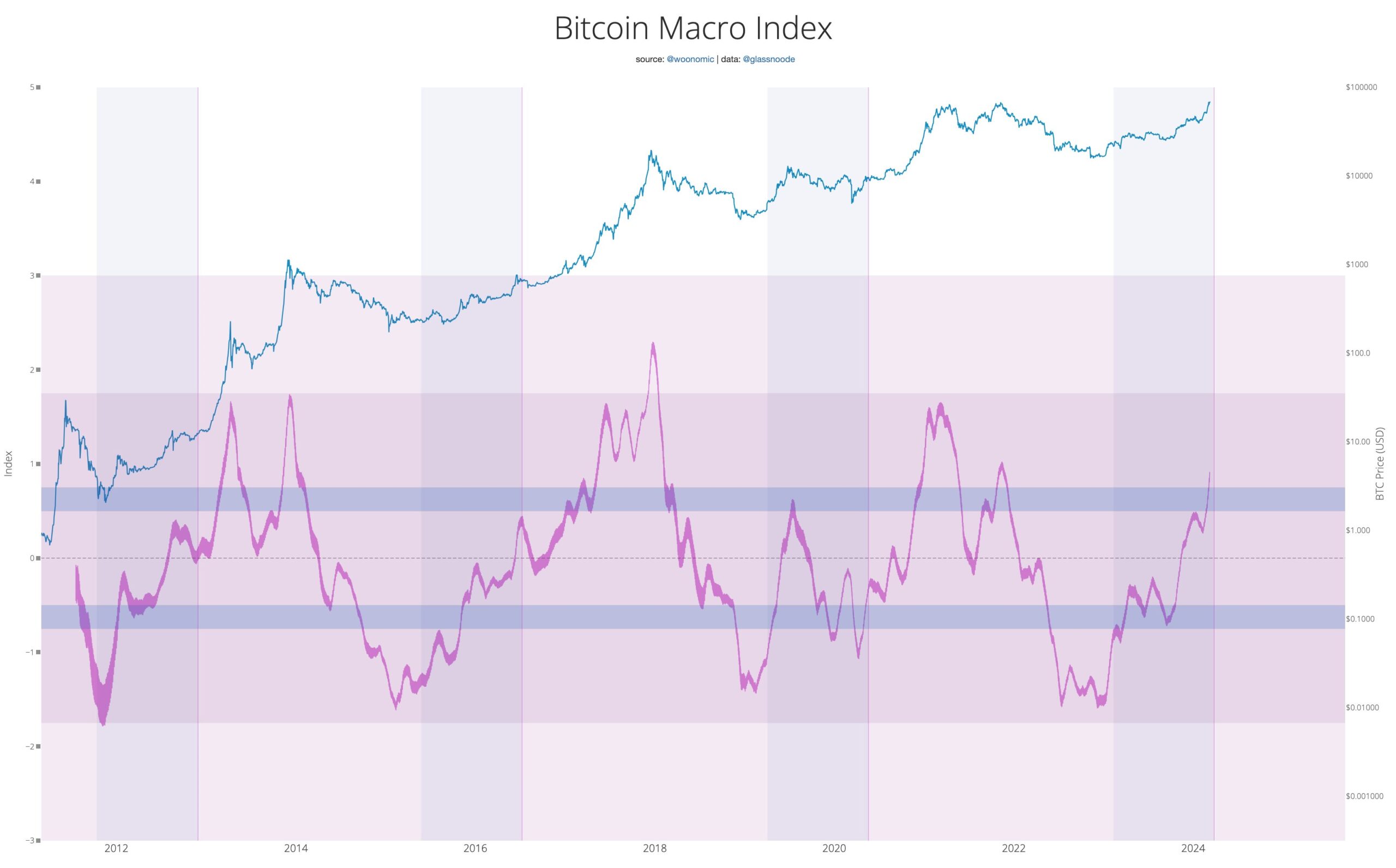

Additionally, Woo shared a chart stating that the Bitcoin Macro Index broke the upper blue band this week, indicating a full-fledged bull market based on fundamentals.

Meanwhile, analyst Rekt Capital suggests that current bull market dynamics could result in an earlier macro peak compared to previous cycles. In a piece dated March 11, Rekt Capital says:

“If the accelerated perspective holds true, the next bull market peak could occur within 266 – 315 days. This would mean December 2024 or February 2025.”

In addition, Bitcoin analyst CryptoCoin expects Bitcoin’s four-year cycle to accelerate by about a year. In a post dated March 11, the analyst wrote:

“With Bitcoin entering price discovery mode and new ATH levels occurring a year earlier than usual, we may be witnessing the death of the 4-year cycle. Previously well-structured cycles called for a peak in late 2025, but now we seem to be on the right track for a peak in late 2024.”

Bitcoin Could Reach $170,000, Analyst Predicts

Bitcoin analyst Dave the Wave suggests that if the emerging parabola continues to develop into a full-fledged parabola, Bitcoin could reach approximately $170,000 by May. Investors often use technical indicators like the weekly moving average convergence divergence (MACD) to assess potential entry and exit points. In a post dated March 11, the analyst said:

“If the newly emerging parabola continues to evolve into a full parabola, there could be an argument for a level of about $170,000 in May.”

However, these price targets are becoming modest in the current bull market. For example, Cathie Wood stated on March 7 that Ark Invest’s long-term price target for Bitcoin is well over $1 million, referencing the regulatory approval of spot Bitcoin exchange-traded funds in the United States:

“This target was before the SEC gave us the green light, and I think that was a significant turning point and moved the timeline forward.”

Türkçe

Türkçe Español

Español