According to CoinMarketCap data, the price of Ethereum began to rise today, increasing by 3.5% in the last 24 hours to $4,065, reaching the highest level of the year. Ethereum‘s price movement occurred as the leading cryptocurrency Bitcoin increased by 4.4% in the last 24 hours and entered the $72,000 range after setting an all-time high of $72,377 on March 11th. Ethereum’s price has increased by 16% over the last seven days, reflecting Bitcoin‘s 15% price increase during the same period.

Why Is Ethereum Rising?

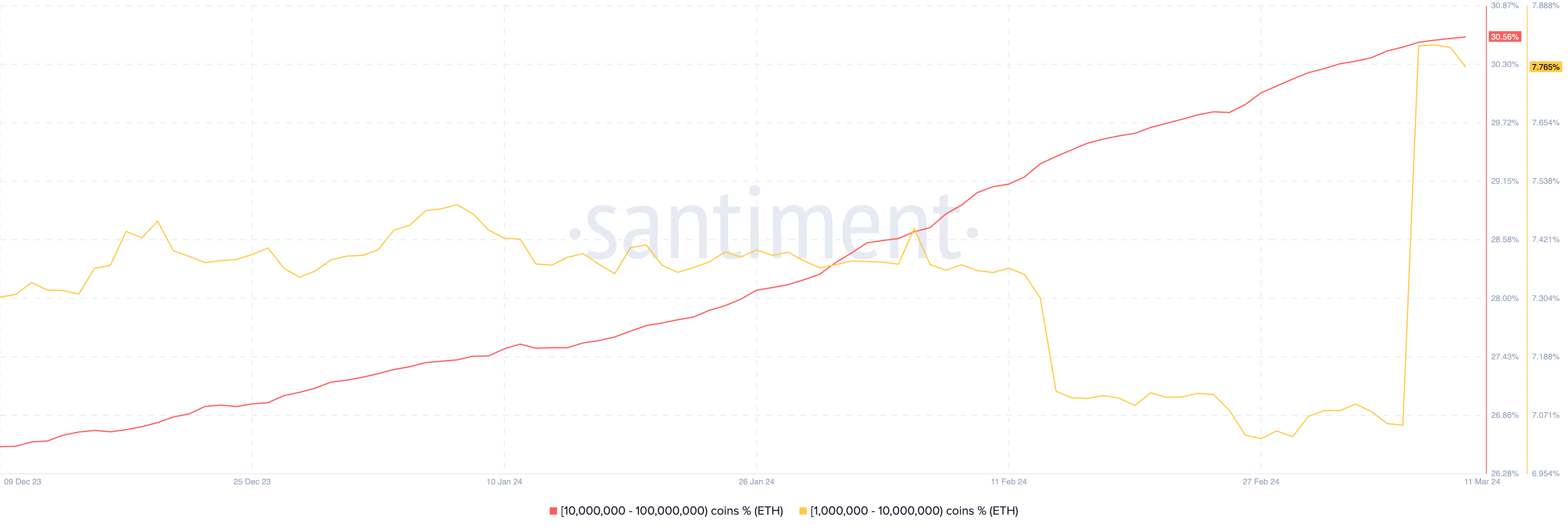

Major Ethereum investors are adding to their assets with the expectation of future price increases. Data from the analytics firm Santiment shows that the percentage of wallets holding between 10 million to 100 million Ethereum increased from 27% on January 1st to 30.56% on March 11th. As shown in the graph below, the percentage of those holding between 1 million to 10 million Ethereum has shown a sharp increase from 7% to 7.6% in the last five days.

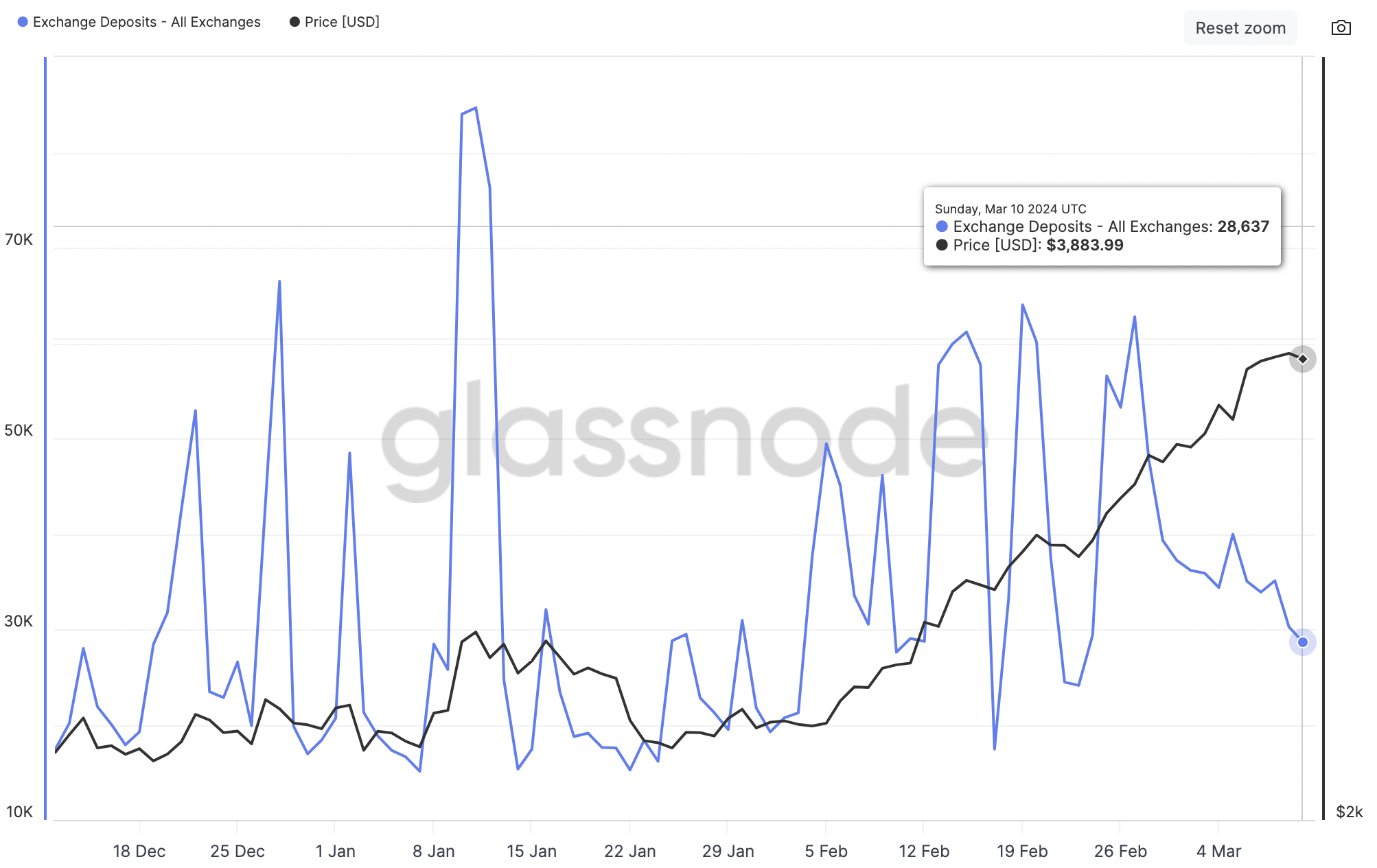

The accumulation of Ethereum by whales is supported by the reduction of Ethereum deposits in exchanges. According to data from blockchain analytics firm Glassnode, the number of deposit transactions to known exchange wallets began to decrease on February 27th when the Ethereum price rose above $3,200. This decline continued as Ethereum’s price exceeded $3,500 on March 5th and fell from 39,953 transactions to 28,637 on March 10th.

The decrease in Ethereum transfers to exchanges generally indicates a bullish sign of no intent to sell. Instead, there has been an increase in the number of transactions transferring Ethereum from exchanges. On March 11th, blockchain tracker Whale Alert flagged several transactions transferring large amounts of Ethereum from exchanges to Web3 wallets.

One investor transferred Ethereum worth $80,695,382, equivalent to 20,000 Ethereum, from the Bybit cryptocurrency exchange to an unknown wallet. Another withdrew 4,999 Ethereum valued at $20,044,345 from Binance to an unknown wallet.

Notable Data on Ethereum

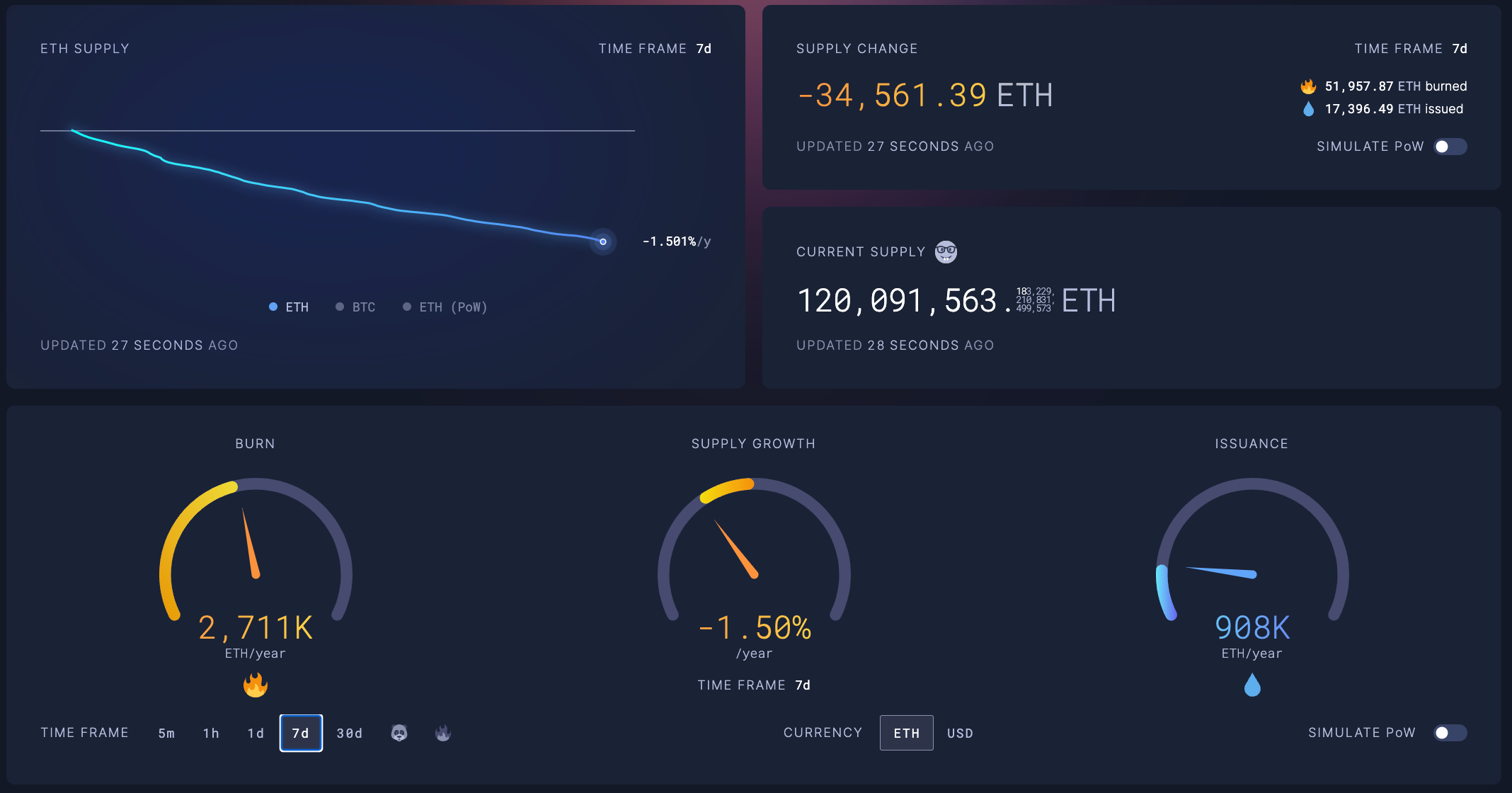

The reduction in Ethereum supply on exchanges is not the only factor increasing demand for Ethereum today. Data from Ultrasound Money shows that over the last seven days, approximately $210 million worth of more than 51,957 Ethereum has been burned. This is significant for Ethereum holders as it indicates a reduction in Ethereum’s circulating supply, thereby reducing selling pressure on the price.

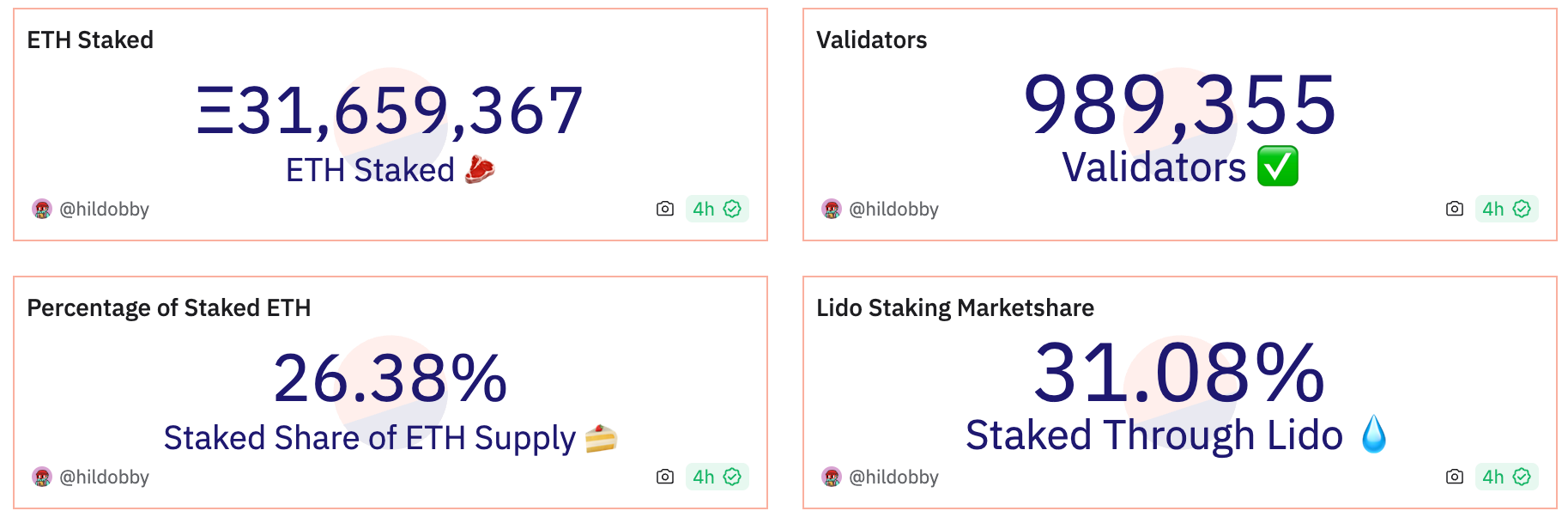

Another data supporting the reduced circulating supply of the altcoin is the amount of Ethereum deposited in the Beacon Chain. Dune Analytics reveals that more than 31.65 million Ethereum, valued at current rates at $128 billion, is staked in Ethereum’s proof-of-stake layer protocol.

This means that 26.38% of Ethereum’s circulating supply is staked and not available in the market, involving over 989,000 validators. Staking on Ethereum is further facilitated by liquid staking solutions like Lido, which constitute 31% of all staked Ethereum.

According to data from DefiLlama, the total value locked in LIDO has surpassed $40 billion, highlighting the increasing adoption and popularity of Ethereum liquidity protocols.

Türkçe

Türkçe Español

Español