VanEck, Bitcoin witnessed a significant increase in purchases. The asset management giant recorded an inflow of $118.8 million yesterday, drawing attention. This figure represents a sharp increase from the company’s usual average of $6 million. The inflows are expected to continue to rise in the coming days.

VanEck’s Bitcoin Assets

These inflows led VanEck’s Bitcoin assets under management to nearly double, reaching $251 million. Additionally, VanEck announced that they will not charge any fees until their assets reach $1.5 billion or until March 31, 2025.

Total net inflows reached half a billion dollars, balanced by GBTC’s sale of $494 million. However, this was offset by BlackRock‘s purchase of $563 million and Fidelity’s addition of $215 million.

Market Performance and Bitcoin Price

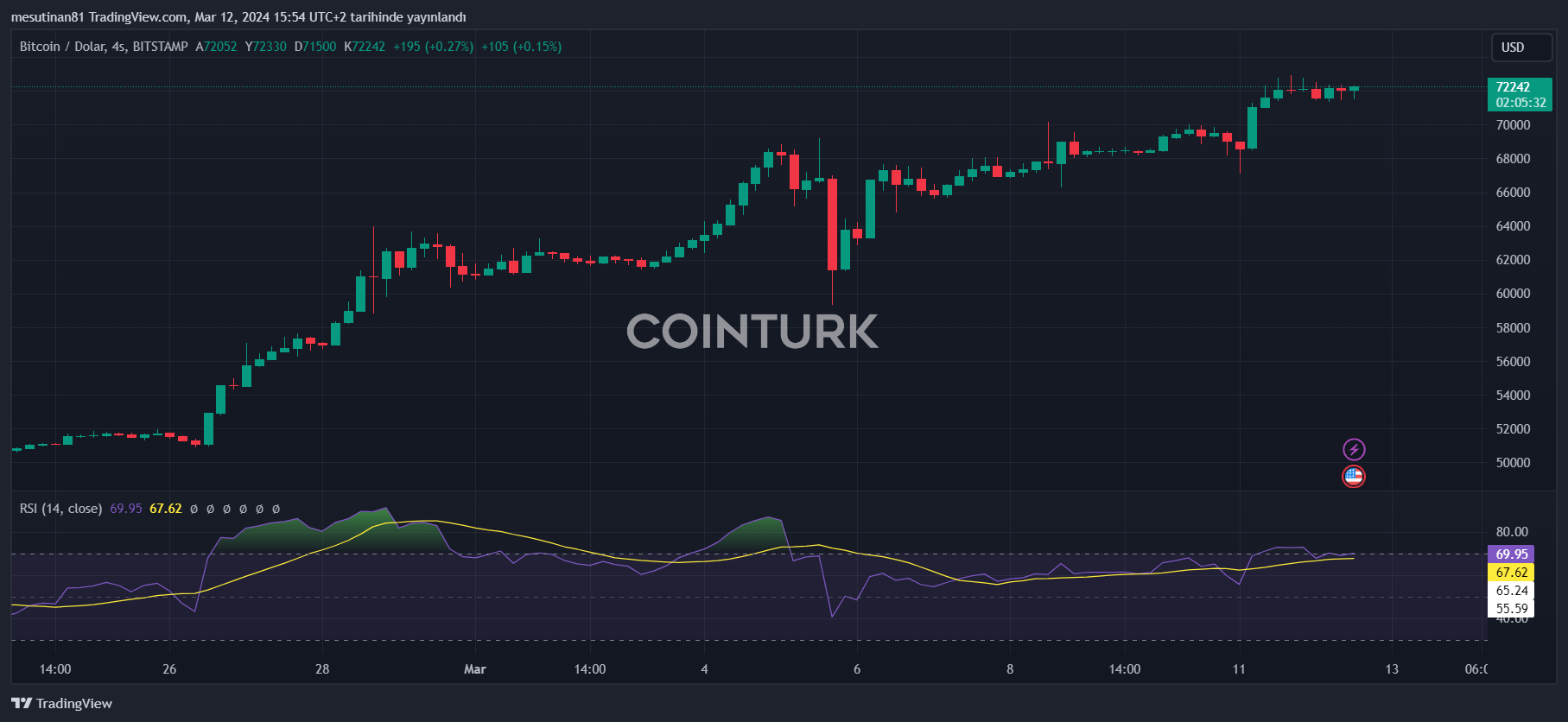

The net inflows doubled the average to $246 million, resulting in Bitcoin reaching $72,800. However, there was a decline during the Asian trading session, with Bitcoin falling to $71,300. Nonetheless, the cryptocurrency quickly recovered, surpassing $72,000 as the US trading session began.

Today’s announced Consumer Price Index (CPI) was reported at 3.2% for February. Although this figure is slightly above the expectation of 3.1%, the markets seem generally satisfied. After the CPI announcement, the dollar index DXY rose to 102.7, while Bitcoin fell to $71,460. However, DXY later dropped to 102.3 and is currently returning to 102.6, with Bitcoin trading above $72,000.

Today’s market opening, with net Bitcoin purchases exceeding half a billion, looks to be interesting, especially as Bitcoin’s rise seems to be slowing and every $1,000 gain is met with resistance. This indicates that FOMO is not fully present or that there is no enthusiastic surge. Bears still seem to be lurking around. Therefore, it could be another day of battle.

Is a Correction Expected in the Crypto Market?

The answer to this question is actually clear. Following Bitcoin’s new record highs, a strong correction expectation in the crypto market has become increasingly evident. However, assessments point to a correction particularly after the halving.

Before the correction, there are also expectations that BTC will reach $80,000. Even if a correction occurs, discussions of six-figure BTC figures have already started within the crypto community.