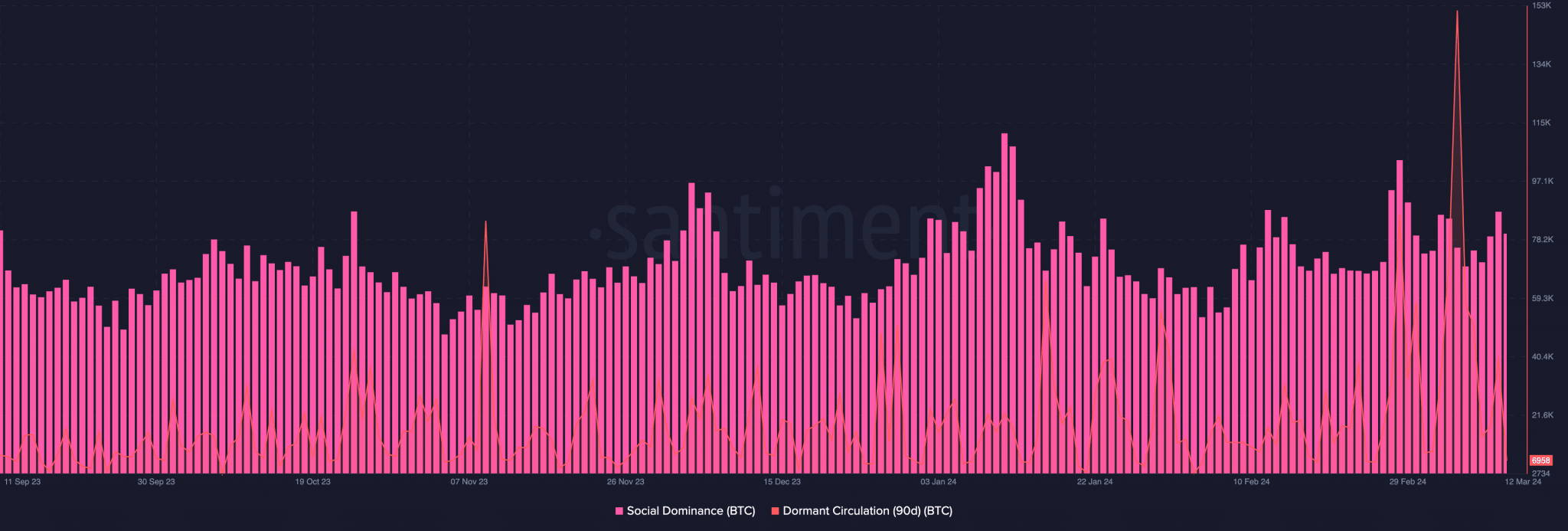

The leading cryptocurrency Bitcoin (BTC) has surged past the $73,000 mark. But will the momentum in the cryptocurrency continue? Here are the latest data on the flagship of the markets, Bitcoin! The increase in Bitcoin’s inactive circulation could mean that long-term investors are showing interest in the market. Historically, this could be a confirmation of a bull market. It is also indicated that social dominance suggests BTC’s value could rise much more.

Historical Data on Bitcoin

When comparing the price of the cryptocurrency with social dominance, it is noted that the correlation is low. During past bull cycles, the low discussion about BTC, independent of the price increase, could be a sign that the cryptocurrency has not reached its peak. Along with these metrics, predictions ranging from $80,000 to $100,000 are suggested to be possible.

DAA stands for daily active addresses. Therefore, the relationship between the price and Bitcoin’s DAA has been effective in highlighting the market’s lows and highs. Investors can use this to determine when to buy and when to sell. At the time of writing, on-chain data showed that the DAA price was -191.31%. This could mean that the DAA has dropped much more than the price.

Price Prediction for BTC

The recorded threshold implies that despite BTC’s rise, it has not attracted many new or individual investors. From a transaction perspective, this discrepancy could serve as a strong buy signal. Therefore, if activity on the Bitcoin network begins to reach flawless levels, the price could rise above $72,000.

However, this parameter could be the best option for short-term investors. Technically, BTC’s buying volume is much higher than the selling side. This situation could mean that with sellers lagging behind, the price may continue to swing towards $80,000. In addition, open interest (OI) is increasing, which could indicate an increase in net positioning. Although OI shows a 50-50 buyer-seller group, the increase indicates that buyers are more aggressive.