Bitcoin lingers at high levels while altcoins experience double-digit rises as this article is prepared. BNB and SOL have climbed to prices not seen in a long time. Bitcoin reached $73,650. So, how does Glassnode interpret the latest crypto surge? What do the current data tell us?

Crypto Market Rise

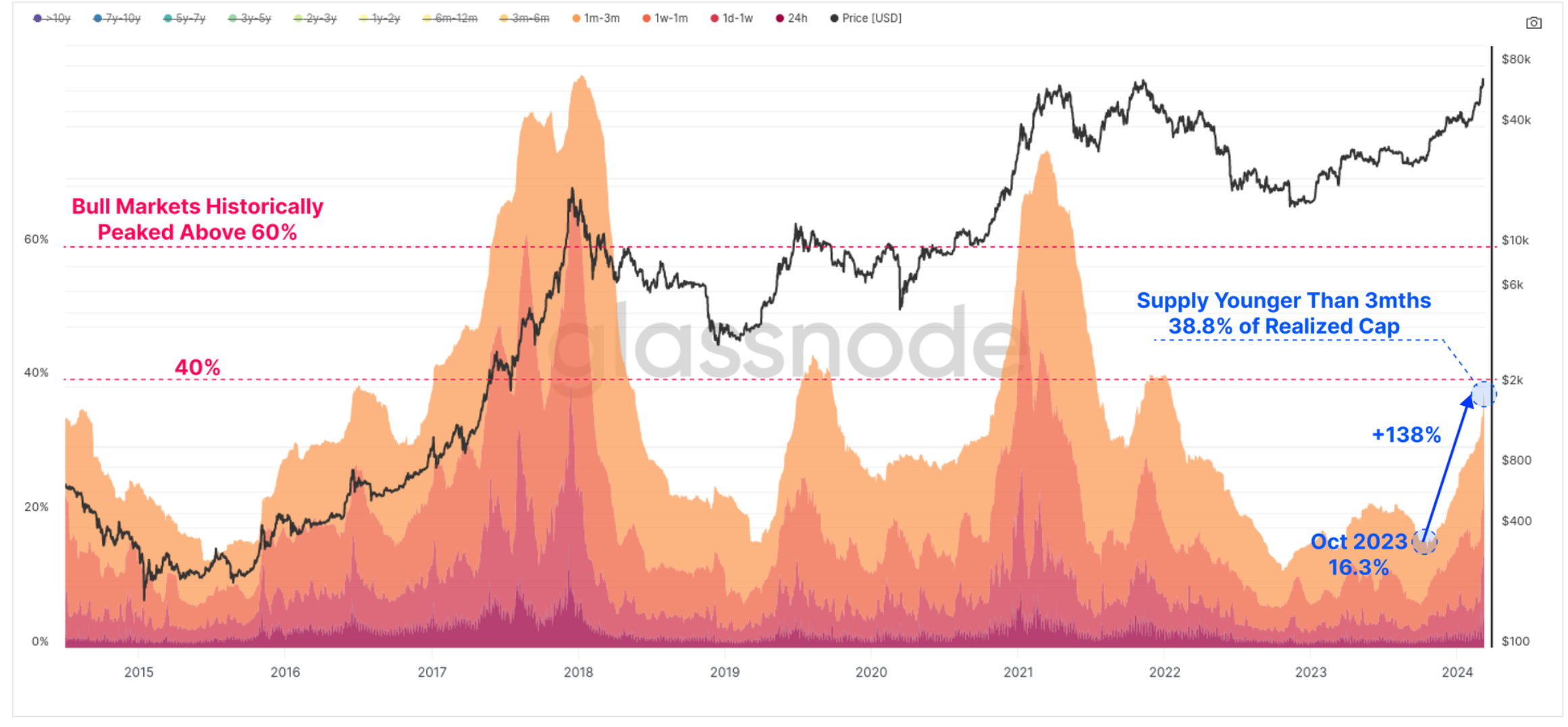

Glassnode‘s latest “The Week Onchain” report discusses the current state of the markets. As the most intense days of bull markets begin, long-term investors tend to sell to newcomers. This marks the start of the journey to new historical highs. Glassnode draws attention precisely to this point.

Analyst Checkmate wrote that BTC‘s rally surpassing $72,000 is already pregnant with new highs. The market reaching the Euphoria Zone is supported by the greed index exceeding 81. With speculators entering the market at this stage, FOMO grows. Moreover, there is a multiplier effect at the spot Bitcoin ETF front, which includes traditional investors alongside the FOMO in crypto exchanges.

“Historically, at this stage, we see a significant shift in investor behavior patterns, especially between HODLers and Speculator cohorts in terms of relative balance.”

Crypto Bull Market

The main focus of on-chain analytics firm Glassnode is what we briefly mentioned in the first section. Long-term investors, or holders, are engaging in BTC trades with the speculators we talked about. This situation, described as a wealth transfer, also increases the intensity of bull markets.

The graph below shows that Bitcoin investors who bought at lower prices a few months/years ago are accelerating distribution pressure as Bitcoin reaches all-time high levels.

Since October 2023, the 3-month holder rate has increased by 138%. Moreover, we know that the number of new Bitcoin wallets has increased by 54% within a month, from 308,743 to 475,005. Short-term investor accumulation has increased by 810,000 BTC, and all this seems like a repeat of what we’ve seen in previous cycles.

“Overall, this wealth transfer appears to be following a path very similar to previous Bitcoin cycles, representing both a changing asset structure and the dynamic balance between supply, demand, and price.”

Türkçe

Türkçe Español

Español