Cryptocurrency open interest volume continues to reach record levels, bringing with it an increase in volume. Investors continue to trade and comment on the future of cryptocurrencies like Bitcoin (BTC) and XRP, while continuing to evaluate potential threats. In particular, the current rises have shed the market’s greed and showed an increasing trend in long positions. The increase in long positions and the state of many indicators suggest that a long squeeze could occur for two of the most traded cryptocurrencies.

Bitcoin (BTC) Open Interest and Funding Rates Hit All-Time Highs

In recent statements, Colin Wu reported an increase to a record $33.94 billion in Bitcoin open contracts. This marks a new all-time high (ATH), over $10 billion higher than the previous ATH of $23.04 billion in BTC.

This level was last seen when Bitcoin reached its previous peak of $69,000 in November 2021, at the end of the last cycle’s rally.

On the other hand, the funding rate of the cryptocurrency on major exchanges has also reached new peaks. As a result, such a high funding rate seems to be facing the threat of a long squeeze due to an excessively imbalanced structure.

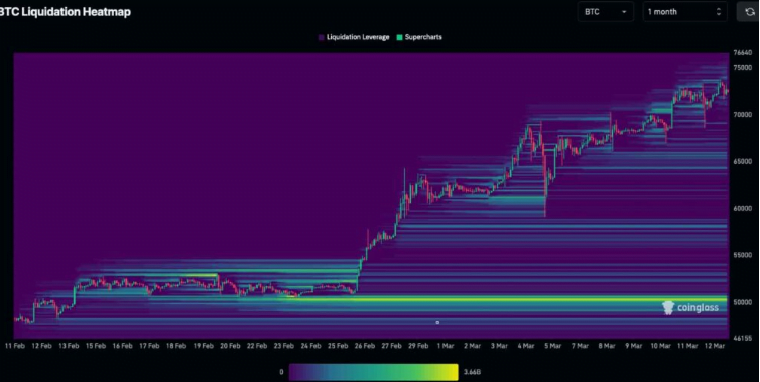

CoinGlass‘s monthly liquidation heat map shows liquidity pools that could target a correction to $50,000 in the event of a long squeeze. In addition, Bitcoin’s price is shaping a support level at its previous ATH of $69,000 before this region.

The Future of XRP

On the other hand, there is also talk of a potential long squeeze for XRP. It is mentioned as the second most likely cryptocurrency for this possibility. Moreover, the liquidity pools appear much narrower than Bitcoin’s, so there is no certainty about the occurrence of the event.

If market manipulators target these long positions, XRP could be pulled down to a price level of $0.5.

In summary, at the time of writing, Bitcoin and XRP were trading at $73,394 and $0.6836, respectively. A potential long squeeze could drive both cryptocurrencies down to $50,000 and $0.50, respectively.

Türkçe

Türkçe Español

Español