Bitcoin price expectations for a further rise increased as Bitcoin reached an all-time high on March 14th. Data from TradingView indicates that a new record of $73,794 was set on central exchanges. Bitcoin erased the signs of weakness seen before the previous Wall Street opening, making a strong comeback overnight.

Prominent Figures Comment on Bitcoin

Popular investor and analyst Rekt Capital reported that Bitcoin fell earlier this week due to recent events and successfully retested its old All-Time High levels as support.

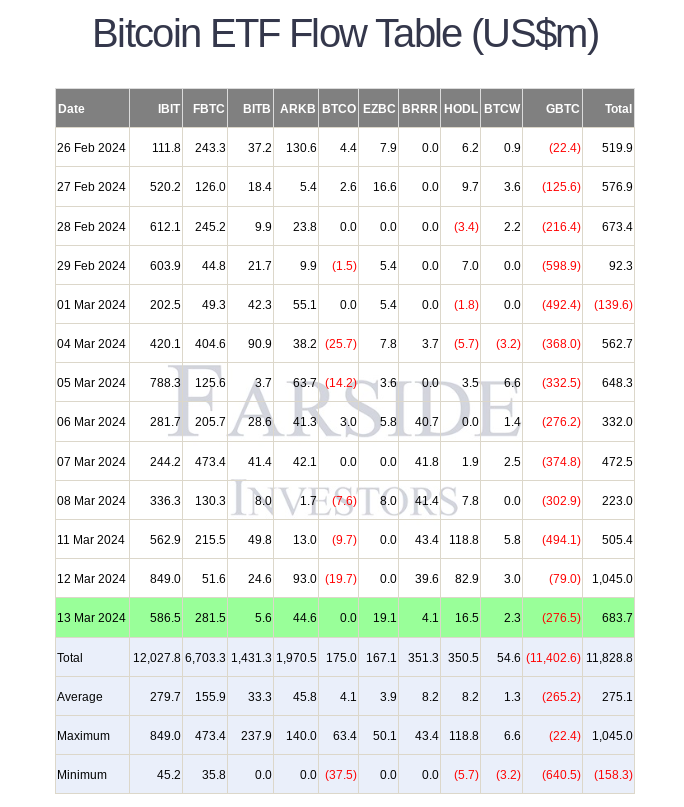

Excitement about known supply trends continued throughout the day, focusing on the impact of the US’s spot Bitcoin exchange-traded funds on the buying side. According to data collected by UK-based investment firm Farside, these funds saw a net inflow of $683.7 billion on March 13th.

This situation turned the supply squeeze momentum in favor of the bulls, surpassing the daily outflows from the Grayscale Bitcoin Trust (GBTC). Willy Woo, the founder of Bitcoin data source Woobull, echoed the thoughts of ARK Invest CEO Cathie Wood, describing institutional products as just getting started:

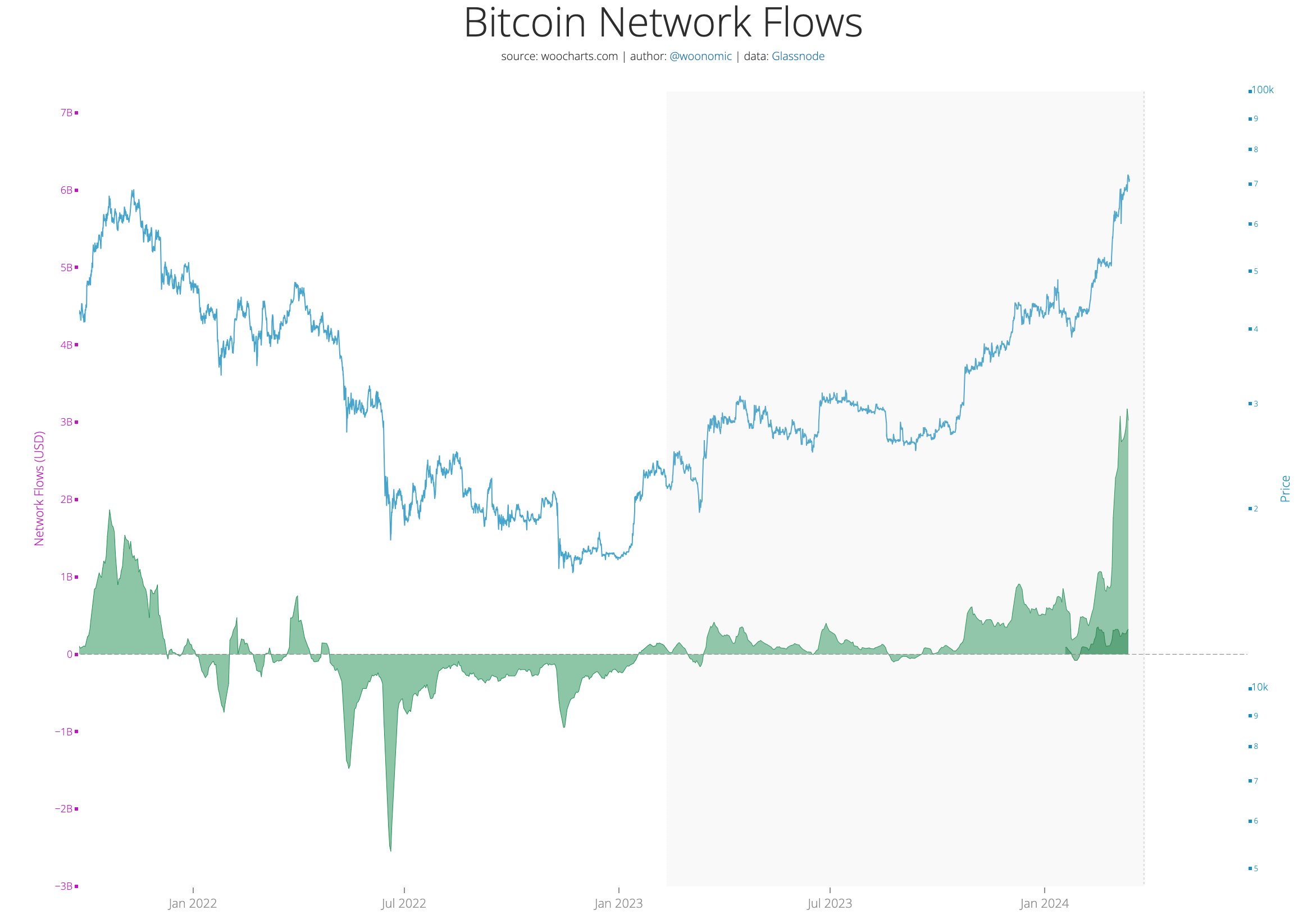

“ETF funds are just starting; it will take institutions and asset management platforms a few months to complete their due diligence before proper allocation begins.”

ETF Funds and Bitcoin

An attached graph shows general Bitcoin Network inflows, with ETF funds marked as a small dark green patch. News that technology firm MicroStrategy, currently the public company with the largest Bitcoin treasury, plans to amass more than 1% of the total Bitcoin supply also caught investors’ attention.

Currently holding 205,000 Bitcoins, MicroStrategy plans to spend an additional $500 million to increase its total to over 210,000 Bitcoins.

Despite some doubts about whether the current momentum in Bitcoin price movement can continue, calls for a rise continued loudly throughout the day. Among the optimists was Charles Edwards, founder of Bitcoin and crypto asset fund Capriole Investments, who predicted a new rise for the BTC/USD pair soon.

Edwards, telling his subscribers that Bitcoin is preparing for a big move, also referenced the latest ETF inflows in another post, adding that a billion dollars of inflow per day is keeping the downturn at bay.

Türkçe

Türkçe Español

Español