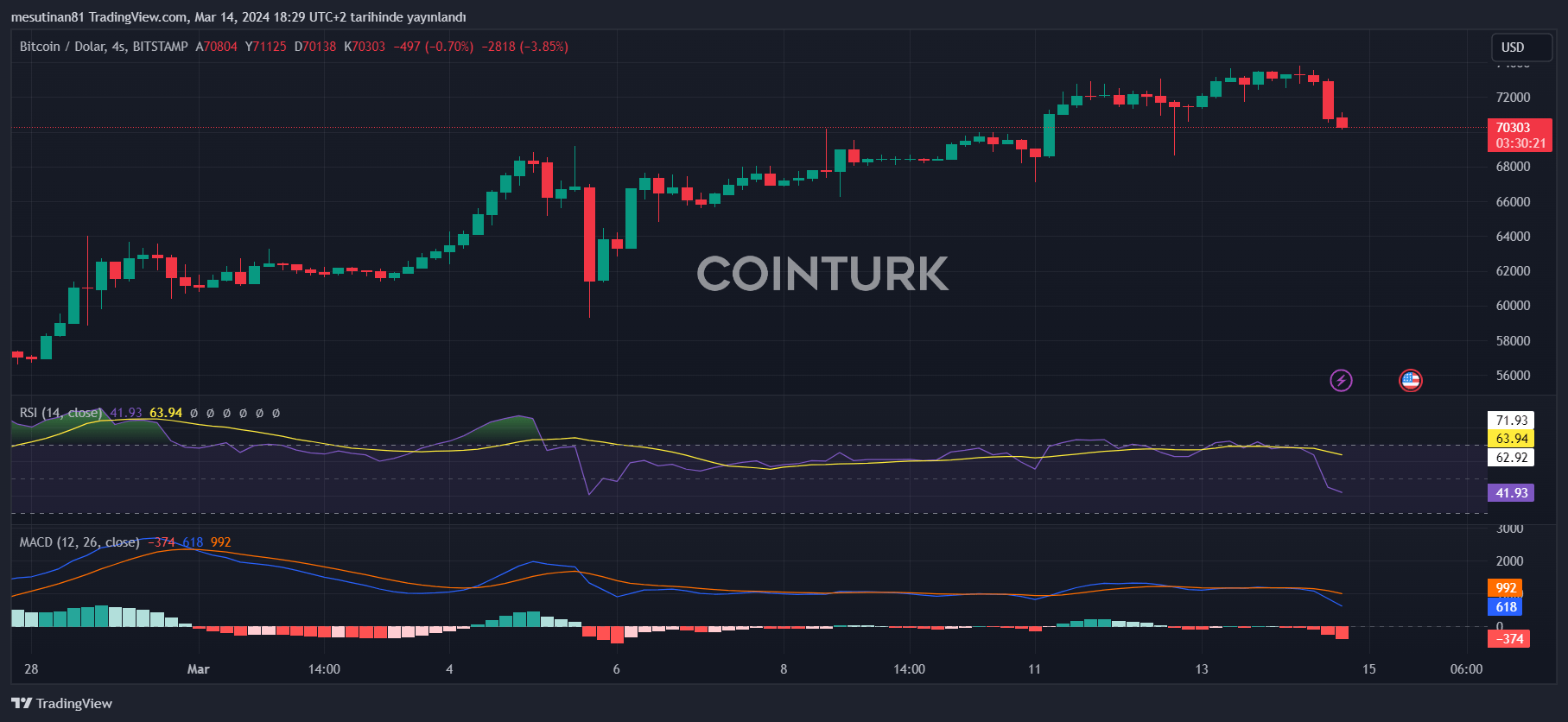

Today, the price of Bitcoin broke records in the morning, reaching $73,777. However, it began to fall with the release of US inflation data. Bitcoin retreated to a level of $69,880. Interestingly, the decline was accompanied by a drop in stock prices. Early on Thursday, Bitcoin’s price approached $74,000 but fell after US inflation data was released, along with leading stocks.

Bitcoin Slides Down

Bitcoin experienced a downturn following news that inflation in February was higher than expected. Bitcoin fell to $69,880. Data released today from the Bureau of Labor Statistics showed that the producer price index increased by 0.6% last month. Expectations were for an increase of only 0.3%. This indicates that inflation has not yet subsided.

Initially, stocks did not move much, but they fell after the data was released. The S&P 500 retreated by 0.2%, while the tech-heavy Nasdaq dropped by about 0.2%. The Dow Jones Industrial Average also fell by approximately 0.3%

Is Bitcoin Price Dependent on Interest Rates?

Investors are hoping that the Federal Reserve will lower interest rates by May, but if inflation does not decrease in the world’s largest economy, the central bank may keep interest rates steady.

Experts say that if interest rates are lowered, the price of Bitcoin will continue to rise. Bitcoin and the broader crypto market surged after the approval of spot Bitcoin exchange-traded funds (ETFs) in January, allowing investors to shift towards cryptocurrency without the need to physically hold and store it.

Türkçe

Türkçe Español

Español