Bitcoin price, at the time of writing, has once again surpassed the $72,000 mark and continues to find buyers near this region. Altcoins such as DOGE and SOL have also started to rise. However, the focus of a popular crypto analyst at the time of writing was on MicroStrategy’s impact on Bitcoin.

MicroStrategy and Bitcoin

Before the approval of a Spot Bitcoin ETF, BlackRock was among the largest investors in MSTR. The asset management company was holding MSTR (MicroStrategy shares) “for its own clients.” Now, it holds Bitcoin directly in its reserves, with the asset size around $15 billion. This is truly exciting, and we have been clearly seeing this excitement in the Bitcoin price for the past 2.5 months.

MSTR, which operates as a proxy Bitcoin ETF, was established by Michael Saylor, who later became a Bitcoin maximalist. The same person was struggling to make money from the hype during the early days of the internet in the Dotcom crisis. He has been doing the same for Bitcoin for the last 3-4 years.

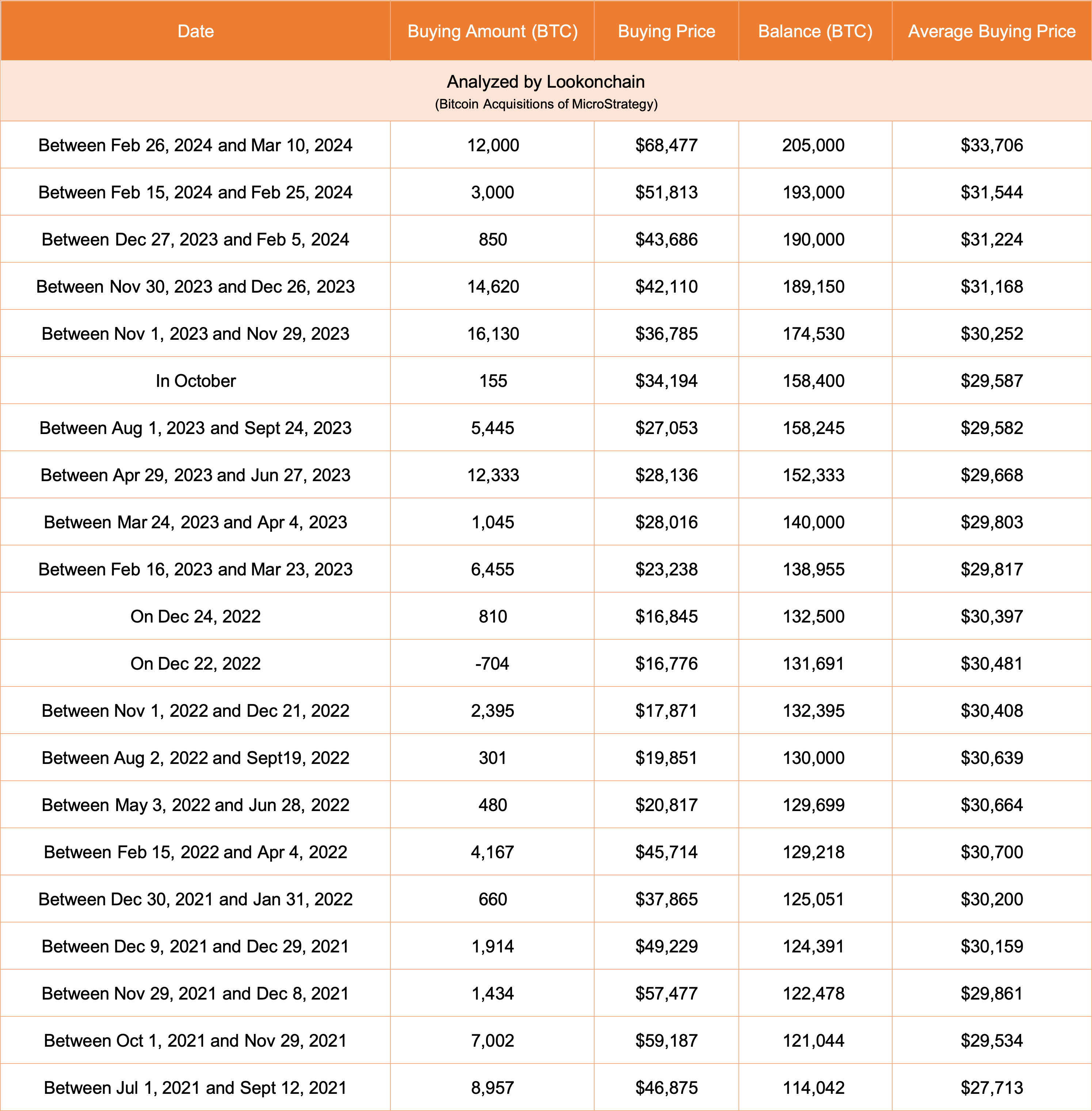

The company is borrowing money, buying Bitcoin, and then borrowing more to buy even more Bitcoin. This year, they announced the issuance of debt securities exceeding $1 billion and have BTC reserves that compete with BlackRock.

Willy Woo and MicroStrategy

Investors are struggling to fully understand why the company keeps buying Bitcoin. MicroStrategy‘s real purpose and why it’s taking such a risk during this process is succinctly explained by popular crypto analyst Willy Woo.

“- It is accepted as collateral by banks, so you can borrow against it, hence it’s an early form of a BTC mortgage.

– In terms of leverage, while TradFi lends USD at 6%, crypto lends USD at 8%-12%, long positions in BTC futures markets are 30%+

– MSTR’s valuation will increase with every leveraged purchase made with cheap financing, so it already acts like a leveraged BTC long

– The company’s free cash flow has a 2% commission advantage over ETFs. So for a 10-year HODL period, this efficiency is worth +22% even if BTC price doesn’t increase, and more if it does.”

According to this, Saylor has followed a correct strategy before the expected major institutional acceptance in the early stages. If he can enter the right level of selling position, he could end this process with significant gains. But for now, he says he won’t sell, assuming that Bitcoin will rise forever.

Türkçe

Türkçe Español

Español