Investments made outside of Bitcoin are closely monitored by cryptocurrency enthusiasts. A well-known figure in the crypto world, Samson Mow, has been in the news recently for his investment moves. Mow is known as one of the leading supporters of Bitcoin. He has announced significant changes to his investment portfolio to the public.

Samson Mow Invests in Bitcoin ETFs

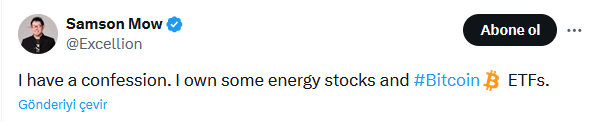

Mow, CEO of Jan3 and former CSO of Blockstream, stated in his announcements through X that his investment portfolio includes Bitcoin ETFs and some energy stocks. He emphasized his investment in spot-based ETFs, which have been approved by the Securities and Exchange Commission and started trading in January.

Spot exchange-traded funds (ETFs) offer the opportunity to invest in Bitcoin indirectly, indexed to the cryptocurrency. This allows users to benefit from Bitcoin’s price movements without holding the currency directly.

On January 11th, the SEC approved these ETFs, the largest of which was launched by BlackRock (IBIT). Since the inception of these funds, Bitcoin inflows have been tremendous. On March 15th, nine of them received a total of 97.15 million dollars worth of 1,434 BTC. BlackRock has added much more. Accordingly, with 4,967 BTC valued at over 336.5 million dollars, IBIT currently holds approximately 228,613 BTC, equivalent to about 15.5 billion dollars.

Mow Sells Off MicroStrategy Shares

Another significant change in Mow’s portfolio was the sale of his MicroStrategy (MSTR) shares. Although Mow had long supported the Bitcoin purchases made by MicroStrategy, he recently exited his position in the company’s shares.

MicroStrategy has recently increased its Bitcoin holdings on its balance sheet by purchasing an additional 12,000 BTC. This is seen as an indicator of the company’s confidence in Bitcoin. However, Mow’s exit from MicroStrategy shares suggests a trend towards focusing on direct Bitcoin assets.

The changes made by Mow could play a significant role in shaping confidence in the cryptocurrency market and Bitcoin. He is recognized as a significant player who trusts Bitcoin, the flagship of cryptocurrencies, for the long term. Therefore, changes in his investment portfolio are likely to be closely monitored. At the time of writing, Bitcoin’s price is approaching the support level of 66,000 dollars. The cryptocurrency BTC is trading at 66,440 dollars.

Türkçe

Türkçe Español

Español