Coinbase Premium Index, a few hours before Bitcoin‘s price fell by more than 7% to $66,000, dropped below 0.05. Over the past few days, Bitcoin has fallen from newly recorded highs to levels not seen in a week, triggering millions in liquidations. Analysts have revealed that the Coinbase Bitcoin Premium Index gave a signal of decline before Bitcoin started to fall.

Significant Data for Bitcoin Investors

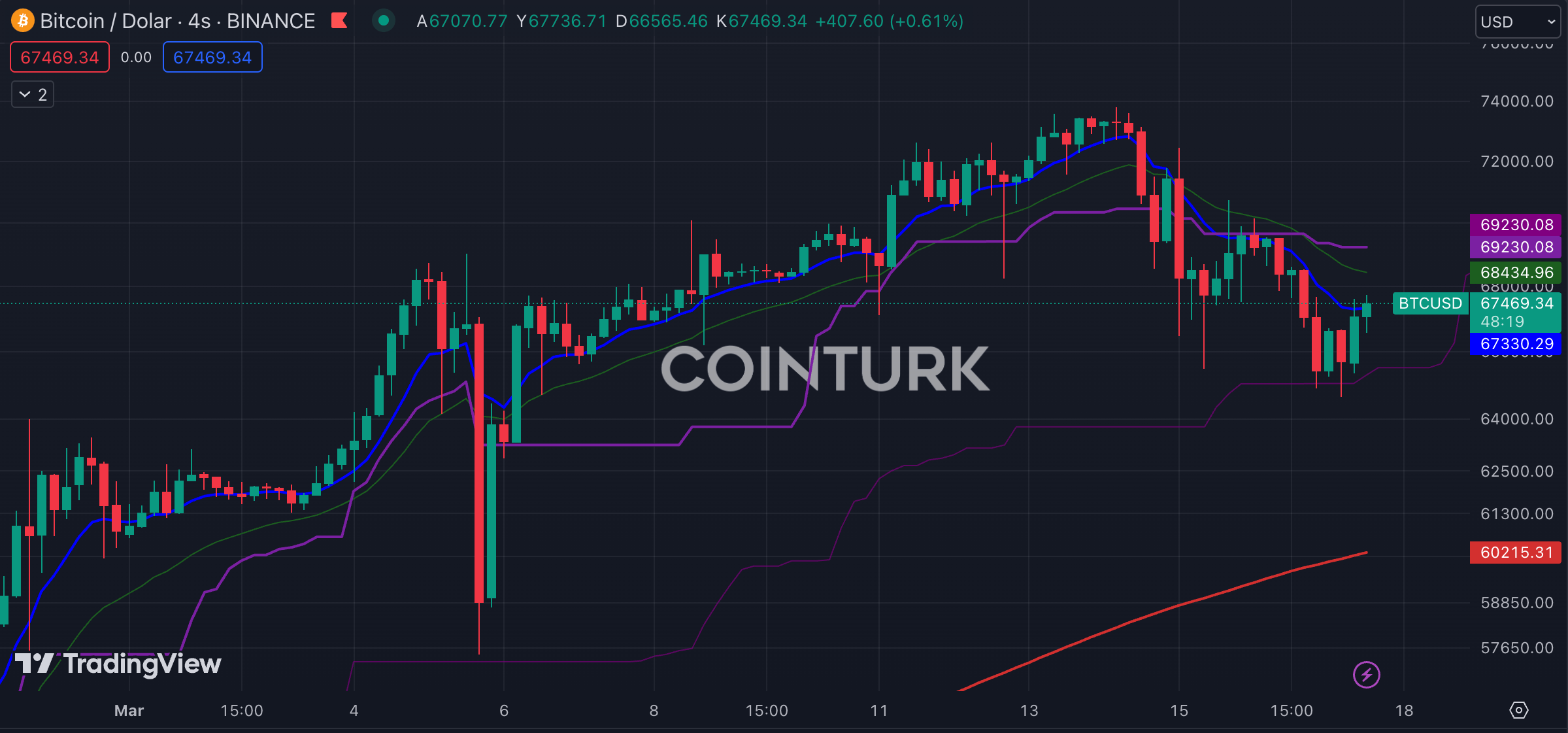

According to an analysis by blockchain data analytics platform CryptoQuant, the Coinbase Premium Index dropped below 0.05 a few hours before Bitcoin’s price fell by more than 7% to $66,000 on March 15 and continued to drop on March 17.

The Coinbase Premium Index represents the percentage difference between the USDT pair price on Binance and the USD pair price on Coinbase Pro. A decline in the index suggests that professional investors are less bullish than individual investors, as a larger portion of Coinbase’s trading volume comes from the initial investor group.

A negative trend in the Coinbase Premium Index typically signals a short-term correction in a bull market and increases the likelihood of a pullback and downward movement in the near term. This also indicates that the chances of witnessing a sudden price surge in Bitcoin are low.

The drop of the premium below 0.05 highlighted a period when buying pressure from US investors weakened. The subsequent price correction was seen as necessary by analysts. Analysis platforms like CryptoQuant and Bitfinex also warned of a price correction risk during Bitcoin’s rise above $73,000.

Prominent Analyst Makes Key Statements

Popular technical analyst CryptoCon reported that a 20% price correction for Bitcoin was necessary before the asset could reach new levels. With warning signs that Bitcoin could fall further, the asset may experience an approximate 6% loss in the coming days.

CryptoCon expects Bitcoin to reach a cycle peak in the next three to nine months after the current cooling period, based on historical data from the Directional Movement Index (DMI), an indicator that measures the strength and direction of an asset while reducing potential false signals.

Meanwhile, Bitcoin’s drop on March 15 liquidated over 190,000 investors with a total value of approximately $700 million. The largest wrecked position was on the crypto exchange OKX, exceeding $13 million. As unrealized profit margins for short-term holders reached extremely high levels during Bitcoin’s rally surpassing $73,000, Bitcoin’s recovery may take some time.

Türkçe

Türkçe Español

Español