A critical week for risk assets is taking shape around the Federal Reserve’s (Fed) next decision on interest rates and accompanying comments by Fed Chairman Jerome Powell. The Federal Open Market Committee’s (FOMC) next meeting will conclude on March 20 and will be a significant factor for classic risk asset volatility.

US Data and Bitcoin

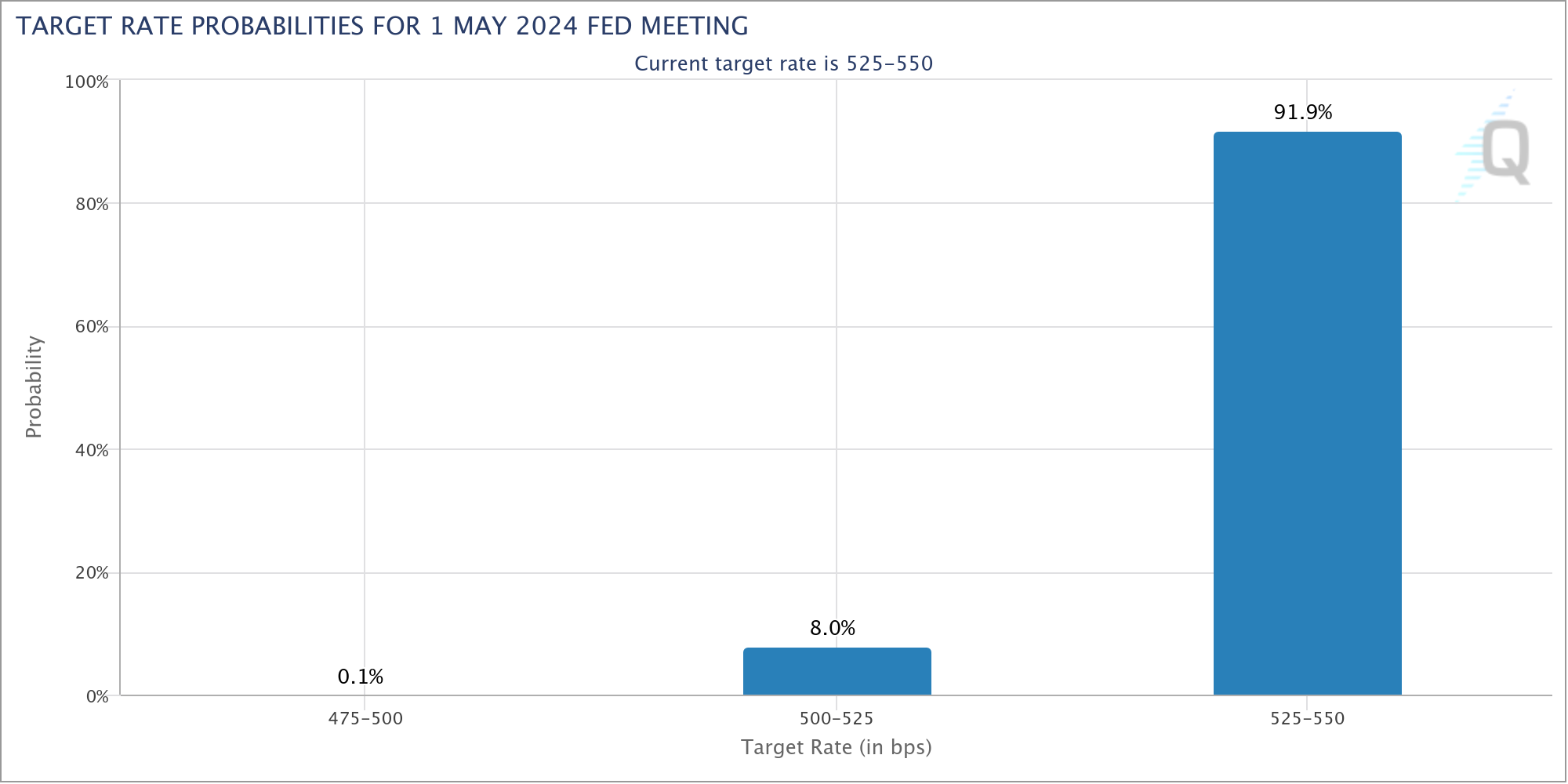

With all these developments, markets are expecting very few surprises and believe that the chance of a persistent inflation interest rate cut is gone, and even subsequent FOMC meetings are unlikely to change this trend. For instance, according to the latest predictions by CME Group’s FedWatch Tool, there is only an 8% chance of a rate cut at the FOMC meeting. In an analysis of FedWatch data, trade source The Kobeissi Letter provided the following comments in a broader analysis:

“It’s now official: For the first time this year, markets see only 3 rate cuts in 2024. This is also the moment when the markets align with the latest Fed guidance for the first time.”

Powell will make two speeches this week, the second of which will be on March 22. Market observers will closely monitor the language used for clues about future policy moves. The Kobeissi Letter continued in its analysis:

“All eyes are on this week’s Fed meeting for guidance from the Fed. Two months of rising CPI inflation require the Fed’s concern. As the fight against inflation continues, rate cuts in 2024 seem certain.”

Notable Development in Bitcoin Data

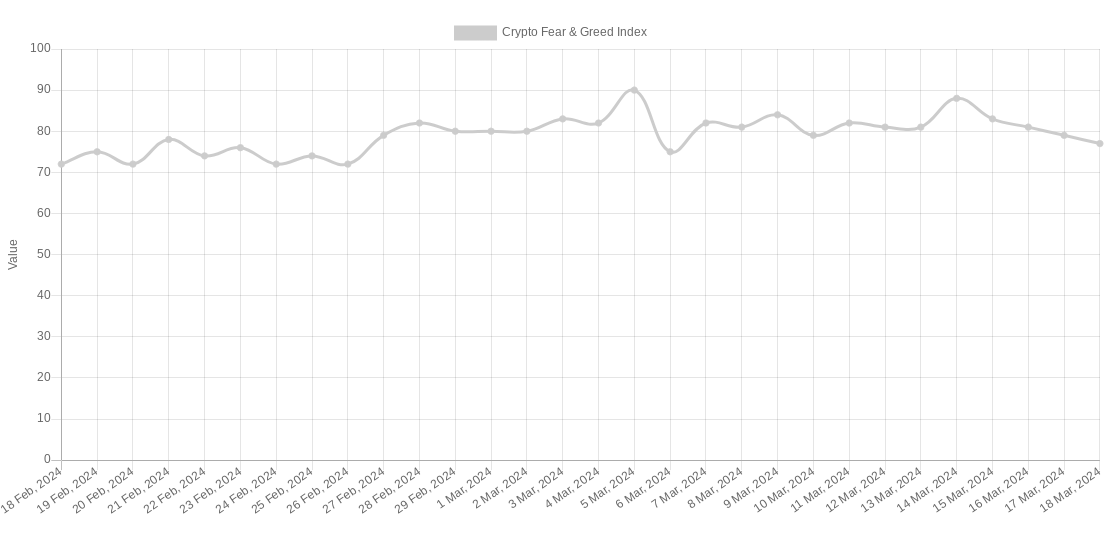

According to the Crypto Fear and Greed Index, a market sentiment indicator, sentiment continues to stay in the extreme greed zone, with some hodlers casting their vote through wallet movements.

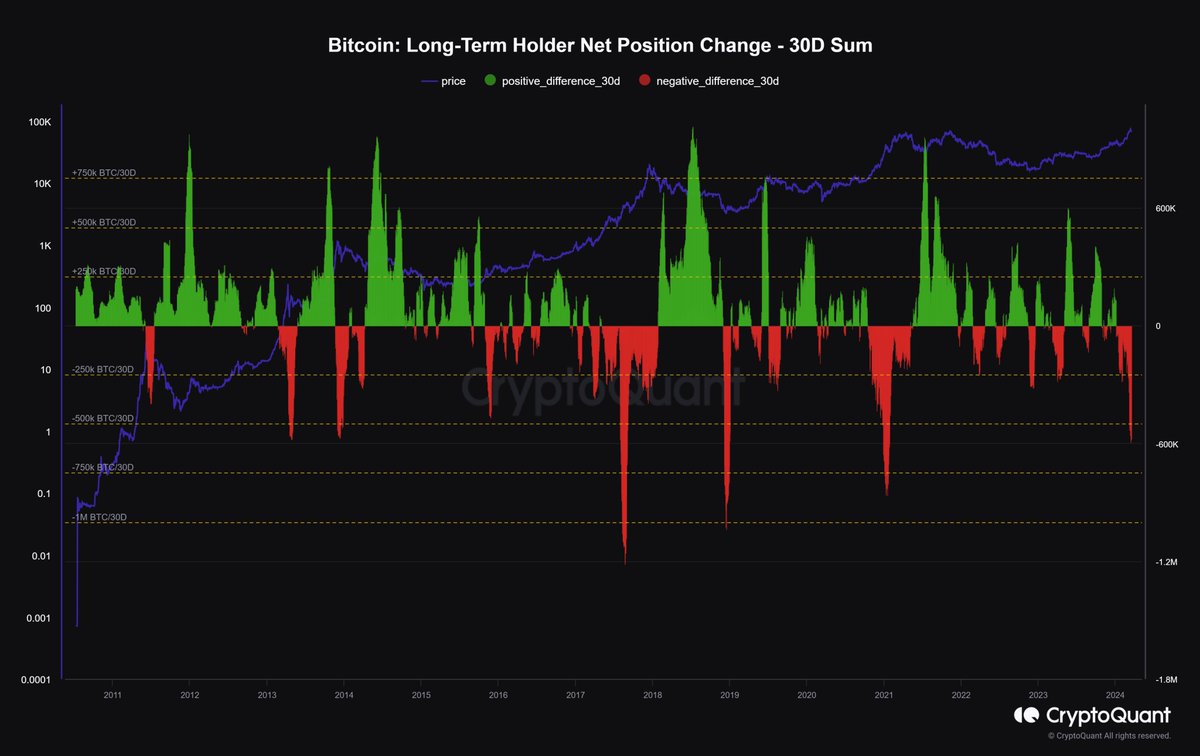

According to the latest data from data analysis platform CryptoQuant, the rate of profit-taking from long-held assets has significantly increased. Long-term holders (LTHs), investors who have held assets for at least 155 days, transacted approximately 600,000 Bitcoin over the past month. Participants at CryptoQuant discussing this process linked part of the sale to the Grayscale Bitcoin Trust (GBTC).

Türkçe

Türkçe Español

Español