Cryptocurrency markets are known for their timely and accurate predictions, and the crypto-focused YouTube channel InvestAnswers’ host, anonymous cryptocurrency analyst and trader James, has predicted a major rally for Ethereum (ETH) amidst the ongoing bull market. The analyst expects ETH to rise to as much as $8,000 at some point during the bull market.

Prediction of $8,000 for Ethereum’s ETH

The anonymous cryptocurrency analyst and trader James shared his latest prediction regarding ETH, the fundamental native asset of the largest smart contract platform, Ethereum. Using a layer-in and layer-out model, the analyst expects the biggest altcoin to rise over 125% from its current levels to $8,000. This prediction implies that a one-unit investment in ETH at current prices could double in value.

The layer-in and layer-out model used by the analyst takes into account various market dynamics such as trend analysis, volatility, and overall market behavior to determine potential price targets for ETH. Despite foreseeing significant upward potential for Ethereum, the analyst advises investors to be cautious and consider other altcoins that may outperform Ethereum in the long term, recommending strategic portfolio management.

Points to Solana

James points to Solana (SOL) as the altcoin he expects to outperform Ethereum. The analyst notes that while ETH continues to be a significant component of his portfolio, constituting only 0.6%, alternative assets like Solana have the potential to offer superior returns and thus deserve a higher percentage.

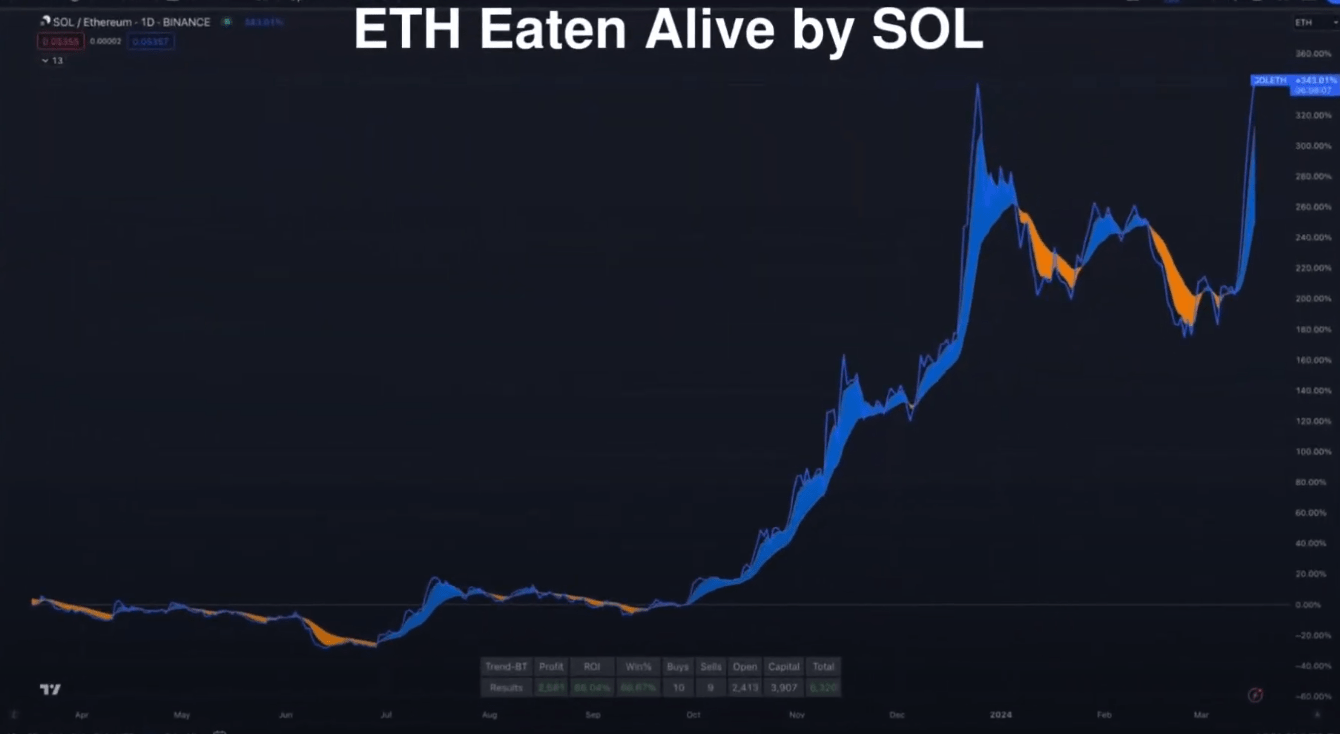

Comparing the performance of Ethereum and Solana over the past year, the analyst highlighted that Solana has brought in approximately 400% more gains than Ethereum, showing a notable advantage. Despite Ethereum’s significant rise from $1,300 to $4,000, Solana has consistently outperformed it, according to the analyst.

The analyst’s observations shed light on the tough competition in the cryptocurrency market, where Ethereum faces increasing competition from emerging altcoin projects like Solana. The performance comparison between the two assets underlines the advice for investors to carefully evaluate the potential of different projects and strategically allocate their resources to maximize gains.

Türkçe

Türkçe Español

Español