While analyses warn that support could be broken, Bitcoin surpassed $61,000 on March 20th, facing a new risk of breakdown. Data from TradingView followed another night of Bitcoin price losses, which have now dropped to as low as $60,760 on crypto exchanges. Currently, the BTC/USD pair is experiencing a 17.5% drop compared to its all-time high, continuing to face selling pressure due to several key factors.

What’s Triggering the Bitcoin Decline?

Among these significant developments are exits from US spot Bitcoin exchange-traded funds and the Federal Reserve’s decision on interest rates on March 20th. The outcome of the Federal Open Market Committee (FOMC) meeting is almost certain, but Fed Chairman Jerome Powell’s subsequent commentary is under scrutiny for risk assets.

The Kobeissi Letter, a trade source, stated in a part of its latest analysis that with less than 24 hours to the Fed meeting, it is unlikely that the Fed will change interest rates tomorrow, and added the following statement:

“However, after recent events, all eyes will be on the guidance. We maintain our view that it is too early for a pivot.”

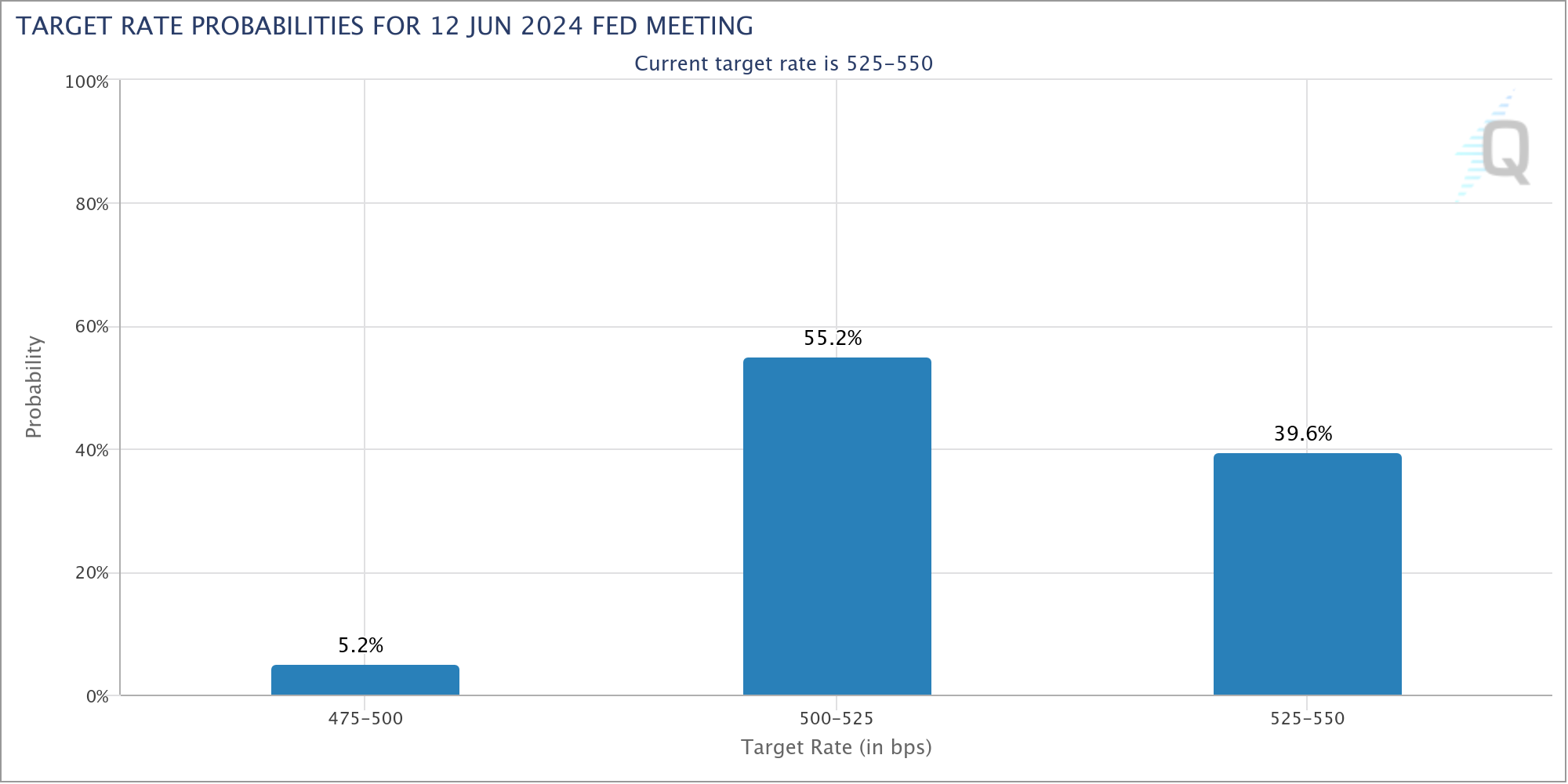

The latest predictions from the CME Group’s FedWatch Tool set the chance of a pivot or return to interest rate cuts at only 1% for March 20th and 9.1% for the next FOMC meeting in May. The probability for the Fed meeting in June is significantly higher at 55%.

What’s Happening on the ETF Front?

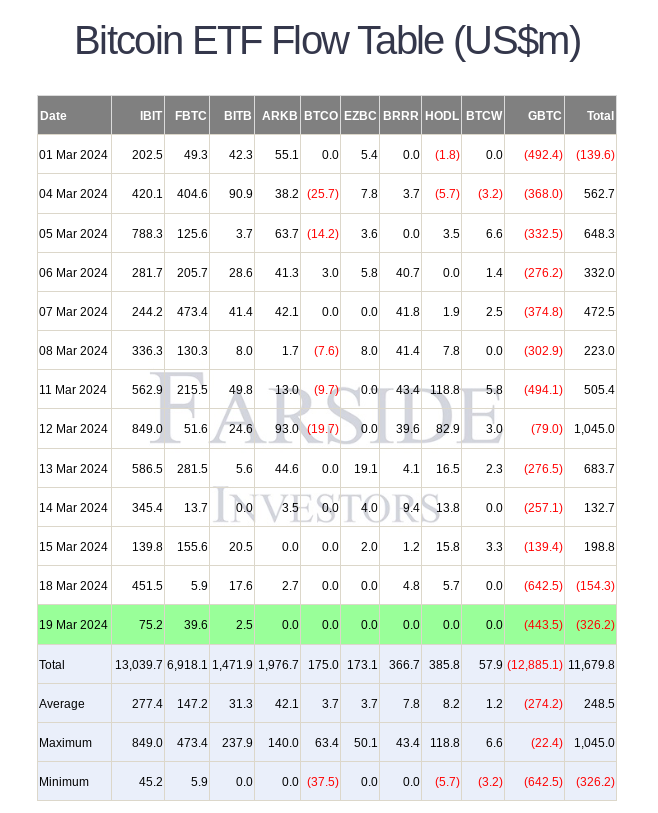

According to data from UK-based investment firm Farside, spot ETF funds saw net outflows for the second consecutive day. Although the outflow from Grayscale Bitcoin Trust (GBTC) was lower than the record $642 million on March 19th, the low inflows into other ETF products created lackluster statistics. Financial commentator Tedtalksmacro shared the following remarks on the subject:

“Almost $500 million exited spot BTC ETF funds in the last two trading days. Investors’ wait-and-see stance before the FOMC and the US tax season could be potential reasons for the slowdown.”

Trade firm QCP Capital warned its Telegram channel subscribers in its Asia Morning Color daily bulletin that the second consecutive day of net outflows could still have serious effects on Bitcoin price strength, sharing the following statement:

“Grayscale saw slightly smaller outflows of $443.5 million overnight, but will the inflows from other ETF funds bring us to a net positive number today? Another net negative figure will likely cause support to break.”

Türkçe

Türkçe Español

Español