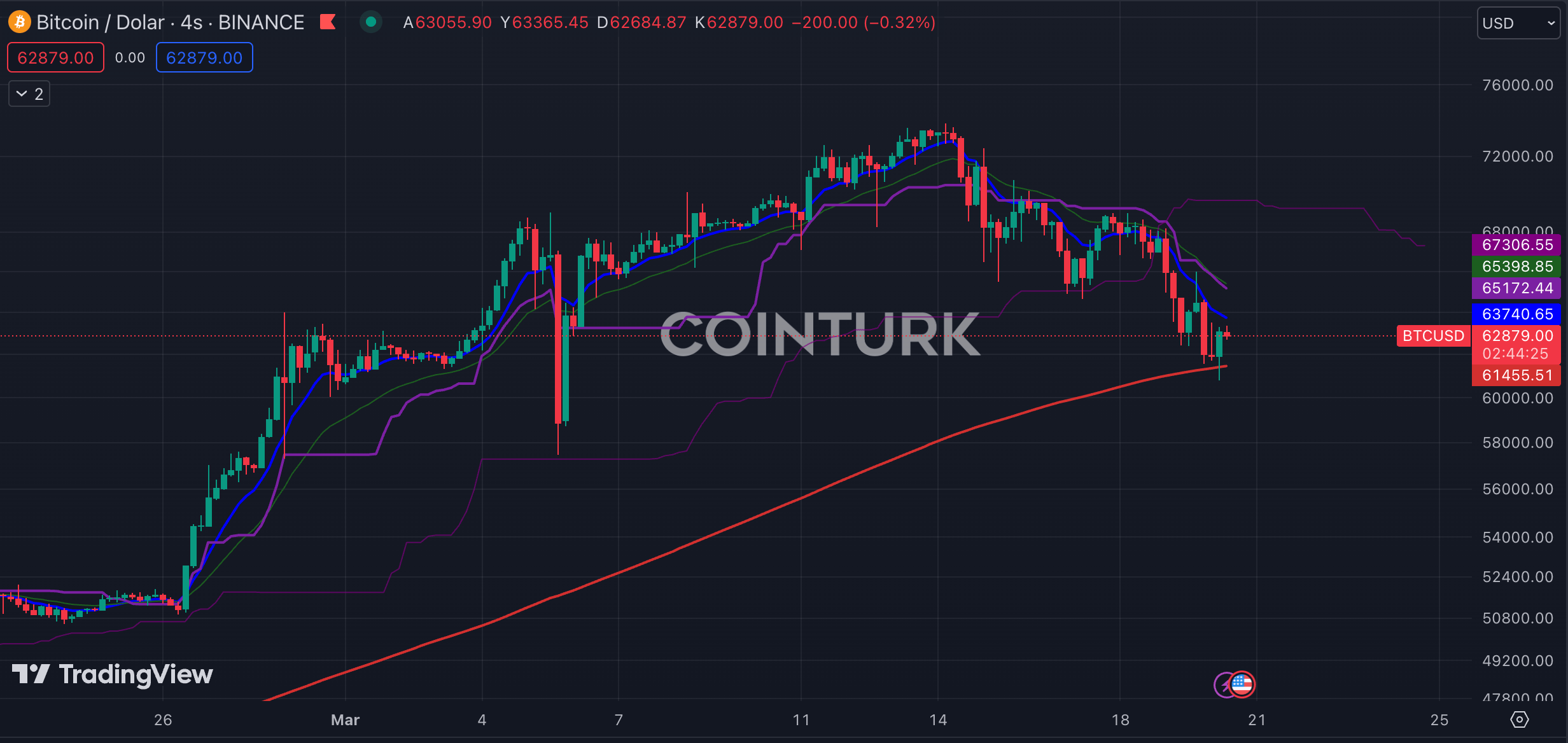

Bitcoin saw a further decline in the early hours of March 20, temporarily dipping below the $61,000 level and continuing the sell-off that began after the cryptocurrency reached an all-time high last week. According to Tradingview data, Bitcoin was trading at $62,824 at the time of writing.

Bitcoin and the Crypto Market

Bitcoin displayed a remarkable performance with a 124% increase last year. The world’s largest cryptocurrency reached just below the record level of $73,800 last week. The price of the cryptocurrency was supported by the launch of spot Bitcoin exchange-traded funds (ETFs) in the US in January, as well as the upcoming halving event in the Bitcoin ecosystem, which effectively slows down the supply of Bitcoin. Historically, the halving event has supported prices.

Coinmarketcap’s data shows that the total value of all cryptocurrencies has decreased since Bitcoin’s all-time high, with a $210 billion reduction as of the morning of March 20. Other crypto assets like Ethereum and Solana also fell sharply, leading to an approximate $400 billion loss in market value for the entire cryptocurrency market since the peak.

Part of the decline is due to profit-taking following the sharp rally in cryptocurrencies. Data from CryptoQuant shows a significant increase in short-term holders selling their Bitcoins for profit on March 12. Vijay Ayyar, the vice president in charge of international markets and growth at the cryptocurrency exchange CoinDCX, commented on the situation, saying, “We received many signs last week that things were heating up,” and he continued:

“In previous Bitcoin bull markets, we saw that retracements of 20-30% were a normal occurrence when things started to heat up.”

Expert Commentary on Bitcoin

BitMEX Research reports that Bitcoin ETF funds recorded a net outflow of $154.4 million on March 18. This was the first net outflow since March 1. While Grayscale Bitcoin Trust, or GBTC, recorded an outflow of $642.5 million, other ETF funds saw modest or steady inflows, according to BitMEX Research.

GBTC has been criticized for its above-average fees. However, Grayscale CEO Michael Sonnenshein stated earlier this week that the crypto fund manager expects to lower transaction fees for the Grayscale Bitcoin Trust ETF in the coming months.

Ayyar mentioned that if Bitcoin falls below the $60,000 support level, the cryptocurrency could weaken further to test the $50,000 to $52,000 range, which will be our line in the sand for this bull market to continue moving forward.

Türkçe

Türkçe Español

Español