Leading research firm 10x Research’s CEO Markus Thielen has warned traders and investors amidst the recent downturn in the cryptocurrency market. Known for his accurate predictions, Thielen had previously forecasted both the rise and the fall of Bitcoin (BTC) and Ethereum (ETH), and is now advising “not to rush in.”

High Risk Alert: Patience Is Key

In his latest report published on March 20th, Thielen summarized why BTC and ETH prices have entered a downward trend and advised investors and traders planning to buy the dip to be cautious.

According to Thielen’s analysis, the key support levels for Bitcoin are currently at $63,000 and $60,000. The analyst predicts a potential drop to the $52,000 to $54,000 range if BTC falls below $60,000. Despite the attractiveness of low prices, Thielen warns against early purchases, considering the ongoing downward trend.

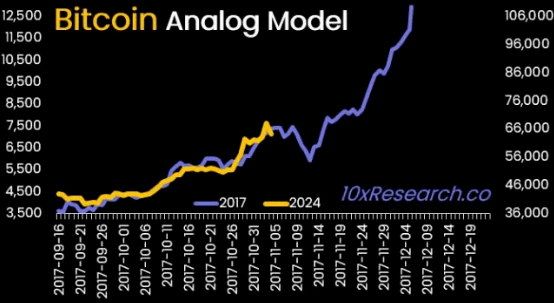

Thielen’s research firm, 10x Research, is known for utilizing various data sources, predictive models, and objective analyses in making market forecasts. Despite the short-term downward trend, the firm maintains its upward targets for Bitcoin at $83,000 and $102,000. This expectation indicates the potential for a significant rally in Bitcoin if certain conditions are met.

Volatility Expected to Increase

Currently, the fundamental factors affecting Bitcoin’s price trajectory include the Federal Open Market Committee (FOMC) meeting, where the Fed’s interest rate cut policy decision is anticipated. The expiration of options and open positions in Bitcoin futures are also among the key factors that will influence price movements. As a result, an increase in Bitcoin’s volatility is expected.

Investors will closely monitor signals from the FOMC regarding the timing and likelihood of future interest rate cuts. Any message from this meeting has the potential to significantly impact the market and the direction of Bitcoin’s price. Additionally, the expiration of options indicates that investors are positioning themselves for potential downside risk, as evidenced by the purchase of put contracts at $58,000, suggesting a downward price trend.

With low trading volumes and net outflows from spot Bitcoin ETFs, Bitcoin’s price continues to show high volatility and a downward trend. According to data provided by CoinMarketCap, the largest cryptocurrency’s price has fallen by 14% in the last 7 days. At the time of writing, Bitcoin is trading at $63,177, with the lowest and highest prices in the last 24 hours being $60,807 and $65,757, respectively.

Türkçe

Türkçe Español

Español