Umoja’s CEO Robby Greenfield stated in an interview that the lack of internal strategy among major financial institutions might postpone the approval of spot Ethereum exchange-traded funds (ETFs) beyond the May deadline. Companies vying for the Ethereum ETF fund include BlackRock, Grayscale, Fidelity, ARK 21Shares, Invesco Galaxy, VanEck, Hashdex, and Franklin Templeton.

Developments in Ethereum ETF Funds

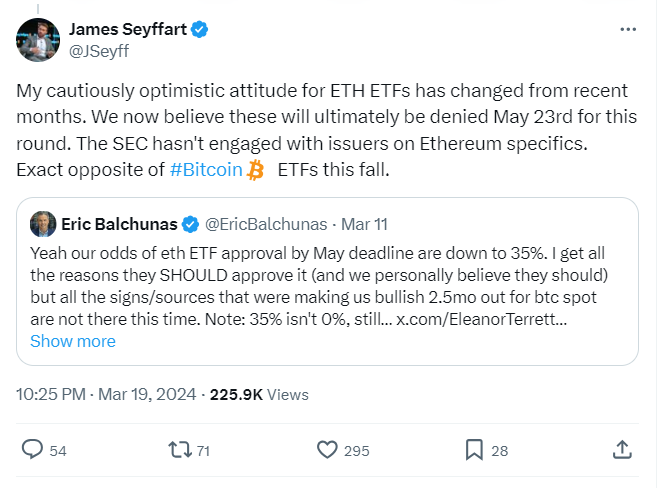

According to a March 19th post by Bloomberg ETF analyst James Seyffart, current Ethereum ETF approvals are expected to be denied by the end of May. The United States Securities and Exchange Commission (SEC) has postponed its decision on the spot Ether ETF funds from Hashdex and ARK 21Shares on March 19th. Both ETF applications have a final deadline for a decision by the end of May.

Due to the decentralized nature of cryptocurrencies like Ethereum, it is more challenging to create institutional strategies for ETF funds. According to Greenfield, while a delay is likely, the approval of Ethereum ETFs is just a matter of time, and he shared the following statement:

“Whether it’s approved in May or December, it’s inevitable. Especially considering the SEC’s increasingly commodity-like view of Ethereum, I don’t understand why it wouldn’t be approved.”

The SEC must make decisions by May 23rd for VanEck’s application, by May 24th for ARK 21Shares’ application, by May 30th for Hashdex’s application, by June 18th for Grayscale’s application, and by July 5th for Invesco’s application. Fidelity and BlackRock’s applications must be decided by August 3rd and August 7th, respectively.

Noteworthy Details on the Subject

In his statement, Greenfield mentioned that besides spot Ethereum ETF funds, major institutional players are still hesitant to invest in decentralized finance (DeFi) due to a lack of infrastructure, which also hinders traditional individual investor participation:

“Institutional capital will not touch the DeFi space without processes and guarantees they are comfortable with. Real individual investors will also not touch the DeFi space without a better user experience, hence a simpler infrastructure is required.”

According to Greenfield, providing individual access to smart investment strategies is crucial because individual investors have less access to asset management tools compared to institutions. Umoja has increased its initial seed funding round by $2 million, bringing the total to $4 million, to provide broader individual access to asset management strategies:

“If you look at all the assets managed on the planet, you’ll see that 52% of them belong to individuals. This means individual investors have more money to spend on wealth creation but by far the least opportunity.”

According to estimates by the World Economic Forum, individual investors made up 52% of the managed global assets in 2021, and this percentage is expected to rise to 61% by 2030.

Türkçe

Türkçe Español

Español