The cryptocurrency market is showing signs of revival, with the largest altcoin, Ethereum (ETH), standing out with an increase of over 45% since the beginning of the year. This upward momentum in the altcoin king comes after a long period of sharp declines in 2022 and 2023, with advanced artificial intelligence algorithms expecting ETH to rise further within the year.

Bullish AI Algorithms on Ethereum’s Trail

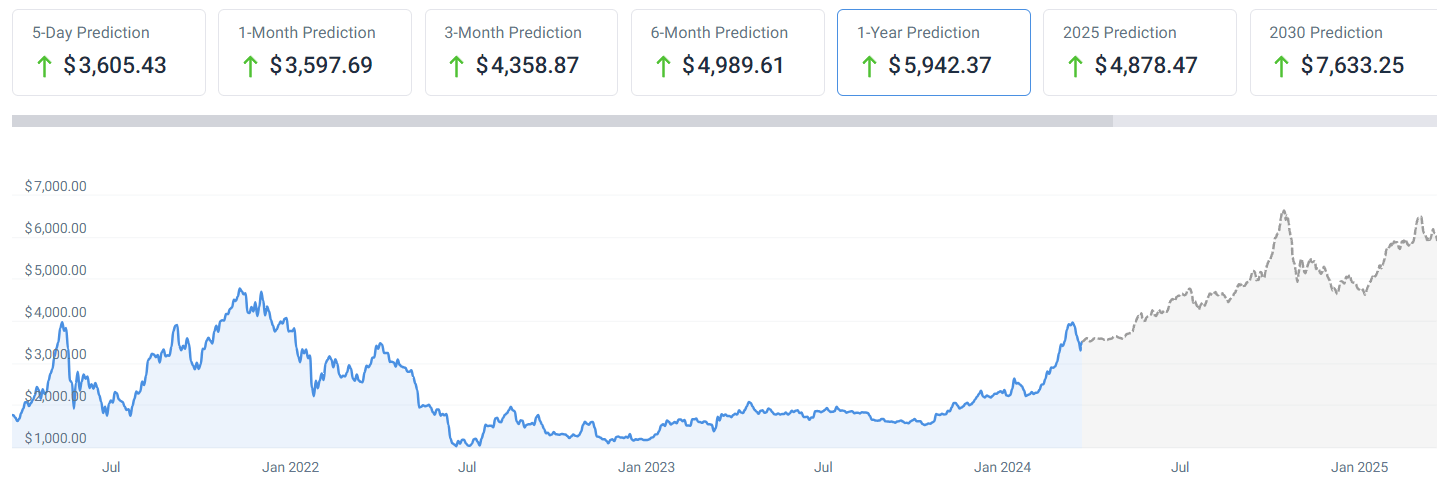

Various artificial intelligence algorithms have made optimistic predictions about the price trajectory Ethereum will follow by the end of the year. One AI algorithm forecasts a target price of $4,778, corresponding to an increase of over 35% from current levels. Another AI prediction platform, CoinPriceForecast, is predicting an increase of over 90% for ETH by year’s end, targeting $6,770.

OpenAI’s latest generative AI ChatGPT-4 predicts a price range for Ethereum of $3,500 to $4,000 by the end of 2024, expecting it to potentially exceed $4,000 with increasing bullish expectations and positive regulatory developments. Additionally, Anthropic’s AI model Claude 3 Opus puts forward a conservative estimate between $3,800 and $4,200, with the most optimistic scenario predicting a range between $4,500 and $5,000.

The upward trend expectations for the altcoin king by AI algorithms coincide with the support given by Solana’s (SOL) co-founder Anatoly Yakovenko amidst the increasing scrutiny of Ethereum’s classification by the US Securities and Exchange Commission (SEC).

Critical Threshold: $3,500

The positive momentum ETH has been experiencing is associated with the recent Dencun update implemented on March 13th, aimed at improving the network’s data storage mechanisms and reducing gas fees (transaction fees). An anonymous cryptocurrency analyst CryptoJelleNL highlights the importance of the altcoin king’s resistance above the critical level of $3,500, suggesting that sustained closures above this level could potentially drive the price to $5,000 in the short term.

While AI algorithms predict strong growth for Ethereum by the end of the year, it’s crucial to emphasize that investors should conduct comprehensive research and stay informed about overall market developments before making investment decisions. Despite optimistic predictions, Bitcoin (BTC), Ethereum, and other altcoins are traded with high volatility, underscoring the importance of exercising due diligence in the highly volatile cryptocurrency market.

Türkçe

Türkçe Español

Español