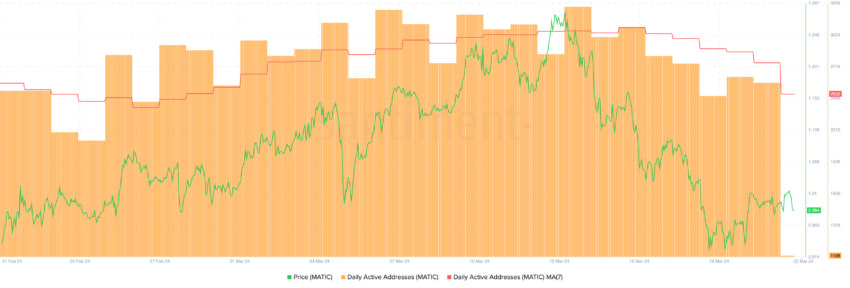

The price of Polygon (MATIC) is under experts’ scrutiny as the number of daily active addresses has decreased over the last eight days, reaching the lowest seven-day moving average level not seen since February 27th. This could be a possibility as 51% of MATIC holders are facing losses at their current positions.

Active Addresses on MATIC

A recent death cross on the MATIC exponential moving average (EMA) lines could indicate a lasting downtrend, casting a shadow on the cryptocurrency’s near-term outlook. The number of daily active addresses on MATIC has recently shown a significant increase, displaying a robust growth model. Overall, there was a notable increase in daily active addresses from February 1st to March 14th. The addresses rose from 1,946 to 3,301, recording an impressive growth of 69.63%.

This upward trend indicates growing interest and participation in the MATIC network. However, this strong growth rate may show signs of slowing down in the last eight days. This trend can also be understood from the seven-day moving average. The relationship between MATIC price movements and daily active addresses, especially the seven-day moving average, has historically been tight. This correlation can also be seen in the most recent price increase observed from February 1st to March 14th, where MATIC’s price experienced a notable increase of 41.77%.

Historical Data on MATIC

Considering the recent decline in the seven-day moving average of daily active addresses, it could be inferred that the price of the altcoin may be preparing for a potential correction phase in the short term. If historical patterns hold true, this decrease in active address growth could signal a cooling period for MATIC’s market valuation and may indicate an impending adjustment in the price trajectory in the coming days.

The current situation, where 51% of MATIC addresses are at a loss and only 44% are profitable, could indicate a downtrend. According to experts, this situation could also prompt those incurring losses to sell as soon as prices recover, creating selling pressure at certain thresholds and potentially limiting any price increase.

Türkçe

Türkçe Español

Español