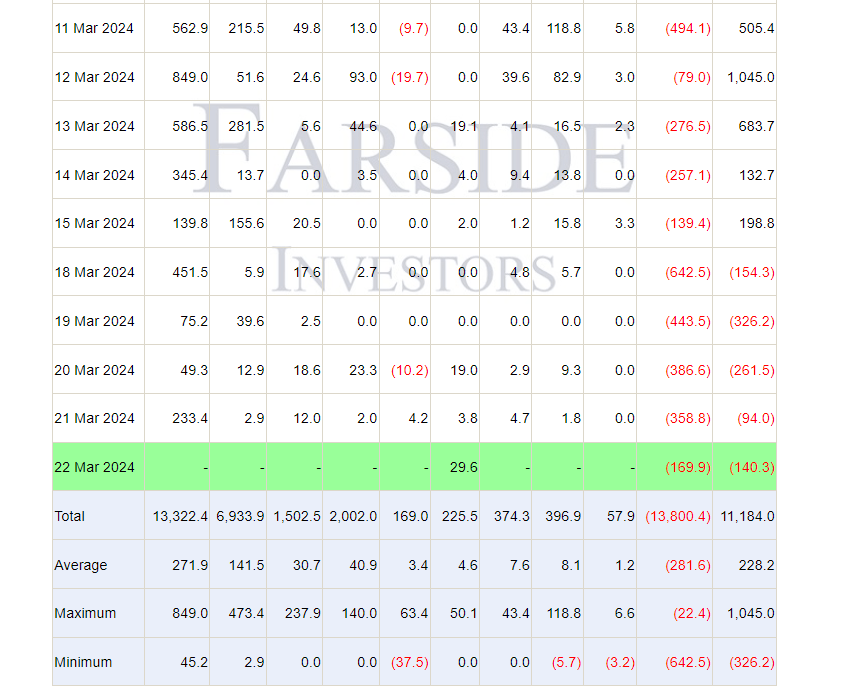

Bitcoin price fluctuations were supported by ETF outflows, and key data has just arrived. Throughout the week, we experienced net outflow days due to dominant GBTC outflows and weaker inflows from other ETFs, indicating a decrease in risk appetite through the ETF channel.

Cryptocurrencies May Rise

The recent net outflow data slightly increases the possibility of a cryptocurrency rise over the weekend. In the past five trading days, ETF outflows, particularly from GBTC, gradually decreased. This led investors to enter the weekend with expectations of a rise, although any uptick was not sustained.

However, it might now be possible. On March 22, GBTC outflows amounted to $169.9 million. Consequently, due to inflows in other ETFs, we might have witnessed the first net inflow day of the week. The understanding of this event by more investors over the weekend could lead to increased optimism for Monday and a potential rise in prices.

Despite the $169.9 million in GBTC outflows, inflows from just EZBC (Franklin) alone were a net $29.6 million. With additional inflows from IBIT and Fidelity, it’s possible for the Bitcoin price to target $68,000.

Türkçe

Türkçe Español

Español