Spot Bitcoin exchange-traded fund (ETF) inflows slowing down combined with investors’ high unrealized gains could lead to downward pressure on Bitcoin prices after the upcoming halving event. According to Julio Moreno, research director at CryptoQuant, the unrealized profits from Bitcoin’s recent rally are increasing selling pressure. In the coming months, a slowdown in spot Bitcoin ETF inflows could exert further pressure on Bitcoin prices.

Bitcoin Investors Warned of Potential Sell-Offs

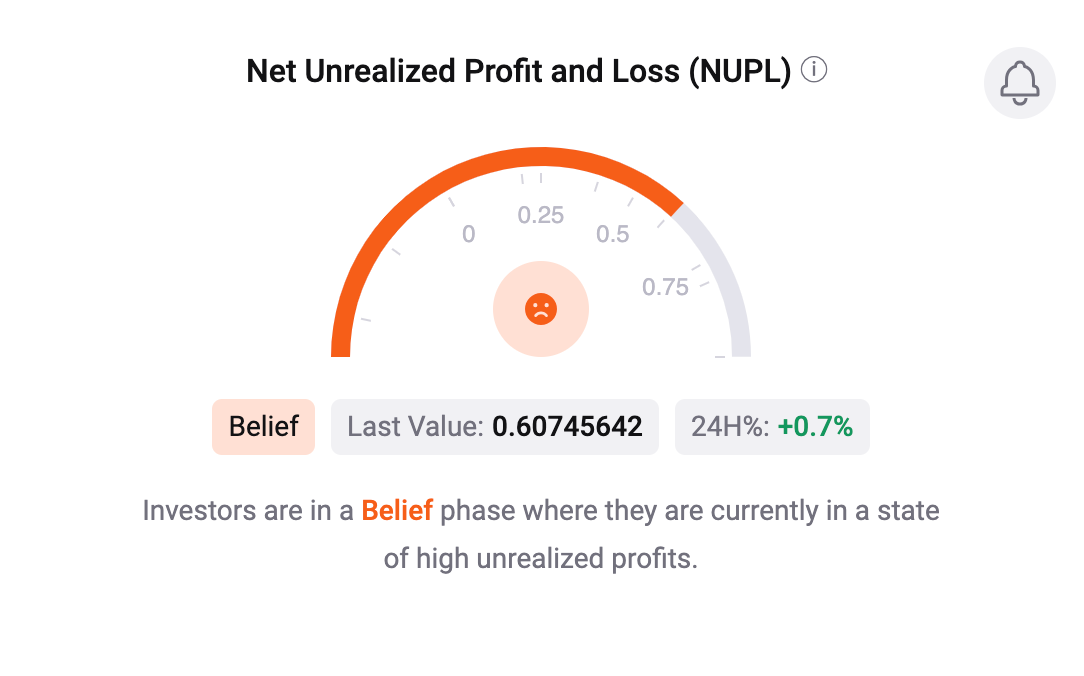

CryptoQuant’s Net Unrealized Profit and Loss (NUPL) indicator analysis supports this view. The indicator’s warning signal at 0.7 suggests Bitcoin investors may be ready to take profits, potentially driving prices down and increasing selling pressure. On March 17th, despite recent price corrections, NUPL data showed a 0.41% increase over the previous 24 hours, reaching 0.606. Moreno commented on the potential for a price drop:

“For a bearish price outlook: First, a slowdown in ETF Bitcoin purchases and second, a high likelihood that investors will sell to realize profits, entering the halving process with high levels of unrealized gains.”

Bitcoin ETFs recorded one of their lowest net inflow days on March 14th, with only $132 million in net activity, marking the lowest level in eight trading sessions and an 80% decrease from previous days. James Butterfill, Head of Research at CoinShares, suggested that a potential downturn might not be as severe as previous bear markets because institutional investors typically implement portfolio rebalancing strategies, which could mitigate rather than increase volatility:

“During the last bull market in 2021, volatility was at 120%. It’s currently only at 45%, and prices have risen above all-time highs. We believe this is due to the dampening effect of portfolio rebalancing.”

What to Expect During the Halving Process?

Bitcoin ETF funds flowing through are countering the negative price effects of miners’ sales ahead of Bitcoin’s deflationary mechanism, the halving event. Halving reduces the reward for mining new blocks by 50%, thereby decreasing the rate of new Bitcoin production. This year’s reduction will lower miners’ rewards from 6.25 to 3.125 Bitcoins per block.

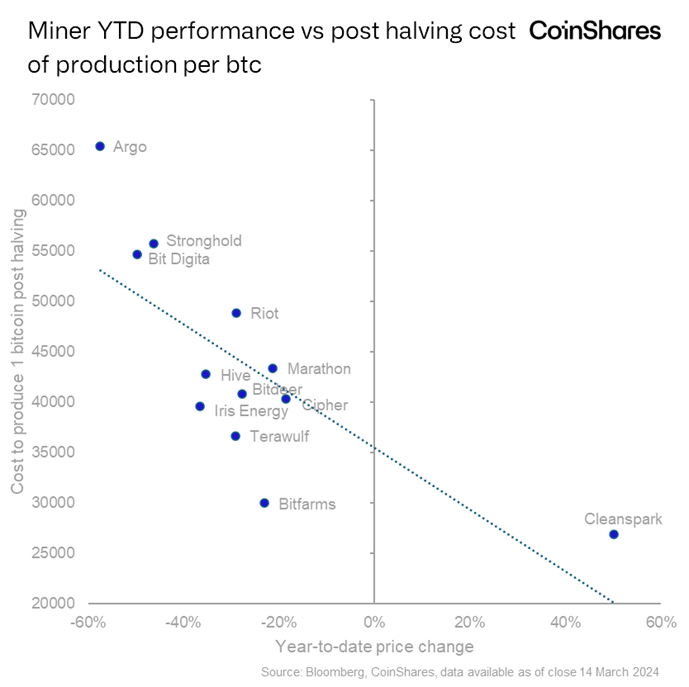

However, mining costs will remain the same or may increase as miners typically improve their operations to remain profitable after the event. CoinShares expects the average production cost for crypto miners post-halving to be $37,856. Butterfill shared his thoughts on the matter:

“Looking at miners’ price performance to date, investors’ concerns about the halving are coming to the fore. However, I believe it’s a mistake to tar them all with the same brush since average costs for Bitcoin mining show significant variability, but those with higher costs seem to be more affected.”

Türkçe

Türkçe Español

Español