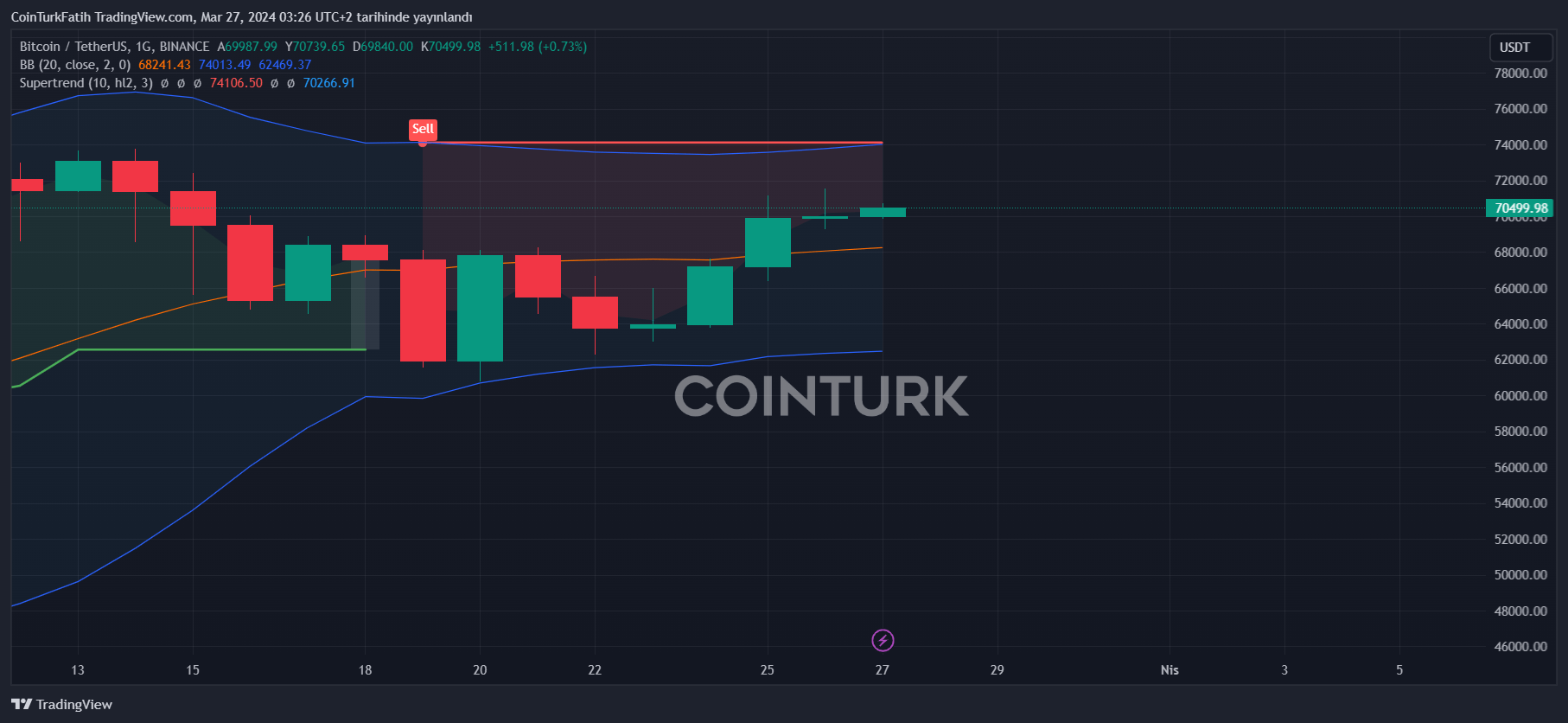

Bitcoin (BTC) was nearing the $70,800 mark at the time of writing and could experience further increases. It is also crucial for investors that the daily close remains above $69,000. The latest data arriving amidst signs that the recent price correction may have ended is promising. So, what is the current situation in cryptocurrencies?

Spot Bitcoin ETF

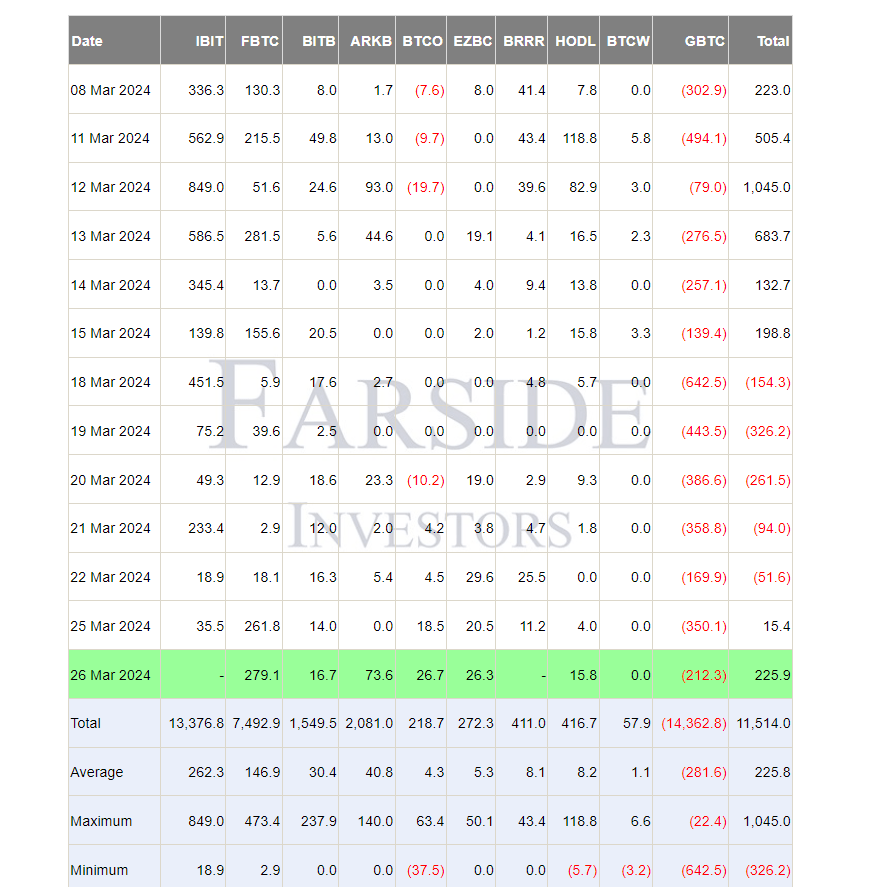

For months, we have been highlighting the impact of investor appetite for the Spot Bitcoin ETF on spot prices. If demand in the ETF channel is strong, investors feel encouraged to take on more risk, which was confirmed last week. We witnessed net outflows for five days due to Genesis sales, and cryptocurrencies were in decline.

This week, however, the situation is changing. On Monday, we saw the first net inflow of the week, a signal of recovery from the previous week’s nightmare, and indeed it was. Particularly in altcoins, double-digit gains were experienced. The data from March 26 is even more significant. In the past 24 hours, GBTC saw a net outflow of $212 million.

However, Fidelity reported its second-best day ever with $279 million, and we saw this for several ETFs, resulting in a cumulative net inflow of over $225 million. Even more importantly, this satisfying inflow was seen before the BlackRock (IBIT) ETF data arrived. If IBIT captures a similar inflow to its competitor FBTC, we might see a cumulative net inflow close to half a billion dollars.

Will Bitcoin Rise?

After the net inflow on March 15, we experienced daily outflows exceeding $300 million. We saw a modest net inflow on Monday, and now cryptocurrencies are preparing for further increases with a targeted net inflow of half a billion dollars. If we compare with previous days, satisfying price increases following strong net inflow days are not surprising.

If the Bitcoin price targets $73,777 in the coming hours, this would not be surprising (especially if IBIT has seen strong inflows). Moreover, we should not overlook the fact that we have seen a total net inflow of approximately $11.5 billion in a short period of about 70-80 days. Considering the supply on exchanges is around $140 billion, we could talk more about a supply shortage by the end of the year.

Türkçe

Türkçe Español

Español