The leading cryptocurrency Bitcoin (BTC) once again climbed above $70,000 at the start of this week, highlighting a widespread bullish sentiment. As Bitcoin‘s price rose from the previous week’s low of $60,000, other major altcoins like Ethereum, Solana (SOL), BNB, and DOGE continued their upward trends together.

Bitcoin’s $70,000 Level

The total market value surpassed $2.8 trillion but retreated to $2.77 trillion on Wednesday due to a minor fluctuation, a 1.6% decrease. Bitcoin is trading around $70,069 and has gained 11% in value over seven days. The interest in the rising trend may be waning as the trading volume decreased by 24% to $33 billion.

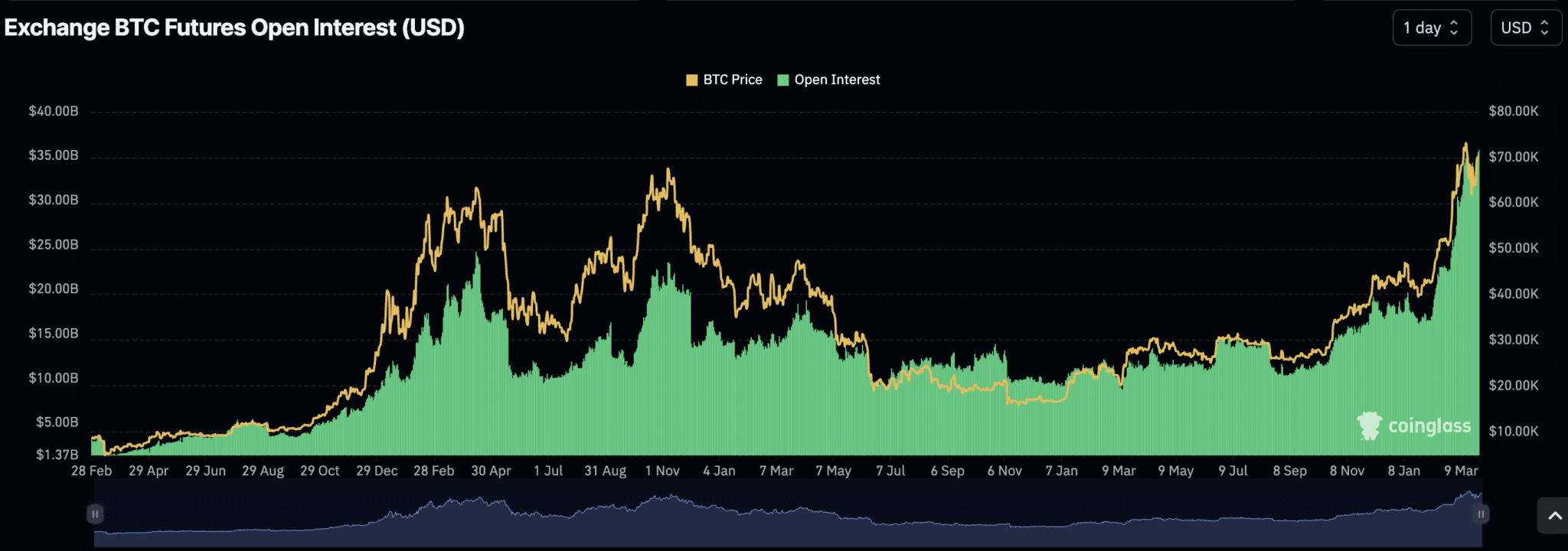

The Bitcoin futures market has returned to its previous upward trend after a sell-off from an all-time high just above $73,000 down to $60,000. Investors temporarily lost confidence in the bullish trend, reflected by the drop in open positions to $31.58 billion on March 20th.

Bitcoin and Analytics Firms

According to crypto analytics firm Coinglass, current open positions have reversed the trend surpassing $35 billion, indicating that interest in the rise is gradually resuming. Whales are on the rise not only in ETFs but also in standard blockchain transactions. According to IntoTheBlock, transactions considered large, at least $100,000, exceeded 26,000 and contributed to the upward momentum behind Bitcoin’s price.

Data from SoSoValue suggests that after a few days of poor performance in the Bitcoin ETF sector, investors seem to be returning, with the total daily net entry reaching $417.98 million as of March 26th. BlackRock’s IBIT and Fidelity’s FBTC were among the top-performing ETF products, with Ark Invest and 21Shares not far behind. If this commendable buying in ETFs continues before the Bitcoin halving, the momentum for a breakout targeting $80,000 could continue to build.

Türkçe

Türkçe Español

Español