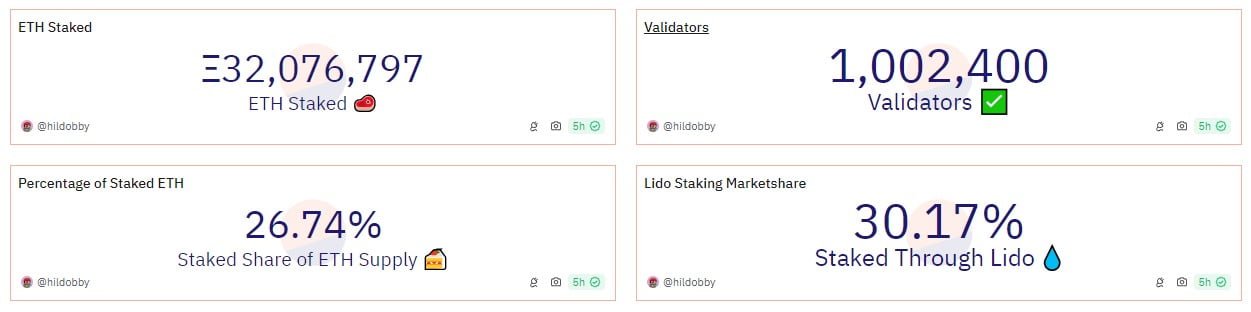

Ethereum network recently reached a milestone of one million validators, with currently 32 million Ethereum staked, valued at approximately 114 billion dollars according to current market prices. On March 28th, the Dune Analytics dashboard created by Hildobby to track Ethereum staking progress showed that the network reached one million validators and that 32 million Ethereum represent 26% of the total supply.

What’s Happening on the Ethereum Network?

The data also indicated that about 30% of Ethereum is staked using the Ethereum staking pool Lido, a liquid staking platform for proof-of-stake (PoS) cryptocurrencies. Staking pools like Lido maintain their popularity by allowing users with smaller amounts of Ethereum to pool their assets and participate.

Validators monitor the network against malicious activities such as double-spending, thus ensuring the security of the blockchain network. In Ethereum, validators participate in proposing and verifying transactions within the network. Those who want to join this process must deposit 32 Ethereum. In return, they receive a small portion of Ethereum as a reward.

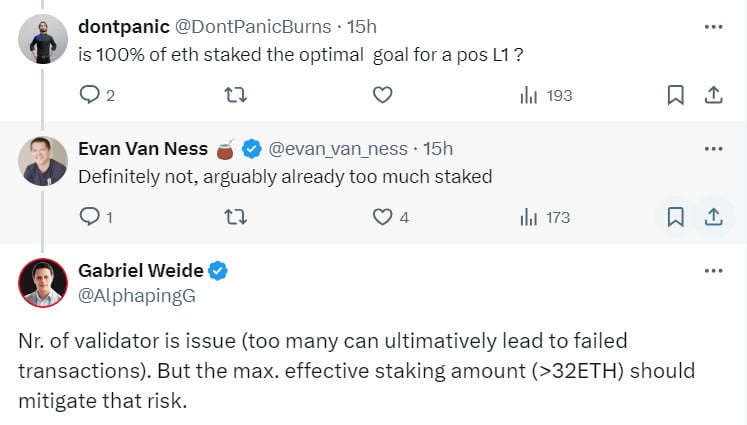

While a higher number of validators can mean increased security for a blockchain network, some community members believe that too many validators could pose a problem.

Comments from Prominent Figures on Ethereum

Venture investor and Ethereum advocate Evan Van Ness controversially stated that there is already too much staked. Gabriel Weide, who operates a staking pool, believes that too many validators could eventually lead to failed transactions. Meanwhile, Peter Kim, engineering manager at Coinbase Wallet, said that while the number of validators is impressive, it is artificially inflated by the 32 Ethereum limit. However, he suggested that this could change soon.

As the number of validators continues to grow, Ethereum co-founder Vitalik Buterin proposed a way to improve the network’s decentralization. On March 27th, Buterin published a blog post suggesting to penalize validators in proportion to their average failure rates.

If a large number of validators fail in a specific slot, the penalty for each failure will be higher. According to Buterin, such an approach could potentially reduce the advantage of those who stake large amounts of Ethereum compared to those who stake smaller amounts.

Türkçe

Türkçe Español

Español