Bitcoin price is nearing the $71,000 threshold about half an hour before the daily close, but it has not yet reached the all-time high (ATH) territory. Investors are acting cautiously due to critical US data expected in about 12 hours. Additionally, Coinbase’s stake service being interpreted as an investment contract is also feeding negativity.

Bitcoin (BTC) Chart Analysis

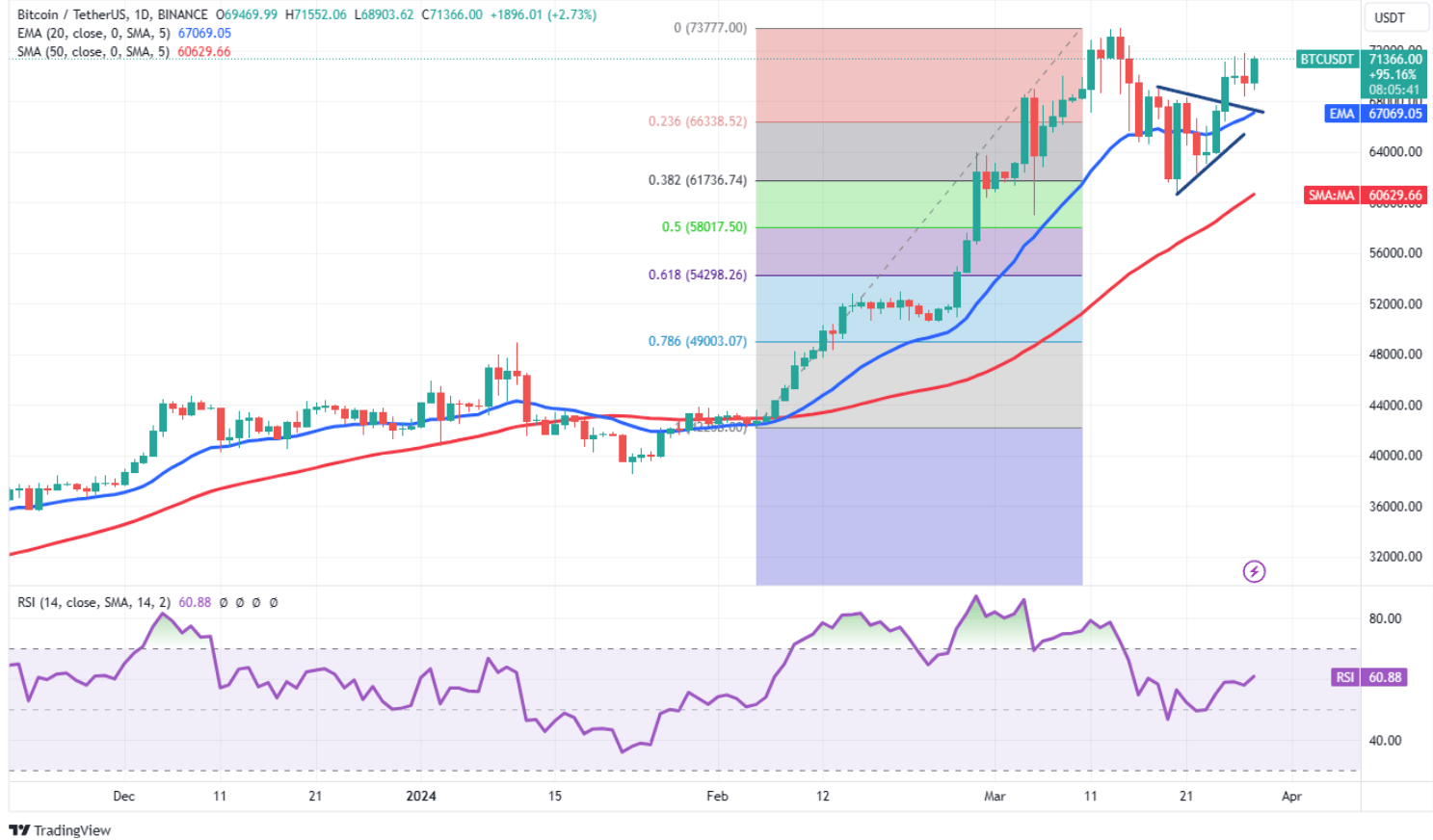

The 20-day exponential moving average (EMA) ($67,069) has started to rise, showcasing the bulls’ persistence. Investors worried about strong price corrections may find more courage with closes above $69,000. The relative strength index is also in the positive zone.

The goal is clear, Bitcoin bulls aim to surpass the $73,777 ATH level to reach new peaks. This will also persuade those expecting a price correction to join the uptrend. Live demand in the ETF channel is supportive of the upward movement.

The Fed Chairman mentioned in the last meeting that they will focus more on upcoming data. If tomorrow’s leading inflation indicator is positive, the ATH region could be tested before the week ends. This will also be supported by the bulls’ motivation for a strong March monthly candle close. However, if the price drops below $69,000 and $67,069, especially altcoins may see rapid sales.

In a bearish scenario, closes below the 20-day EMA could open the doors to $60,629.

Ethereum (ETH) Chart Analysis

The SEC shattered mid-term optimism. As everyone was expecting motivation to rise approaching the ETF decision on May 23, the SEC started arguing that the Ethereum Foundation’s altcoin king is a security, which weakened optimism. This is motivating for the bears with the price anchored below $4,000.

Bloomberg experts also reduced the probability of approval in May from 70% to below 25%. This is due to the lack of strong communication with issuers in the BTC ETF process. In other words, if the SEC is not discussing ETF details a few months before, it is understood that they do not plan to approve.

For the bulls, the key level is $3,530; if the 20-day EMA is maintained, $3,678 could be surpassed. Sales are strong in this resistance area, and a BTC price rally could weaken the resistance. Subsequently, targets of $4,100 and $4,500, followed by $4,868, could be tested. Conversely, in a downturn, closes below $3,460 could lead to a decline to $3,302.

Türkçe

Türkçe Español

Español