Bitcoin price today fell to $65,746, experiencing a drop of about 6%. Now everyone is focused on the reasons behind the decline. Particularly, liquidations in long positions and the appreciation of the dollar are among the reasons. Let’s see what triggered the fall.

Liquidations in Long Positions

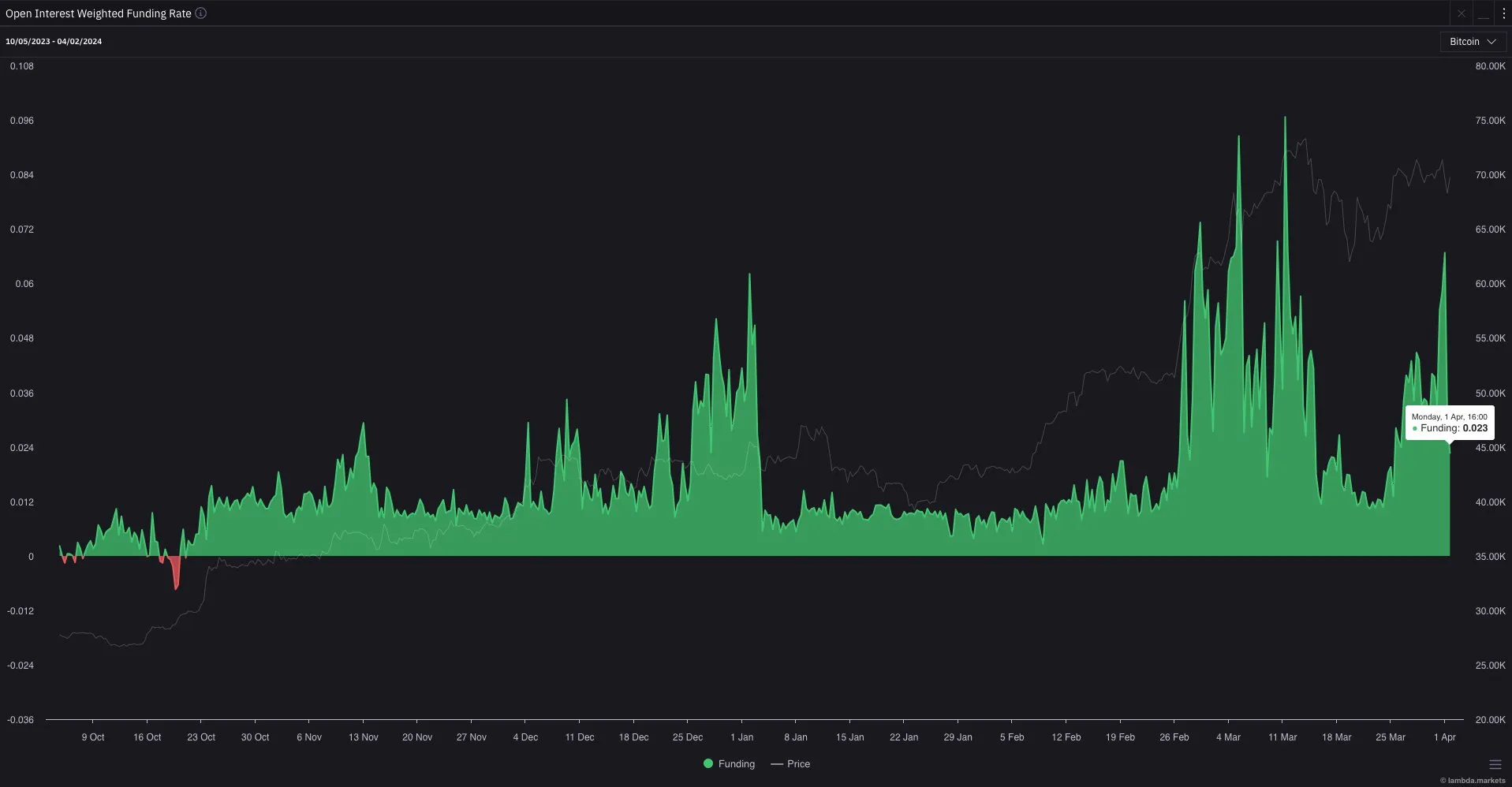

The main force behind today’s drop in Bitcoin‘s price is related to liquidations in long positions. Before the drop, Bitcoin’s Open Interest (OI) Weighted Funding Rate was unusually high. This indicated that leveraged traders were paying a premium to maintain long positions in anticipation of future price increases. However, this optimism left the market vulnerable to sudden corrections.

Data from Coinglass shows that in the last 24 hours, 120,569 investors were liquidated. The total liquidation amount was $395 million, with $311.97 million coming from long positions. Bitcoin-specific long liquidations were at the level of $87.42 million.

DXY Puts Pressure on Bitcoin

DXY, closing yesterday at 105.037, its highest level since November, proved that the US dollar is strengthening.

Considering Bitcoin’s inverse correlation with DXY, the strengthening dollar may have shifted investor preference towards safer assets, moving away from riskier investments like Bitcoin.

Third Profit-Taking by Investors

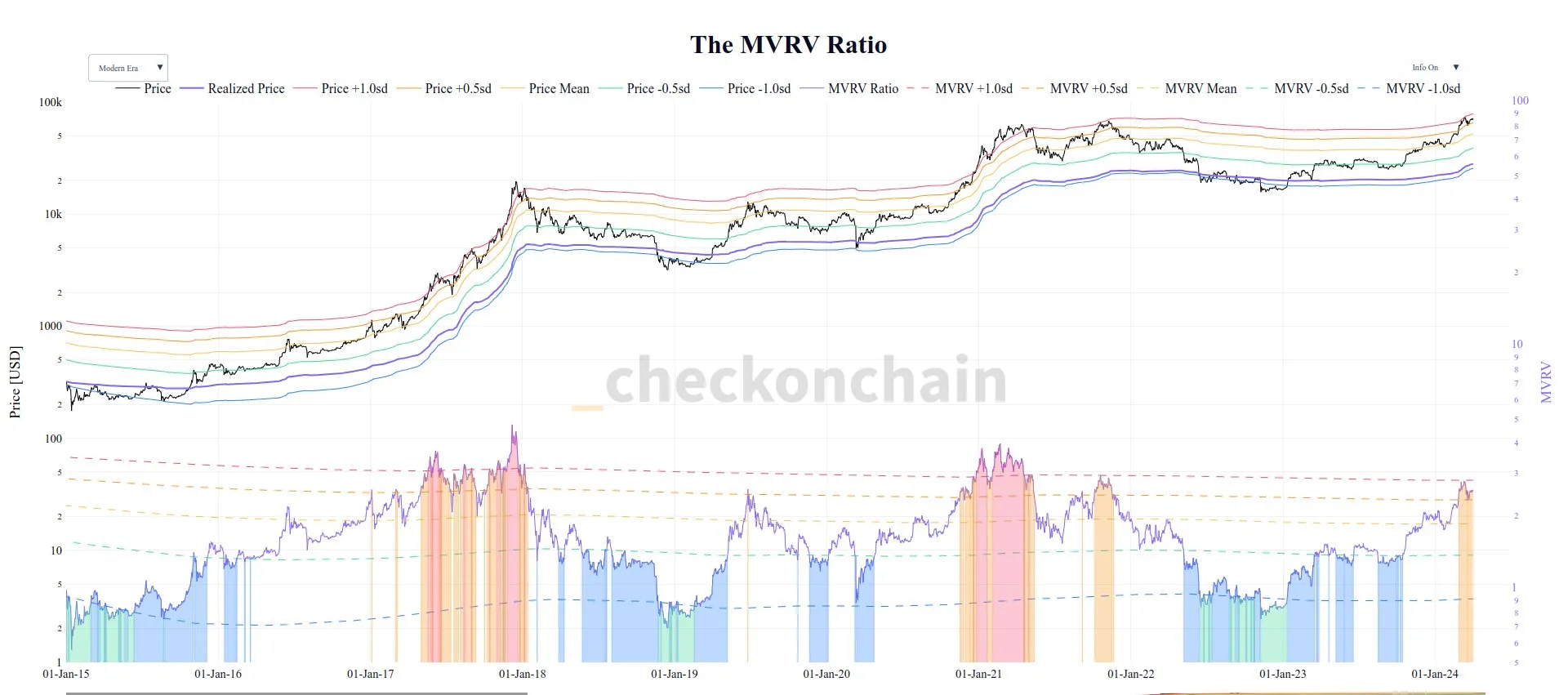

Investors taking profits also played a significant role in the recent price adjustments. The platform Checkonchain, which analyzes on-chain activities in Bitcoin, reported an increase in profit-taking activities.

Profit sales coincided with Bitcoin reaching a peak of $73,000, indicating a high period of profit realization with more than 352,000 BTC sold for profit. This selling behavior is typical in bull markets but plays a significant role in creating resistance levels at local price peaks.

Outflows from Bitcoin ETFs

Lastly, the market witnessed notable outflows from Bitcoin ETFs, indicating a reversal from the significant inflows of the previous week. Grayscale’s GBTC experienced the most significant withdrawal with $302 million, while total outflows reached $85.7 million in a single day.

Meanwhile, Blackrock’s IBIT and Fidelity’s FBTC reported positive inflows of $165.9 million and $44 million, respectively. Commenting on this, WhalePanda stated, “Overall a negative day but not as bad as the price implies. Taking profits due to the end of the first quarter makes sense. Some confusion is expected with the new quarter and upcoming halving.” At the time of writing, BTC was trading at $65,899.

Türkçe

Türkçe Español

Español