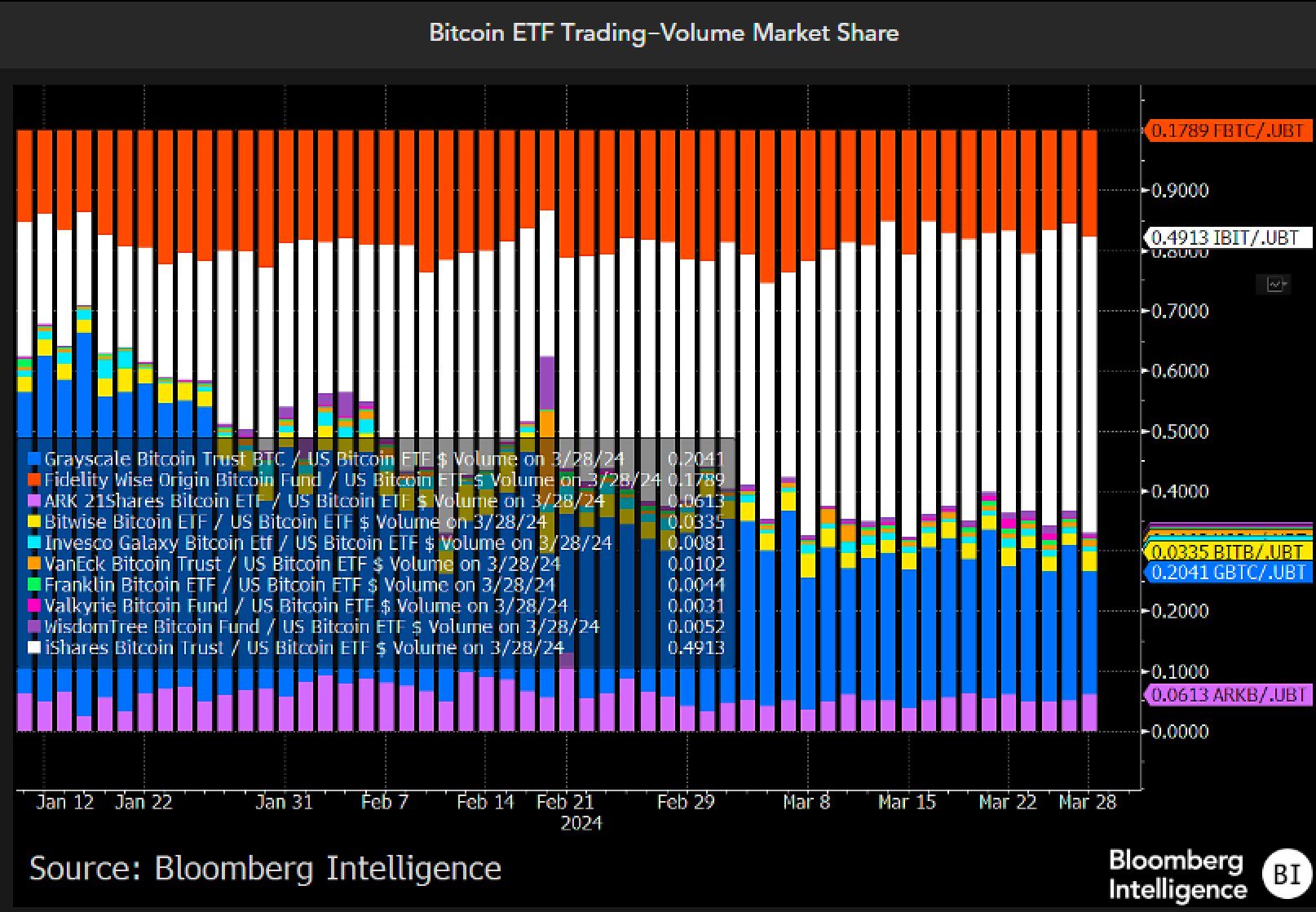

Spot Bitcoin exchange-traded funds (ETFs) witnessed a trading volume increase reaching $111 billion in March. This development was almost three times the trading volume recorded in February, which was dominated by Grayscale and BlackRock ETF funds. According to data shared by Bloomberg ETF analyst Eric Balchunas, spot Bitcoin ETF trading volume soared to $111 billion in March, compared to $42.2 billion recorded in February.

Record Rise in March

It’s important to remember that February was the first full month of trading for Bitcoin investment products since their market debut on January 11. Therefore, the strong performance in March reinforces the growing interest in spot Bitcoin ETF funds.

BlackRock’s Bitcoin ETF fund IBIT continues to dominate the trading volume, followed by Grayscale’s GBTC fund and Fidelity’s FBTC fund. Balchunas acknowledged this in a subsequent post, sharing a chart by analyst James Seyffart that showed IBIT fund’s increasing dominance over GBTC in market share, stating:

“While all ETF funds are scoring profitable hits, IBIT won the volume race and officially became Bitcoin’s GLD.”

What’s the Current State of ETF Funds?

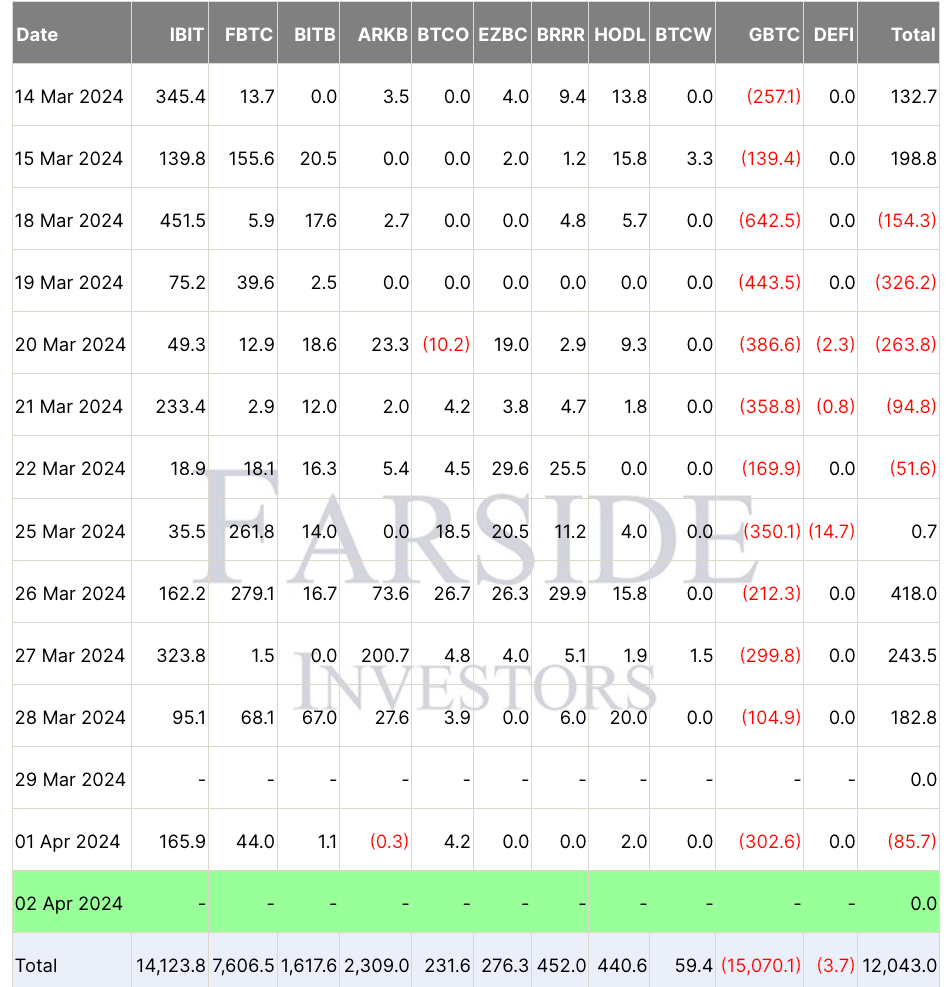

According to data from Farside Investors, cumulative spot Bitcoin ETF funds recorded a net outflow of $86 million on April 1. BlackRock’s dominant IBIT ETF entries, totaling $165.9 million, overshadowed Grayscale’s outflows of $302.6 million.

Fidelity’s FBTC fund recorded the second-highest entry of $44 million on April 1, while ARK Invest’s 21Shares ETF ARKB fund saw its first outflow of $300,000 since starting to trade on January 11. BlackRock and Fidelity’s spot Bitcoin ETF funds reached approximately $18 billion and $10 billion in managed assets last month, respectively, becoming the most successful in terms of entries.

On the other hand, Grayscale’s GBTC fund surpassed $15 billion in total outflows after recording over $300 million on April 1. According to Coinglass data, GBTC’s assets under management dropped by 46%, falling to $22 million. Spot Bitcoin ETF funds have completely transformed the Bitcoin market, reaching all-time highs in March. Market participants anticipate a different cycle with the success of ETF funds and the upcoming Bitcoin halving event in less than 20 days.

Türkçe

Türkçe Español

Español