Crypto currency market analysts point to the growth of stablecoin reserves as a major bullish indicator. This is largely because stablecoins are commonly used to purchase other cryptocurrencies. According to on-chain analysis firm Santiment, whale wallets holding over $5 million in tokens have been accumulating stablecoins with enthusiasm for the past three weeks.

Santiment’s Stablecoin Report

In the last three weeks, whales have purchased more than 5% of the total supply of leading cryptocurrencies, including USDT, USDC, DAI, and TUSD. As of April 1st, whales controlled over 55% of the total circulating stablecoins. The crypto analytics firm Santiment suggests that whales may be expecting a significant market correction, which would allow them to make large purchases and increase their Bitcoin (BTC) positions.

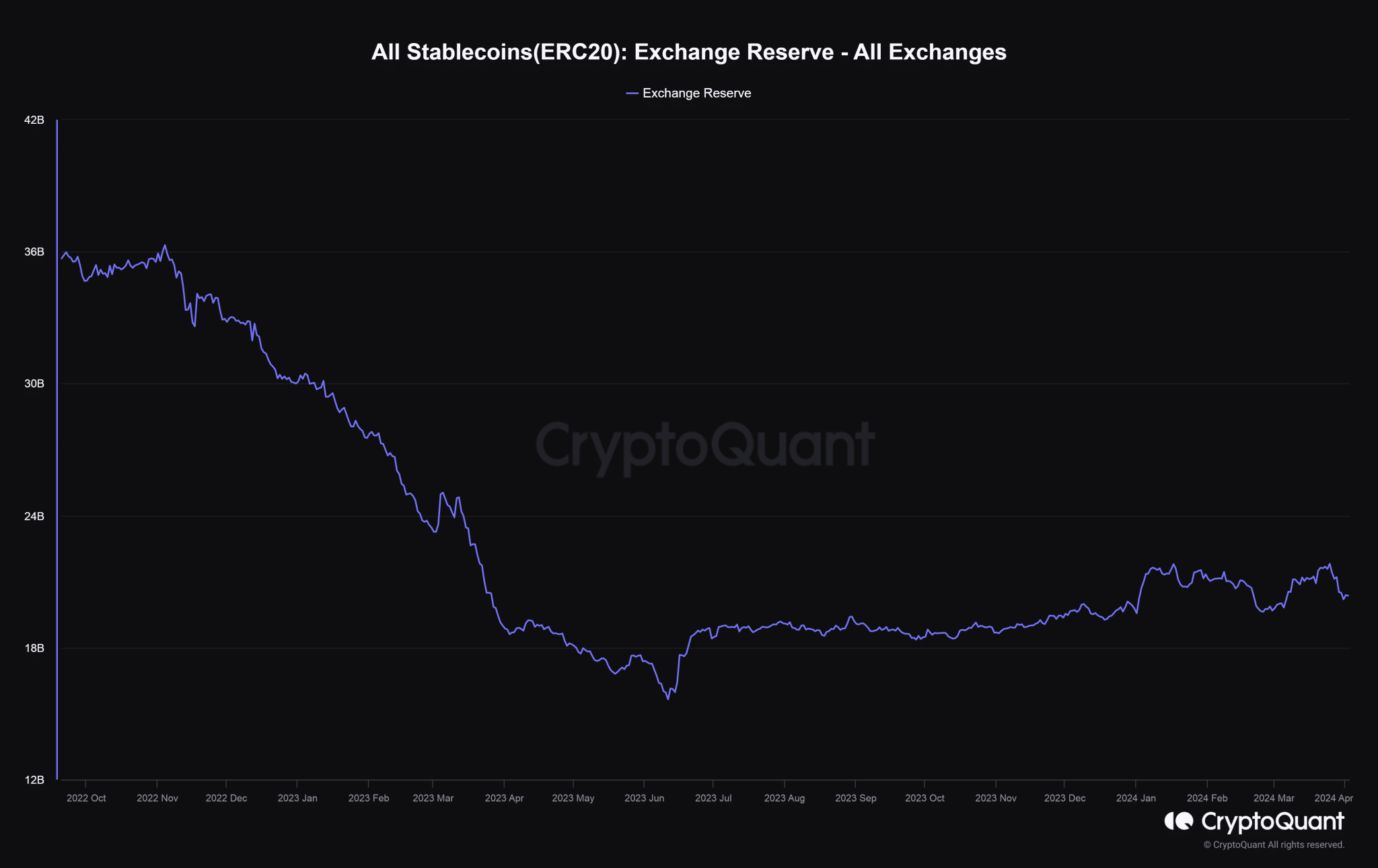

However, the crypto market saw a decline on April 1st. Data from CryptoQuant confirmed this situation, showing net stablecoin inflows to exchanges. Stablecoin reserves in exchanges have significantly increased since the beginning of the year. At the time of writing, approximately $20.36 billion in crypto currency was held in exchange wallets, marking the highest figure in over a year.

Historical Data on Stablecoins

Historical data indicates that the increase in stablecoin deposits preceded a sharp rise in Bitcoin‘s market price. Therefore, the likelihood of increased volatility and a Bitcoin recovery was higher in the following two weeks. Additionally, the global stablecoin cap continued to rise, surpassing $143 billion for the first time since 2022. The recovery was led by two major assets, (USDT and USDC).

The world’s largest stablecoin, USDT, has maintained its positive momentum since last year, showing a 13% increase since the beginning of the year and reaching a significant market valuation of $104 billion. However, the real success story was USDC, which, after facing major setbacks last year, increased by 33% to reach $32 billion.