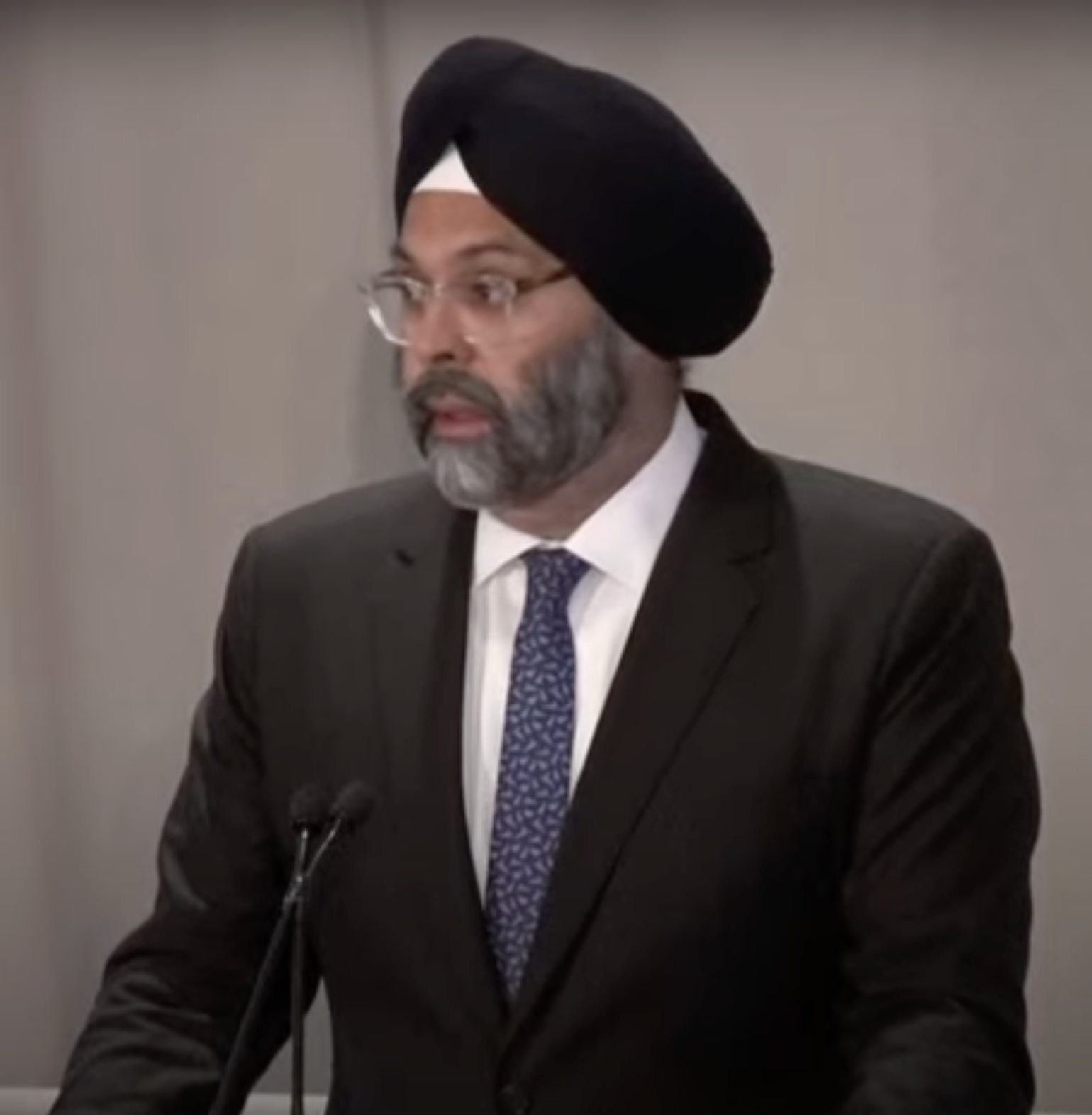

The Director of the Enforcement Division of the United States Securities and Exchange Commission (SEC), Gurbir Grewal, has countered criticisms that the regulatory body has been setting rules regarding cryptocurrencies. In his speech prepared for the SEC Speaks event on April 3rd, Grewal claimed that companies in the crypto sector have undertaken many creative initiatives to continue operating in the United States while avoiding the commission’s jurisdiction.

Notable Comments from a Prominent Figure

Addressing the concerns, Gurbir Grewal spoke about the accusations that the SEC has recklessly exceeded its authority or regulated through enforcement in cases against crypto firms. Grewal cited the need for enforcement actions, using Sam Bankman-Fried as an example.

On March 28th, the former FTX CEO was sentenced to 25 years in federal prison for defrauding investors of the cryptocurrency exchange, including people who had to sell their homes and cars or take on second jobs to recover their losses. Grewal made the following statement:

“After a long and growing list of courts that have affirmed our authority to oversee the crypto markets, I hope we can move past these and address the very real issues present in this sector that lead to high investor risk: fraud, lack of transparency, commingling of assets, conflicts of interest, and lack of oversight, to name just a few.”

SEC and the Crypto Market

Grewal reiterated that the SEC’s standard for determining what constitutes a security under the Howey test is applied clearly and consistently. He did not specifically address reports that the SEC was investigating whether to classify Ethereum as a security rather than a commodity under the jurisdiction of the Commodity Futures Trading Commission, stating:

“These are not secret analyses; they are public documents for the whole world to see. Even parties who argue in court that their actions do not affect federal securities laws have internally used the Howey framework for years to assess crypto offerings.”

In March, a Utah judge imposed sanctions on the SEC for acting with bad faith in a case against the firm Debt Box. Many industry participants have pointed to the commission’s seemingly inconsistent approach to sanctions on crypto firms and exchange-traded funds, suggesting it could lead to an exodus from the US.

The enforcement director’s comments followed remarks by SEC Commissioner Hester Peirce on April 2nd, criticizing the regulator’s accounting guidelines for institutions wanting to hold crypto assets. She, along with other staff and commission members, will speak at the SEC Speaks event concluding on April 3rd.

Türkçe

Türkçe Español

Español