In the US, spot Bitcoin ETFs have started sending positive signals to the Bitcoin (BTC) and altcoin markets after a week of increased entries in March. This is interpreted as a sign of restored confidence among investors.

Renewed Inflows into Spot Bitcoin ETFs

Particularly, expectations of a significant decline in outflows from Grayscale’s spot Bitcoin ETF, GBTC, have increased. According to the data, daily outflows from GBTC were below $100 million for the second consecutive day on April 3rd. On April 3rd, GBTC experienced a net outflow of $75 million, the lowest since February 26th. This trend indicates a significant change in interest towards spot Bitcoin ETFs, especially due to the sustained institutional interest in the cryptocurrency market.

On the same date, BlackRock’s spot Bitcoin ETF, IBIT, continued its consistent buying trend since the ETF’s launch, with a notable purchase of $42 million. Additionally, Fidelity also made a significant purchase of $117 million for its spot Bitcoin ETF, FBTC, representing the highest buying volume since March 26th. As a result, the total entries into all spot Bitcoin ETFs reached $113 million.

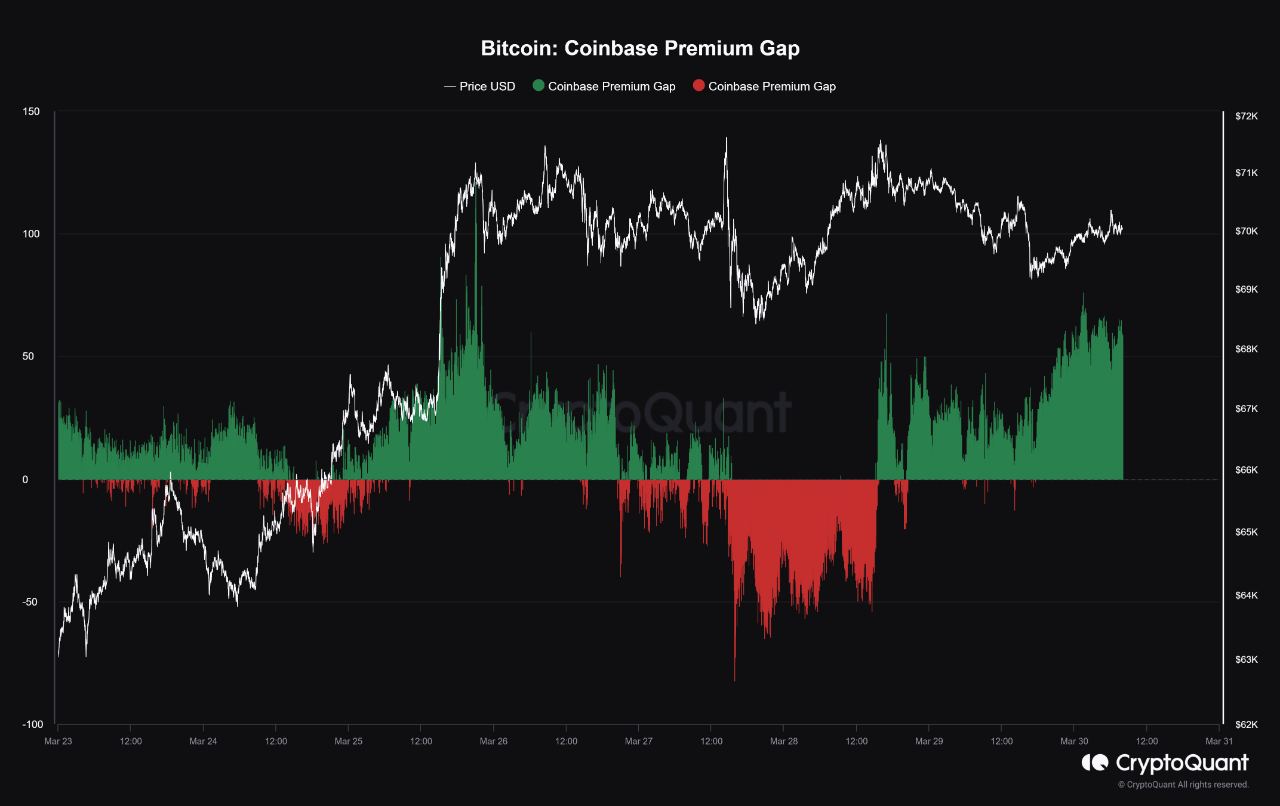

This positive trend in the spot Bitcoin ETF market underscores the persistent institutional interest in Bitcoin. This institutional interest is also evidenced by indicators such as the rising Coinbase Premium, reflecting increased Bitcoin purchases by US institutional investors. Along with these developments, it’s observed that BTCs continue to be withdrawn from cryptocurrency exchanges. Data shows that approximately 18,828 BTCs have been withdrawn from exchanges, indicating that institutions are moving their BTCs to private or cold wallets, potentially triggering a future supply shock.

Funding Rates in Bitcoin Futures Remain Positive

Furthermore, data from CryptoQuant shows that funding rates in Bitcoin futures are at a level that could support a rise, indicating a strong bullish sentiment among investors. However, historical patterns suggest that such optimism often precedes price corrections and may signal a potential buying opportunity in the short term.

Based on the positive institutional activity surrounding Bitcoin, the likelihood of the cryptocurrency market rising, especially after a healthy correction in recent times, is increasing day by day. Additionally, the upcoming fourth Bitcoin block reward halving this month is expected to introduce an additional supply shock to the market and potentially enhance the anticipated rise.

Türkçe

Türkçe Español

Español