We have not been having a good period for cryptocurrencies since the week of March 20, and bulls are not dominant before the halving. Despite bears struggling to maintain lower levels, BTC price is stuck below $69,000. So, what are the new predictions for ETH, BNB, and SOL Coin?

Ethereum (ETH)

ETH price has continued to trade below the 50-day SMA ($3,434) for three days. The chart, reflecting the lack of demand, was formed with the weakening optimism on the ETH ETF front. We had mentioned how much ETH price had lost against BTC. If a recovery is to start, now is the time, or the ETH price could move towards a devastating $2,000 target.

Strong support is found at the $3,056 level, and if it is lost, ETH price could fall to $2,700. However, if a recovery starts from the support, a new rise up to $3,678 can be expected. Closures above this could target the annual peak, similar to BTC holding above $69,000.

Binance Coin (BNB)

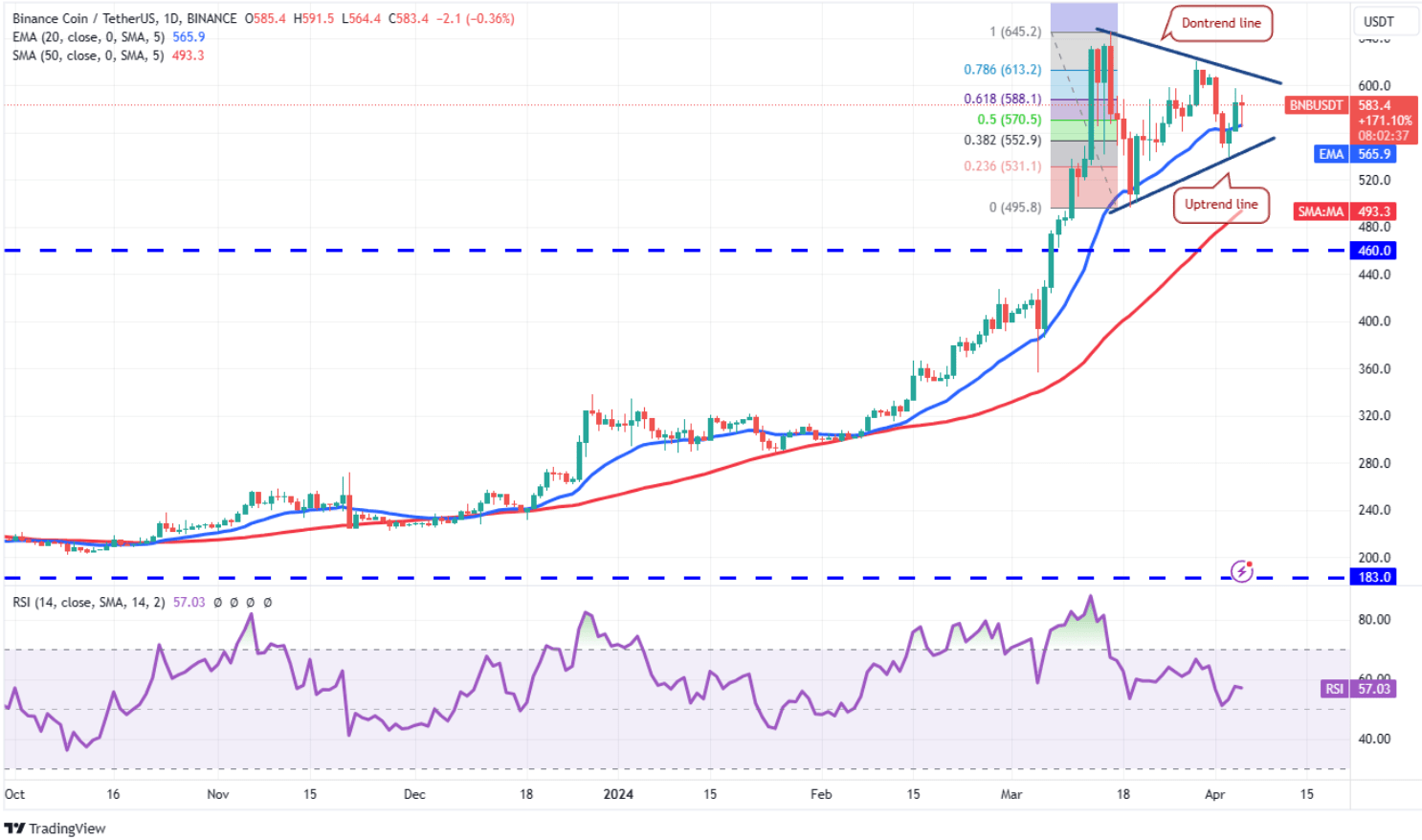

BNB Coin, one of the largest altcoins by market value, has fallen from prices around $645 to below $600. A symmetrical triangle, which we recently mentioned in the Bitcoin chart, has also formed here. This formation, indicating indecision, could soon trigger a breakout that increases volatility.

Investors have two options. They can either wait for the breakout from the triangle and take a position once the direction is clear or act boldly to increase their rewards. For now, flipping a coin seems to be the only solution for direction.

If a downward breakout occurs, sales could continue towards $460 and $395. But if the price bounces from $565, it could move towards the formation targets of $692 and $795.

Solana (SOL)

75% of the transactions on the network started to fail. It was revealed that FTX sold locked SOL Coin assets at $64, and the bulls are tired. The meme coin frenzy on the Solana network also weakened due to the uncertainty in the BTC price. SOL Coin is now targeting $162 with closures below $181.

If the decline continues, Solana (SOL) could fall to $162, $152, and $126 in the coming days.