Bitcoin price continues to hover around its 2021 bull market peak, which isn’t particularly exciting. As the price once soared to $73,777, the current level of $69,000 doesn’t concern investors much as they have grown accustomed to these levels while anticipating higher peaks. A few months ago, targets above $50,000 were exciting.

Bitcoin Halving

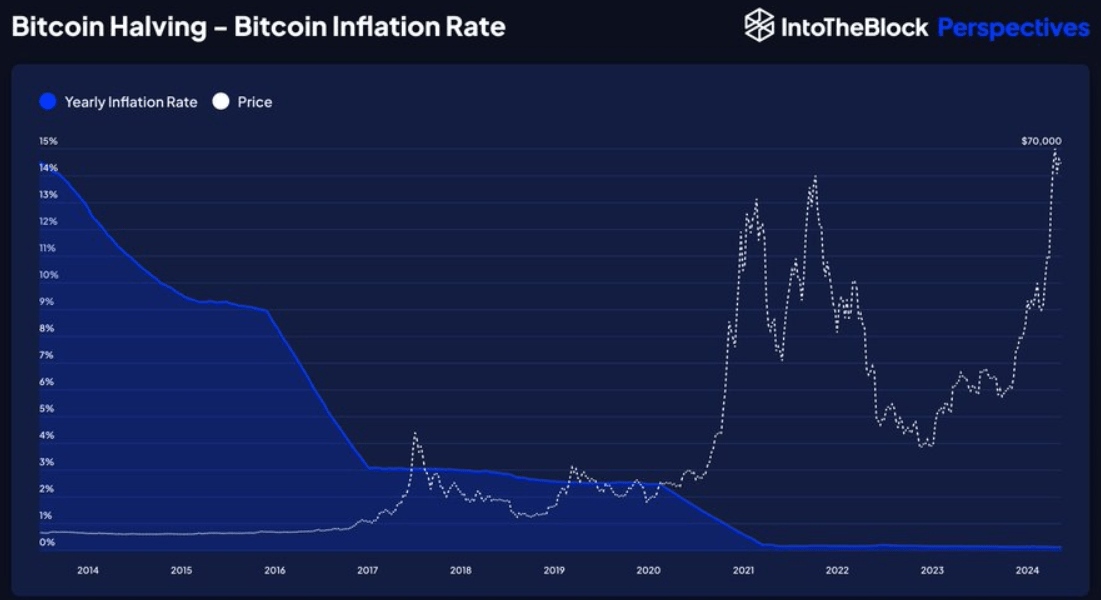

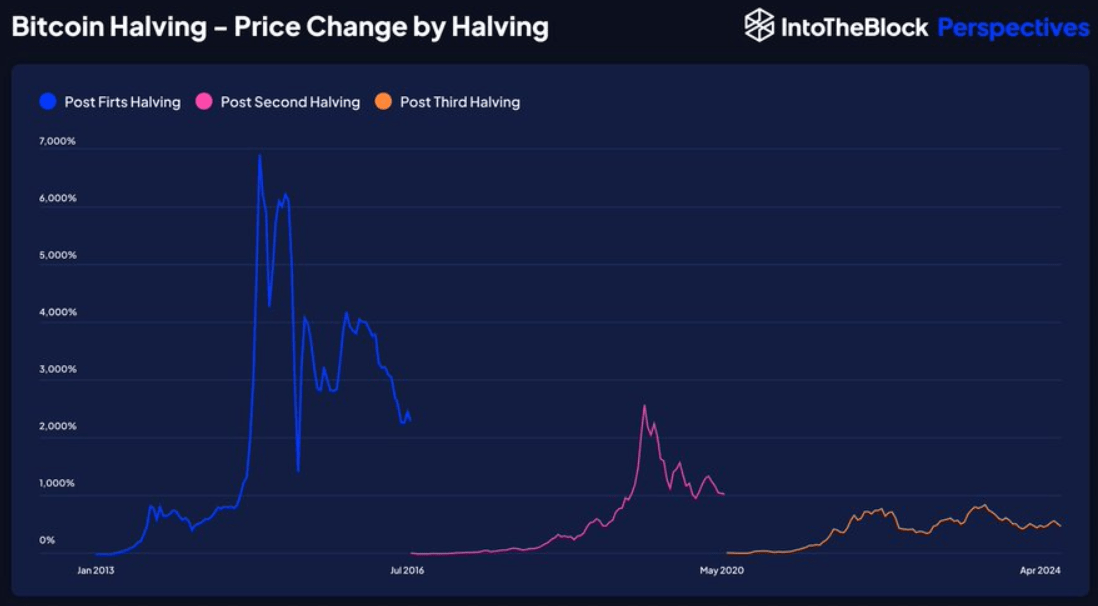

So what’s happening as the price continues to normalize at higher levels? The most significant upcoming event is the Bitcoin block reward halving, and historically, we have discussed its impact on price several times. Bitcoin saw a 67% increase in the first quarter of 2024, mainly supported by the excitement in the Spot Bitcoin ETF channel.

On the other hand, the halving was one of the two most important events of the year, and it is expected to occur around April 20 (estimated). Some analysts argue that the current Bitcoin price remains low in the current environment. Jason Fernandes, co-founder of AdLunam, said in his latest assessment;

“We may see a short correction, but as central banks ease monetary policy, this will increase both direct Bitcoin purchases and ETFs, as Bitcoin tends to behave like a tech stock or speculative asset and generally gains with the easing of monetary policy. I expect Bitcoin to reach a peak between $100,000 and $150,000 within 12-18 months after the halving.”

Expert Predictions

Some experts believe that the market has already priced in the Bitcoin block reward halving. However, the majority of market experts argue that we will experience another historical surge following the halving. For instance, researchers at NYDIG say;

“While the halving event may not serve as an immediate price catalyst, historical data shows that it plays a vital role in shaping Bitcoin’s price cycles. Typically, there is a path leading up to the halving, followed by significant returns post-event. The current positive price performance before the halving gives investors reasons to be optimistic about Bitcoin’s future potential.”

Only time will tell, but days as volatile as those in January are approaching. We can expect significant volatility in the next two weeks, both with inflation data and the halving.

Türkçe

Türkçe Español

Español