The value of the cryptocurrency market has once again surpassed the $2.5 trillion threshold as Bitcoin‘s (BTC) price soared above $68,000. Despite a slight decline in overall trading activity, the increase in buyer volume demonstrates a growing confidence among investors who are on an upward trend. In particular, a newly released altcoin called Ethena (ENA) continues to be an asset closely monitored by the market.

Ethena Stands Out as a Decentralized Synthetic Dollar Protocol

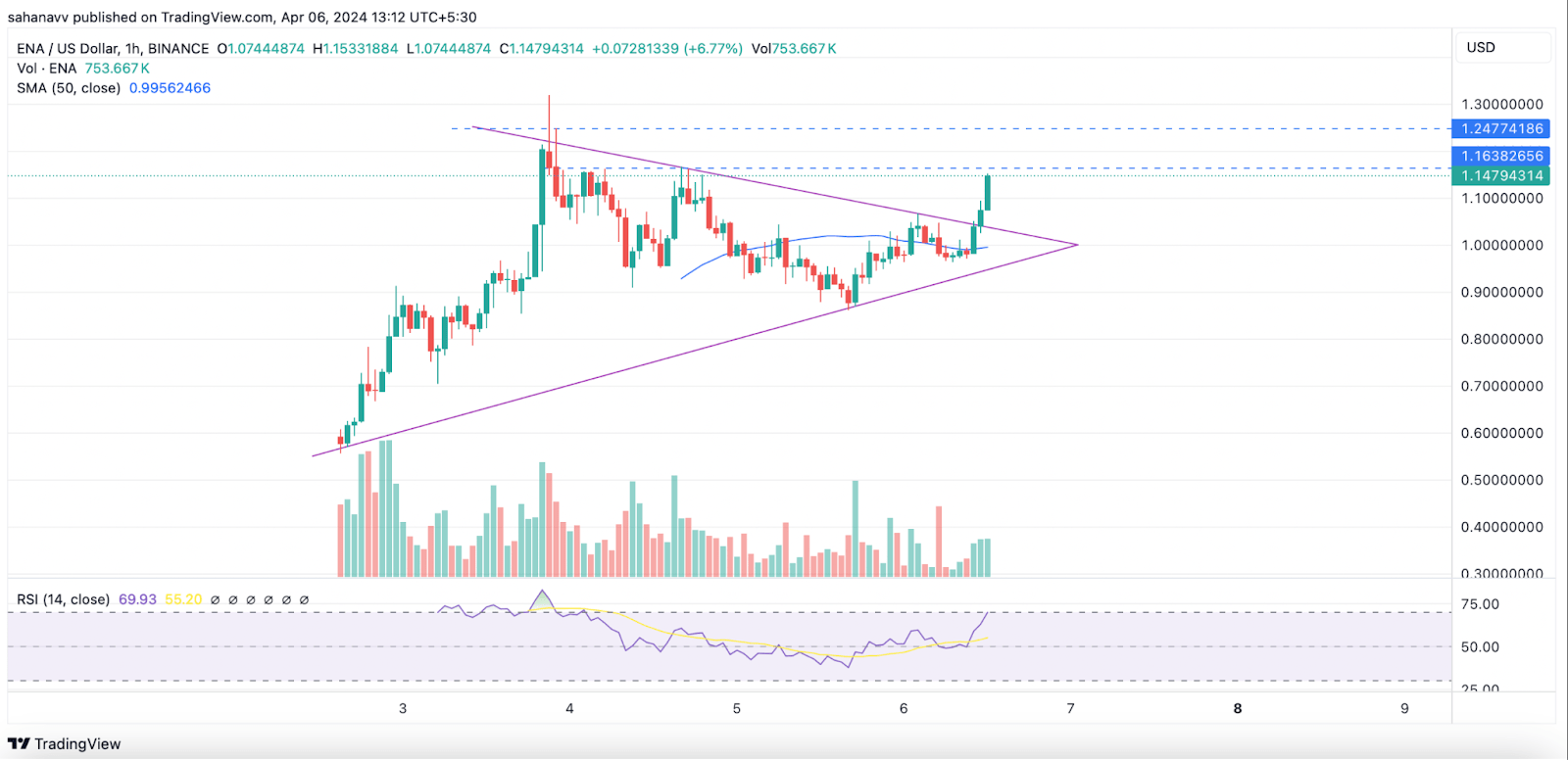

Ethena is gaining prominence as a synthetic dollar protocol built on the Ethereum Blockchain, offering a decentralized solution independent of traditional banking systems. The altcoin’s recent upward trend reflects a renewed upward trajectory, and according to CoinMarketCap data, it is trading around $1.15, down 5.13% in the last 24 hours as of the time of writing.

Although the altcoin is currently showing a downward trend, the breakout from the decisive triangle formation on the price chart is encouraging, indicating a positive momentum for the altcoin. Additionally, the Relative Strength Index (RSI) is showing an upward divergence towards the upper threshold, further strengthening the optimistic sentiment.

Analysts anticipate that if the upward momentum continues with an entry into the upper range, the altcoin could test the $1.16 resistance level with potential for further upward movement towards $1.25.

With Block Reward Halving, Ethena Could Sustain Its Upward Trend

Investors generally maintain active buying pressure on ENA and other altcoins due to high expectations surrounding the upcoming 4th Bitcoin block reward halving. Market sentiment remains optimistic with the anticipation of the block reward halving, and there is an expectation that ENA’s price trajectory will continue its upward momentum. This optimism could potentially position ENA to surpass the $1.25 level and create new short-term highs above $1.3.

Looking ahead, market forecasts offer a promising outlook for Ethena’s ENA price trajectory, indicating the potential to reach a new all-time high (ATH) of $1.5 before the end of the month. Not surprisingly, such predictions are in line with a broader upward trend expected to continue in the cryptocurrency market, supported by suitable market dynamics and increasing investor interest in cryptocurrencies.

Türkçe

Türkçe Español

Español