Bitcoin price failed to hold above $71,700 and is now trading below $69,000, with the halving event only 10 days away. This event, historically known for doubling Bitcoin‘s price, is set to occur in about two weeks. What are the current predictions of CryptoQuant experts for the cryptocurrency markets?

Halving and Expert Predictions

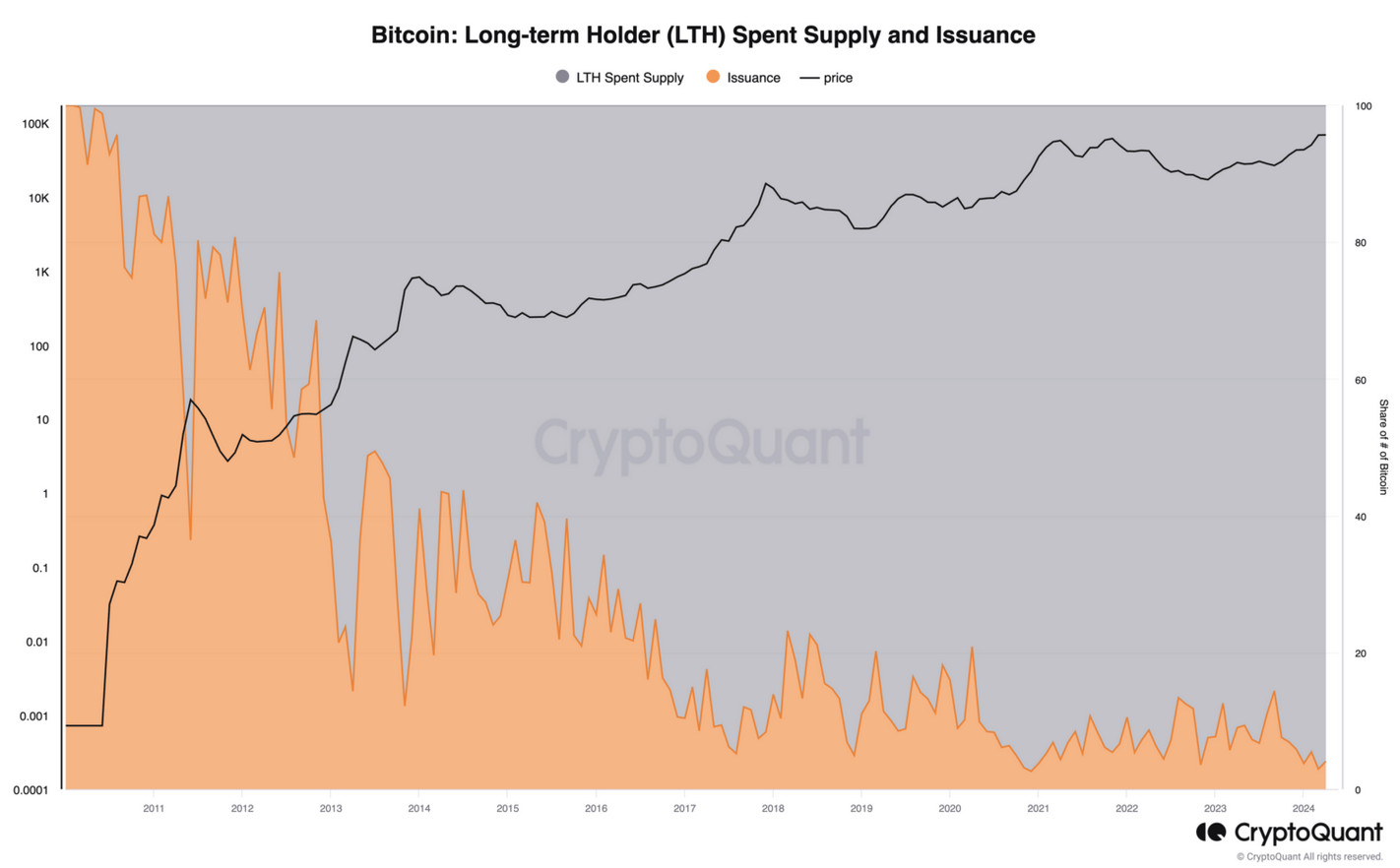

In a few days, block rewards will drop to 3.125, and the new BTC issuance will decrease by 14,000 on a monthly basis. A critical detail is that we are moving towards days when miners will have fewer assets to sell. The decrease in miner sales with the reduction of newly mined BTC is motivating for the bulls.

Last year, long-term investors’ BTC sales averaged 417,000 BTC per month, exceeding the monthly issuance of 28,000. In contrast, CryptoQuant indicates that especially demand from whales will be/is the main driving force for a major rally after the halving.

“In previous cycles, an increase in Bitcoin demand from large investors or whales has led to a sudden surge, fueling the price rally.”

Cryptocurrencies Set to Rise

Each cycle is getting weaker, and Bitcoin’s price increase is proportionally smaller. However, today’s BTC price at $69,000 is comparable to the days when it hit $20,000 in the previous cycle. Even a 100% increase from the peak could bring the BTC price to the long-awaited six-figure target. Moreover, there’s an important detail that makes the current cycle even more significant.

For the first time in history, Bitcoin demand from long-term investors has surpassed issuances. This suggests that we should see an even bigger rally post-halving. Investors are adding up to 200,000 BTC to their balances monthly, which is significantly more than the approximately 28,000 BTC issued each month. Considering the issuance will drop to 14,000 BTC after the halving, the figures become even more intriguing.

CryptoQuant also points out that the monthly Bitcoin issuance has fallen to only 4% of the current total Bitcoin supply. Consequently, with strong demand and decreasing supply, we are likely to see days when Bitcoin price reaches new highs. If we can return to the record volumes of ETFs in March, this balance could be further disrupted, paving the way for even larger accelerated rallies.

Türkçe

Türkçe Español

Español