The Layer-1 ecosystem Solana has been losing momentum in recent days, despite starting the year 2024 with great enthusiasm. Ongoing network congestion has caused significant user backlash, and the Solana team continues to be the target of criticism. So, what is happening on the Solana front? We examine this with detailed on-chain data and chart analysis.

What’s Happening with Solana?

According to data from the blockchain data analysis platform DefiLlama, Solana ranks fourth in terms of total value locked (TVL). The TVL value has seen an 8% decrease over the past week, standing at $4.37 billion at the time of writing.

Another blockchain data analysis platform, Token Terminal, reports that Solana’s diluted market value surpassed $116 billion on April 1st, marking a recent high. However, following recent events, the market value dropped to $98 billion on April 10th.

The Solana Ecosystem and SOL Price

One of the most important indicators of transaction activity within the ecosystem, the transaction revenue, surpassed $5 million on March 18th. However, with the decrease in memecoin hype and various problems within the ecosystem, transaction revenue remained just above $2 million on April 10th.

The fading memecoin hype, which had previously driven up Solana’s price and attracted a large crowd to the ecosystem, also led to a decrease in daily trading volume. The trading volume, which exceeded $14 billion on March 14th, fell to $2.98 billion on April 10th.

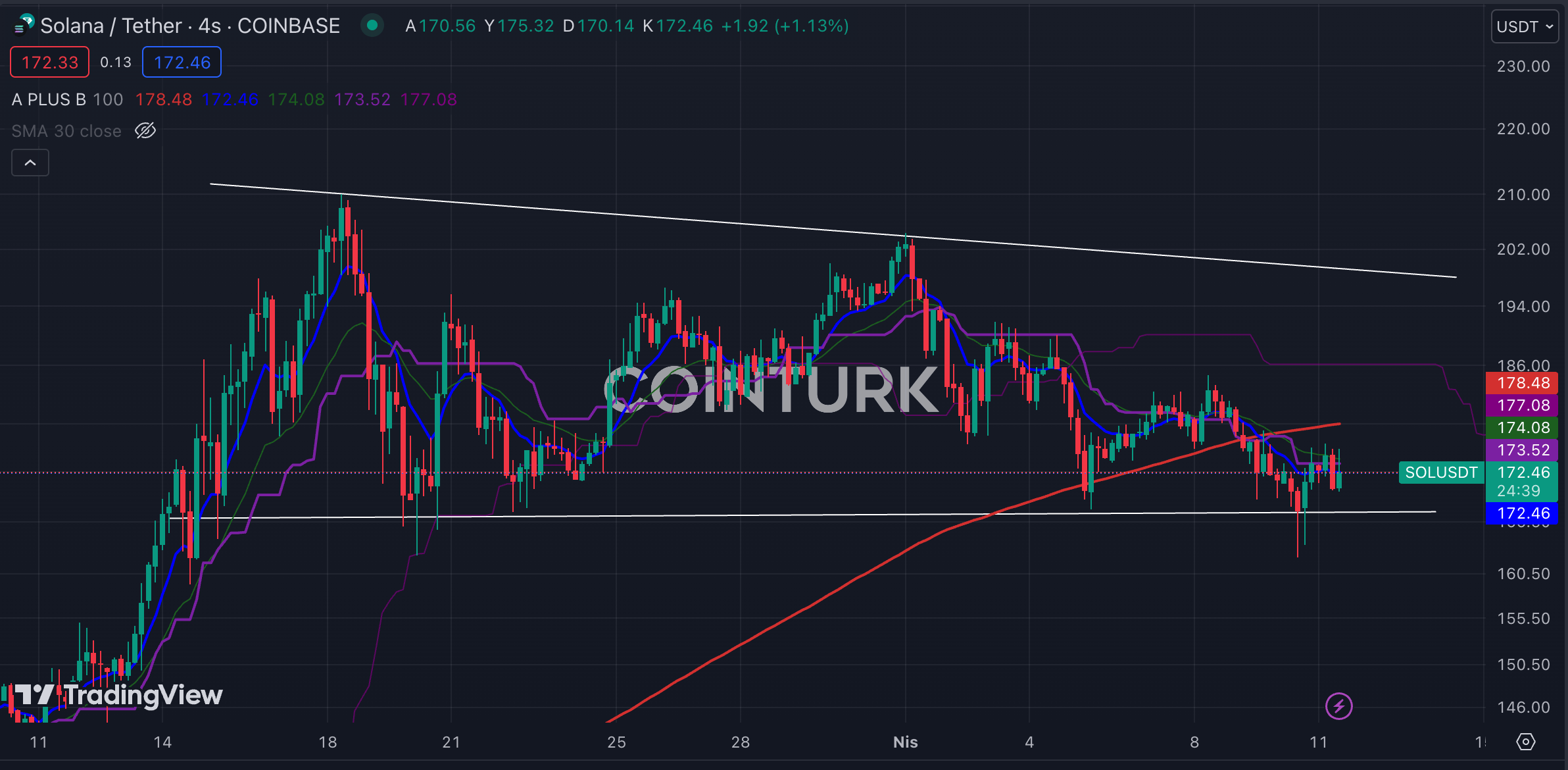

All these developments within the Solana ecosystem, along with the dwindling interest in airdrop events, have caused the price of SOL to drop. The four-hour SOL chart shows the price staying below the EMA 200 (red line) level, which could lead to increased selling pressure in the short term. However, according to the narrowing wedge formation seen recently, a support found at the last bar’s closing could lead to a significant development on the Solana front, potentially accelerating SOL’s price.