Bitcoin’s recent losses continue to negatively reflect on the ETF sector. Accordingly, the Bitcoin exchange-traded fund launched by BlackRock was the only spot Bitcoin ETF based in the United States that saw fund inflows in the last two days, while all other ETFs reported no entries or fund outflows during this period.

Investments in the ETF Sector Approach a Standstill

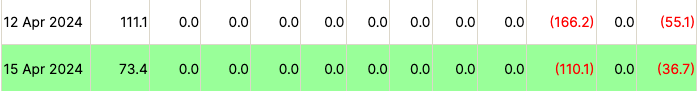

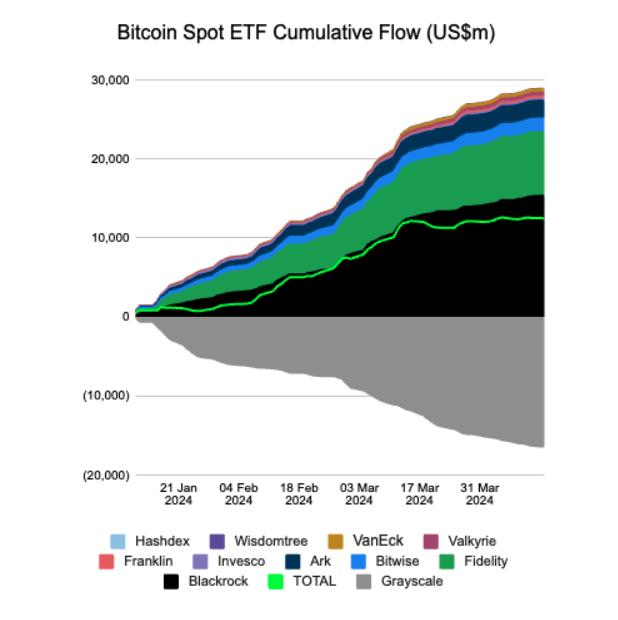

iShares Bitcoin Trust (IBIT) reported a net inflow of $73.4 million on April 15, down from $111.1 million the previous day. According to Farside Investors data, excluding Grayscale, the other eight ETFs did not record any fund inflows in the last two days. However, the inflows experienced by IBIT were not sufficient to offset the outflows from Grayscale Bitcoin Trust, which saw an outflow of $110.1 million on April 15 and a slowdown from the $166.2 million outflow on April 14.

All ten spot Bitcoin ETF funds saw net outflows of $55.1 million and $36.7 million on April 14 and April 15, respectively.

The recent outflows from US Bitcoin ETF funds followed a volatile weekend for Bitcoin, which saw a 11.6% drop to $63,410, according to Tradingview data.

What’s Happening on the Bitcoin Front?

Meanwhile, global Bitcoin investment products saw an outflow of $110 million for the week ending April 12, and CoinShares’ research head James Butterfill highlighted the hesitation among investors once again. Butterfill reported that all combined crypto investment products saw a net outflow of $126 million last week, with weekly volumes rising from $17 billion to $21 billion.

An attack by Iran on Israel on April 13 led to a free fall in Bitcoin price, reaching a three-week low of $61,918. The upcoming halving event for cryptocurrency on April 20 also contributes to price volatility, as investors speculate on how it will affect Bitcoin’s price movement. The halving event is expected to differ from past events, potentially influenced by the momentum in the ETF sector and the Ordinals space.

Türkçe

Türkçe Español

Español