In the cryptocurrency market, led by Bitcoin, a decline initiated by US macroeconomic data has intensified over the weekend due to escalating geopolitical problems. During this period, Bitcoin, along with many altcoin projects, has disappointed investors. What should be considered for Bitcoin in the coming period? We are examining it with detailed chart analysis.

Bitcoin Chart Analysis

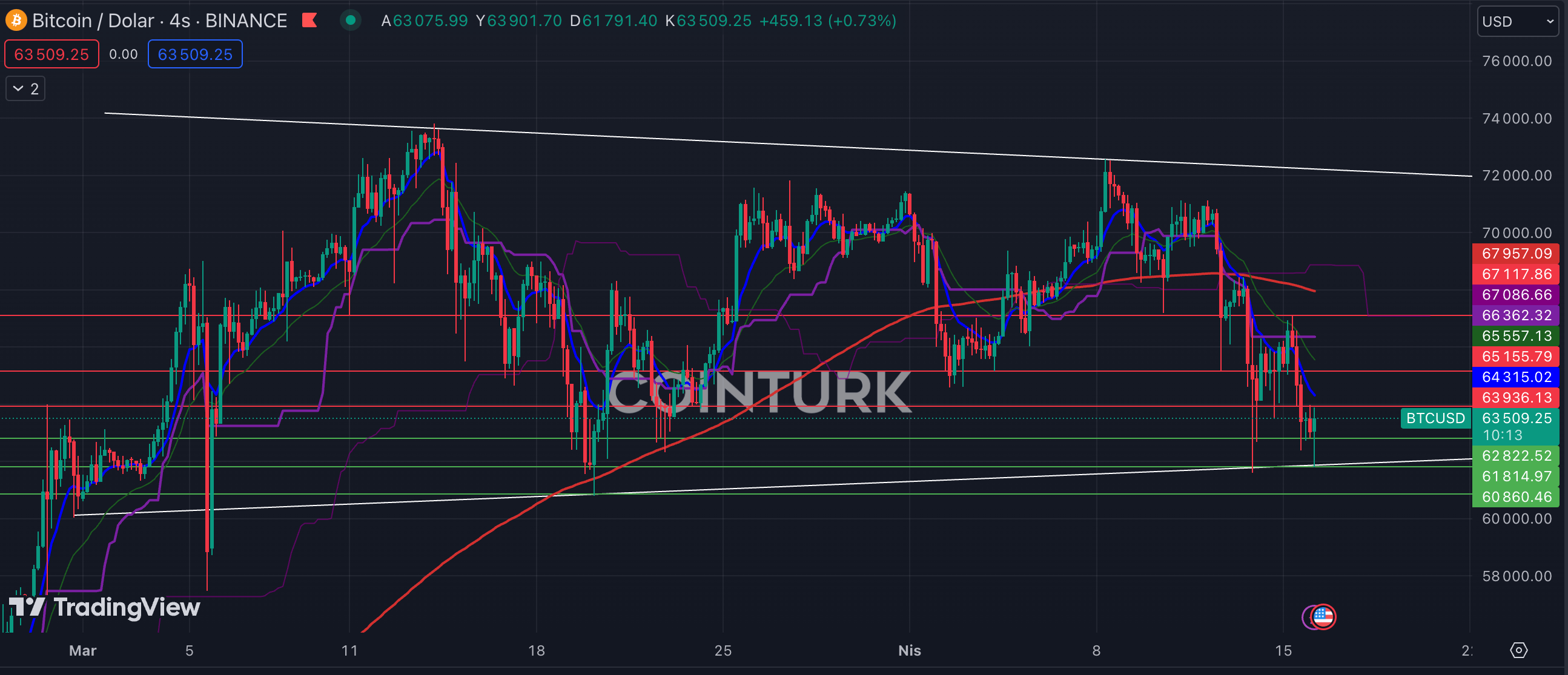

The four-hour Bitcoin chart shows a narrowing wedge formation. So far, the only support break occurred on March 5, which acted as a bear trap. Recent declines have seen reactions from the support line, which will positively affect Bitcoin’s price in the long term. Bitcoin price, currently below averages like EMA 200, EMA 21, and EMA 9, may face selling pressure during this period.

In the four-hour chart for Bitcoin, the support levels to watch are; $62,822 / $61,814, and $60,860. Particularly, a four-hour bar close below the $61,814 level, intersecting with the support line, will cause Bitcoin’s price to lose momentum.

The most important resistance levels in the four-hour Bitcoin chart are; $63,936 / $65,155, and $67,117. Especially, a four-hour bar close above the $65,155 level, intersecting with the EMA 21 (green line), will help Bitcoin gain momentum.

Bitcoin Dominance Chart

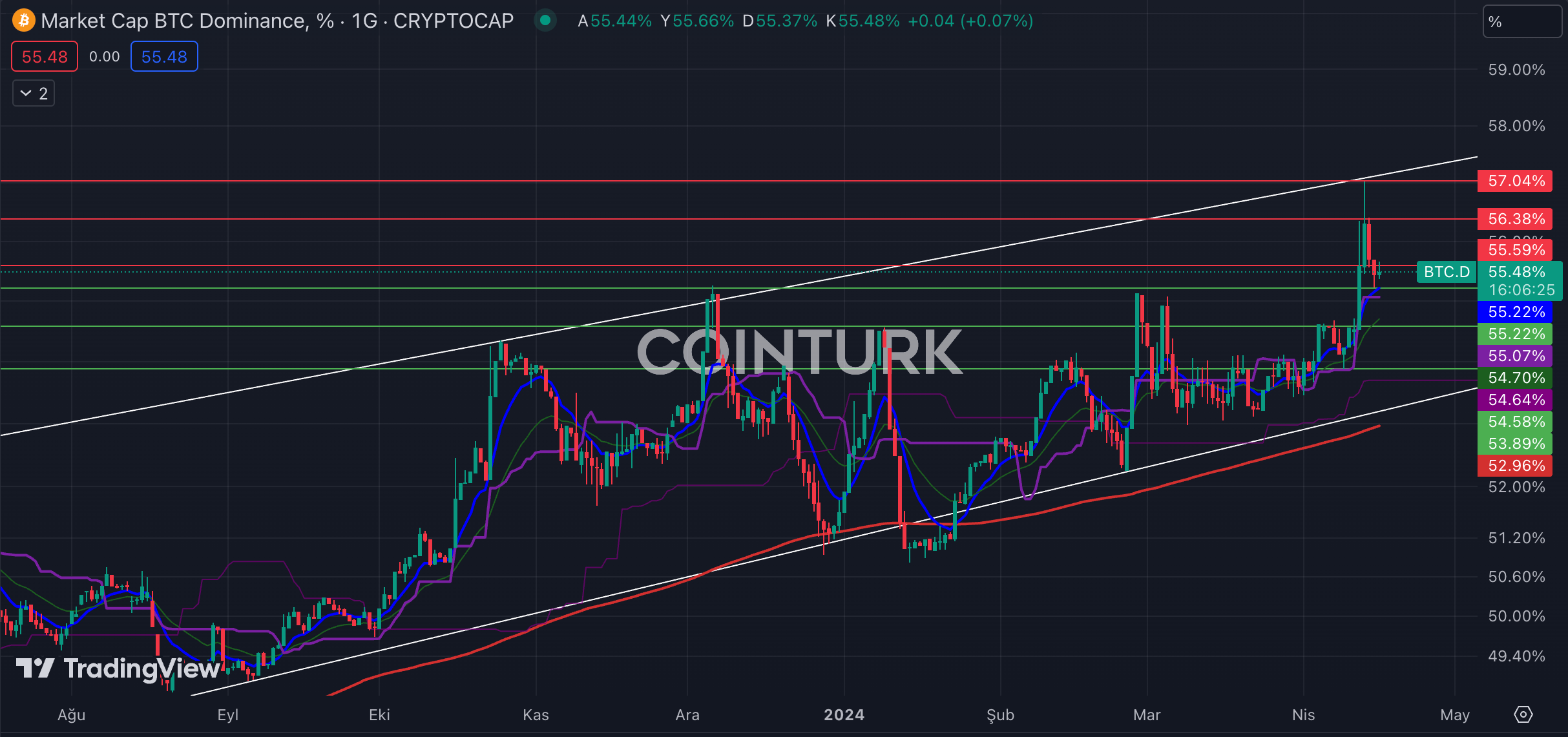

The daily Bitcoin dominance chart features a rising channel formation. With the recent rise, the BTC.D level has reached the highest point in the last three years and started to decline after touching the resistance line. The BTC.D level, finding support at the EMA 9 (blue line), could trigger a rise at these levels, causing selling pressure in the altcoin market.

The most important support levels to monitor on the daily BTC.D chart are; 55.22 / 54.58, and 53.89. Particularly, a daily bar close below the 55.22 level, intersecting with the EMA 9, could lead investors to sell Bitcoin and buy altcoins.

The most important resistance levels to watch on the daily BTC.D chart are; 55.59 / 56.38, and 57.04. Especially, a daily bar close above the 57.04 level, intersecting with the formation resistance line, could cause Bitcoin to suppress the altcoin market.

Türkçe

Türkçe Español

Español