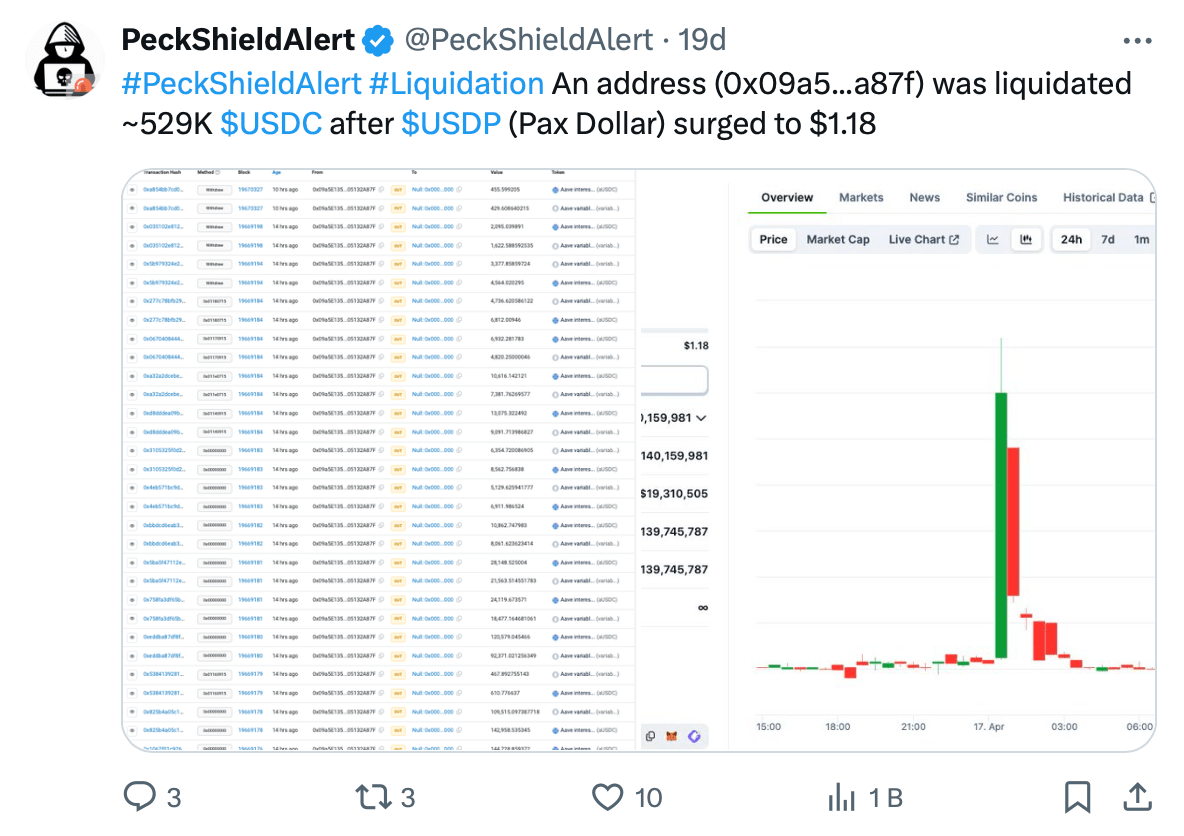

Blockchain security company PeckShield compiled on-chain data showing a wallet address, identified as 0x09a5…a87f, was liquidated following a significant price increase in Pax Dollar (USDP). The liquidation of the wallet address caught the attention of the crypto world, and according to the data, the investor lost approximately $529,000.

$529,000 Liquidation Process

PeckShield reported that the wallet address holding approximately $529,000 in USD Coin (USDC) faced a shocking liquidation. The liquidation occurred after USDP’s peg to the US dollar was lost, rising from $1 to $1.18.

According to on-chain data, the wallet address was liquidated after USDP rose to $1.18, resulting in a loss of approximately $529,000 during this liquidation process.

It is assessed that the rise in USDP’s price to $1.18 likely triggered automatic liquidation mechanisms, resulting in the sale of the USDC held in the affected wallet address. While such automatic processes can sometimes lead to unexpected outcomes for individual users or wallet addresses, they are designed to maintain stability and manage risk in decentralized finance (DeFi) protocols.

Reminder of Risks in the Crypto Market

This liquidation event serves as a new example of the high volatility and potential risks associated with sharp price movements in the crypto market. The approximately $529,000 incident uncovered by PeckShield is just one of many unsettling liquidations in the crypto market, underscoring the need for investors to always be cautious.

This particular event reminds us of the risks inherent in the crypto market, where severe price fluctuations and rapid market movements can have sudden and significant consequences for investors and users. Therefore, individuals and organizations trading in cryptocurrencies should always be cautious and adopt appropriate risk management strategies to minimize potential losses.

Türkçe

Türkçe Español

Español